width=”562″ height=”315″ frameborder=”0″ allowfullscreen=”allowfullscreen”>

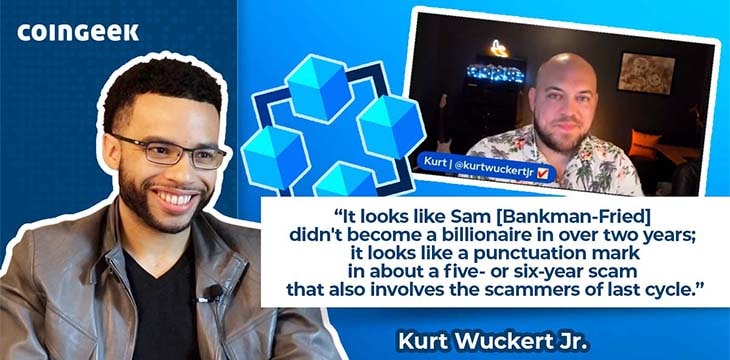

Kurt Wuckert Jr. joined Joshua Henslee for a special broadcast to talk about how Bitfinex and Tether relate to the FTX collapse, how the rats’ nest is deeply interlinked, and what it means for the industry going forward.

Wuckert on Tether, Bitfinex, FTX, and Alameda

Henslee opens the conversation with reference to one of Wuckert’s recent tweets in which he asked whether Tether may have been the reason for BTC pumping to $70,000 before crashing. He asks him to elaborate on this theory.

Wuckert says that back in 2015, Bitfinex was by far the best place to trade. It was leaps and bounds ahead of the competition. In 2016, Bitfinex got hacked, and Wuckert was immediately suspicious, especially when they gave a haircut to everyone who had funds on Bitfinex.

Shortly after this, they came up with the idea of creating an interest-bearing exchange token. Around this time, Tether showed up, and the price of BTC started climbing. Wuckert recalls it went 10x, and everyone was making money. He believes this was when Bitfinex realized nobody would ask any questions as long as they were profiting.

Wuckert likens the setup to fractional reserve central banking. Tether mints tokens and pushes them to Bitfinex, and they distribute them along with other exchanges as banks do in the real world.

“They just copied the playbook,” he says.

Wuckert says he has looked like a “giant horse’s ass” for being a Tether bear over the years. However, the FTX collapse has caused the information to come to light which makes him think he was right all along. This includes the entire second runup to all-time highs being correlated with Tether mints.

The history of FTX, Sam Bankman-Fried, and Alameda

Giving a little history of FTX and Sam Bankman-Fried, Wuckert says the two families are elites from Washington and New York. Sam started Alameda Research back in 2015 to do market making and quickly realized they could wash trade through exchanges as long as other market makers didn’t try to stop them. He believes that many of the spoofed books that pushed BTC up in 2017 might have been entities that became FTX and Alameda.

“It looks like Bitfinex and Tether might have created Alameda and FTX,” Wuckert says, noting the various interrelated shell companies linked to both Ifinex and FTX and the spoofed books on the latter. He believes they set up in the Bahamas to withdraw from shady banks like Deltec. He thinks the FTX bankruptcy will show this and lots of other crazy stuff over the next couple of years.

“That’s just the Tether stuff,” Wuckert goes on, pointing to the dozen or so coins such as SOL that have come out of Alameda Research. He thinks that this firm and FTX were the culmination of 10 years of lessons learned on how to scam. They got so good at it that they even drew in lifelong investors like Mark Cuban and Kevin O’Leary, aka Mr. Wonderful, and VC firms like Sequoia Capital.

How will all of this play out? Wuckert struggles with the idea that the big beneficiaries of these systems will just let it die and call it a day. However, he doesn’t see how it can go on as things are right now.

The proof of reserves meme

Henslee notes the ‘proof of reserves’ meme doing the rounds to try and reassure people with coins on exchanges and in lending platforms. However, he points out that proving how much digital currency you have on an exchange has no bearing on whether or not you can pay out.

Speaking of proof of reserves, Henslee notes that Crypto.com sent 320,000 ETH to Gate.io at the time they were doing audits. This has been touted as a mistake, but Henslee finds that excuse too convenient. He also notes that the claims that everything is OK sound suspicious, like those made by Alex Mashinsky and others just before Celsius Network filed for bankruptcy.

Asking why exchanges keep money on other exchanges, Henslee says he finds this practice strange. Wuckert answers that people have an illusion that firms like Coinbase (NASDAQ: COIN) are massive buildings that keep funds in vaults when in reality, they just have a few Nano Ledgers and dudes controlling them on old laptops.

A recap of the chaos and what it means going forward

“We’re going to see what happens with the latest folks to suspend withdrawals,” Henslee says. The narrative is that Changpeng Zhao (CZ) started it by Tweeting that he was liquidating FTT tokens, causing a cascade of selling. To Henslee, this looks like he’s trying to stay afloat by kicking everyone else off the raft, but eventually, he will be sucked in, too.

Wuckert thinks Zhao is too rich to be involved in the gray markets anymore and wants to repatriate funds somewhere and possibly retire without ending up in prison. He wonders what other powerful people Zhao might have information on and that he might use this to negotiate himself out of trouble if it comes down to that.

As for Bankman-Fried, he will have a harder time as the ‘suits’ who took a chance on him have real power. Wuckert believes this could cause real problems for Tether if they have to convert $30-$40 billion to give these people the money they demand.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

New to Bitcoin? Check out CoinGeek’s Bitcoin for Beginners section, the ultimate resource guide to learn more about Bitcoin—as originally envisioned by Satoshi Nakamoto—and blockchain.