Disclaimer: The text below is an advertorial article that was not written by Cryptonews.com journalists.

The rise of the crypto industry has brought with it an inevitable and relatively unpleasant consequence for cryptocurrency users and investors: the attention of regulators, particularly in the area of taxation. As tax departments in many governments continue to work on creating a regulatory framework around the taxation of crypto industry activities, it’s probably time for investors to anticipate potential tax filing headaches and look into solutions that could make this process as easy as possible. One of the most reliable applications existing on the market has been developed by Blockpit. Before explaining the many features of this application, let’s start with an overview of the tax situation in the US and the UK.

Tax Updates To Be Aware of In The US:

Just in the past year changes in crypto tax reporting and regulations have undergone a lot of changes. Below we’ve listed the IRS’s requirements for reporting digital assets.

“A transaction involving virtual currency includes, but is not limited to:

- The receipt of virtual currency as payment for goods or services provided;

- The receipt or transfer of virtual currency for free (without providing any consideration) that does not qualify as a bona fide gift;

- The receipt of new virtual currency as a result of mining and staking activities;

- The receipt of virtual currency as a result of a hard fork;

- An exchange of virtual currency for property, goods or services;

- An exchange/trade of virtual currency for another virtual currency;

- A sale of virtual currency; and

- Any other disposition of a financial interest in virtual currency.”

IRS – Virtual Currency Reporting

More information on cryptocurrency taxes in the US can be found here.

In the UK, cryptocurrencies reporting requirements are a bit different.

Please refer to the UK government website:

https://www.gov.uk/hmrc-internal-manuals/cryptoassets-manual/crypto10100

Tax Updates To Be Aware of In The UK:

Here’s a quick guide on basic guidelines for cryptocurrency taxes in the UK. For more information on these points, you can find an in-depth guide here.

“Key Points on UK Crypto Tax

- If you sell crypto and the trade results in a profit – the proceeds could be liable for capital gains

- If you earn interest from a crypto savings account – the proceeds could be liable for income tax

- However, whether or not you will need to pay tax will depend on your personal circumstances

- All UK residents get an annual capital gains allowance of £12,300 for the 2022/23 tax year

- As such, as long as you don’t make more than this amount in the current tax year – no capital gains tax will be liable”

UK Crypto Tax

Introducing Blockpit

Blockpit AG was founded in August 2017 with the mission of providing every individual with a simple tool to report their taxes while having the confidence that they are being reported accurately. Blockpit indeed specializes in analyzing transactions related to cryptocurrency trading and has developed tax and compliance solutions for a wide set of market participants: ranging from long-term investors (hodlers) to day traders.

In 2021, Blockpit AG participated in a Series A funding round that saw the firm raise over USD 10 million. Blockpit opted for a name change and became a public company in the same year. On this occasion, the investment tokens called “TAX Token” developed internally were converted into shares for the financing of the company.

Blockpit’s goal is to strengthen trust in the blockchain-based financial market and significantly increase efficiency through standardized software solutions.

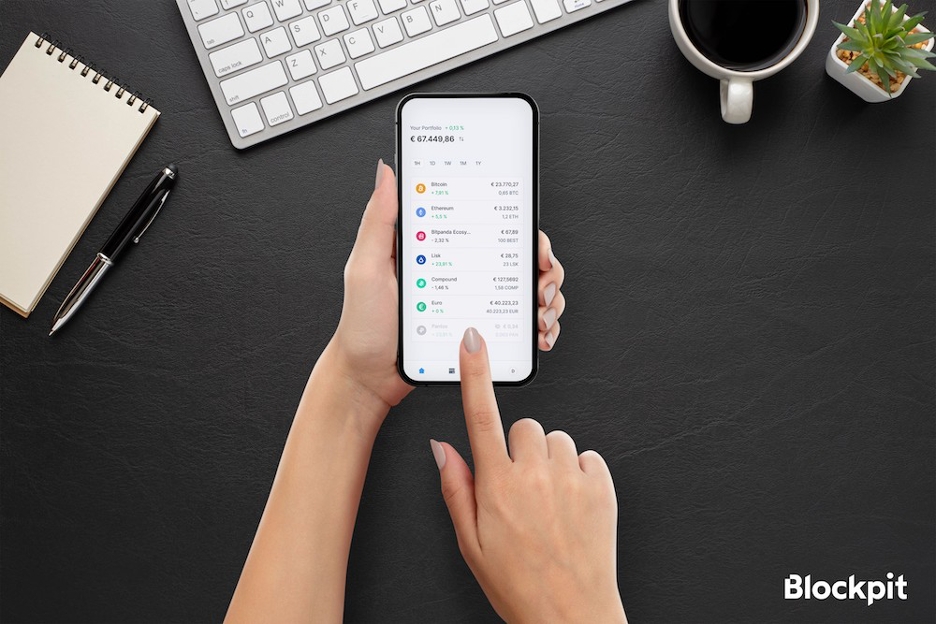

Cryptotax: a tax tracking and reporting application for everyone

Cryptotax is a tax reporting solution that allows crypto traders and investors to seamlessly document their trading operations within a web application to meet the strict compliance requirements of different countries. To this end, it identifies all types of income relevant to crypto traders and investors (staking, lending, mining, airdrops, bonuses, futures and margin trading, etc.). It then calculates the tax base in accordance with a particular country’s legislation. Blockpit currently provides this country specific calculation, including a pre-filled tax return, ready to use with the tax office, for US, Austria, France, Germany, Italy Spain and Switzerland. A generic report with pre-grouped and classified income categories is available for all other countries.

Blockpit called on KPMG, which carried out an analysis of the tax situation in each country to ensure that the tax documents produced by Cryptotax correspond to local regulations.

To make access to the application as democratic as possible, Blockpit offers four types of licenses: a free option, a “basic” option priced at EUR 79 per financial year (currently available at a special price of EUR 49), an “advanced” option priced at EUR 199 per year and a “professional” option priced at EUR 599 per year.

● Filing a tax return with Blockpit: the steps to follow

❖ Importing transaction data :

In order to correctly calculate the amount of taxes, it is necessary to have complete transaction data. To avoid tedious manual import, Blockpit allows users to automatically load all of their transaction data, without limit, from the exchanges’ APIs. This allows a user to have an overview of transactions and detailed information about them, including the list of holders and changes by account and asset type. In addition, the application allows for automatic classification of transactions and incorporates a module that enables error checking of an account. Additional data can be added via a CSV file.

❖ Follow-up of the portfolios

The application allows for tracking the evolution of portfolios, thanks to a complete history and updated data, regardless of the number or type of assets held and the exchange where a user is registered. All operations are automatically recorded, whether they are airdrops, loans, staking, masternodes, mining or bounties.

❖ Optimization of tax management

Cryptotax allows a user to be informed in real-time of his tax situation in order to optimize his trading operations. In particular, the application makes it possible to determine the value of unrealized gains or capital gains.

For the calculation of the tax return, Cryptotax identifies the tax-free asset classes of a portfolio; a tax report can be generated and downloaded in PDF format in just a few minutes.

In addition to the tax reporting software, Blockpit also offers a KYT (Know Your Transaction) solution developed specifically for financial service providers who need to implement anti-money laundering measures.

Blockpit presents itself as one of the most interesting applications for crypto investors due to its ease of use and the many features that make it a complete application. It allows all its users to benefit from a significant time saving by simplifying tedious reporting procedures and could become an indispensable management tool for businesses.

Follow the news of the project on social networks:

Twitter: https://twitter.com/blockpit_io

Facebook: https://www.facebook.com/blockpit.io

Instagram: https://www.instagram.com/blockpit.io/