November. What a month in the Cryptoverse. One most of us would rather swiftly forget. Were there any winners? Or are all crypto bagholders just one big bunch of losers, thanks to FTX and SBF?

(For the record, no, Coinhead doesn’t think crypto investors are all a bunch of losers, even if many portfolios say otherwise just lately.)

But we ask ourselves again, was anything up in the crypto market in November at all? Yes, actually, and we’ll get to specifics in a sec. But first a look on how the month travelled overall, using leading crypto asset Bitcoin (BTC) as the market barometer.

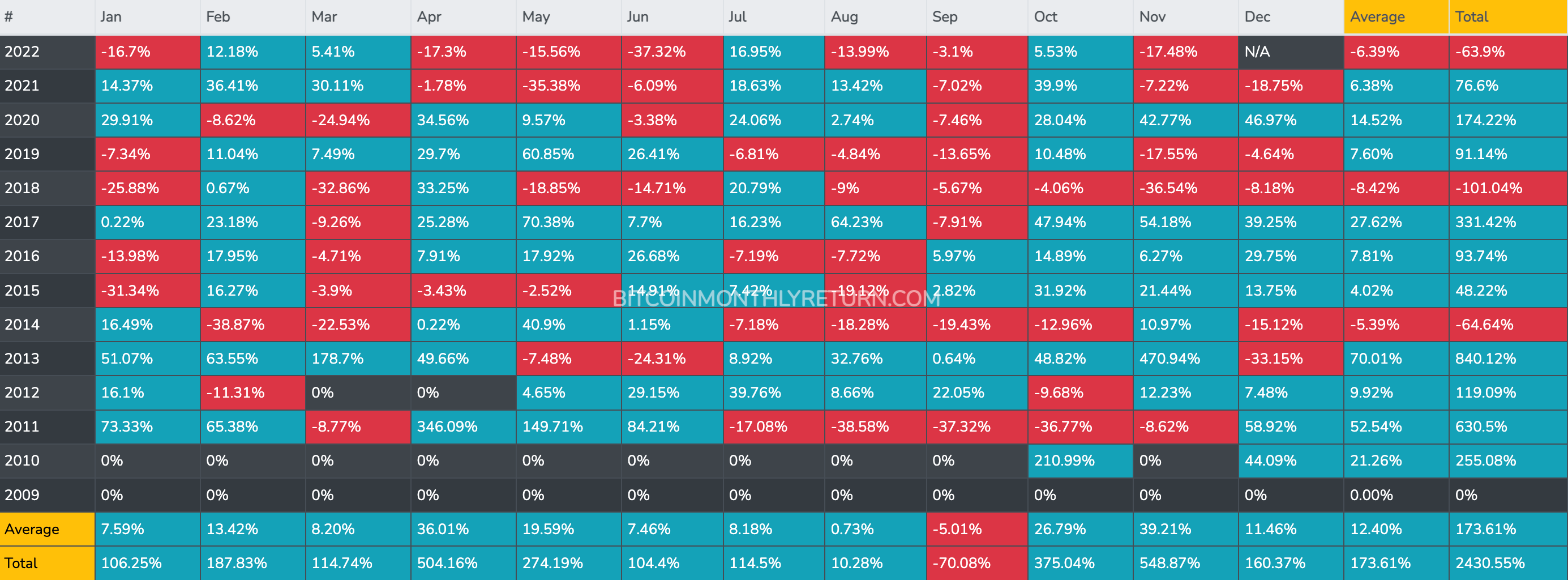

As you can see, November is commonly the very best month of the year for Bitcoin gainage with a +39.21% return on average. This time around, though, it’s turned out to be the second-worst November in Bitcoin’s price history, and the second-worst month this year – after the Terra Luna collapse savaged the market in June.

Here’s hoping for a green Christmas. Could happen, the market’s actually had a bit of a surge (+3.3%) since we published Mooners and Shakers this morning. Still, wouldn’t get your hopes up too much – this year’s been a shocker.

News just in, though:

Brazil has just officially recognised #bitcoin as a means of payment!

— Lark Davis (@TheCryptoLark) November 30, 2022

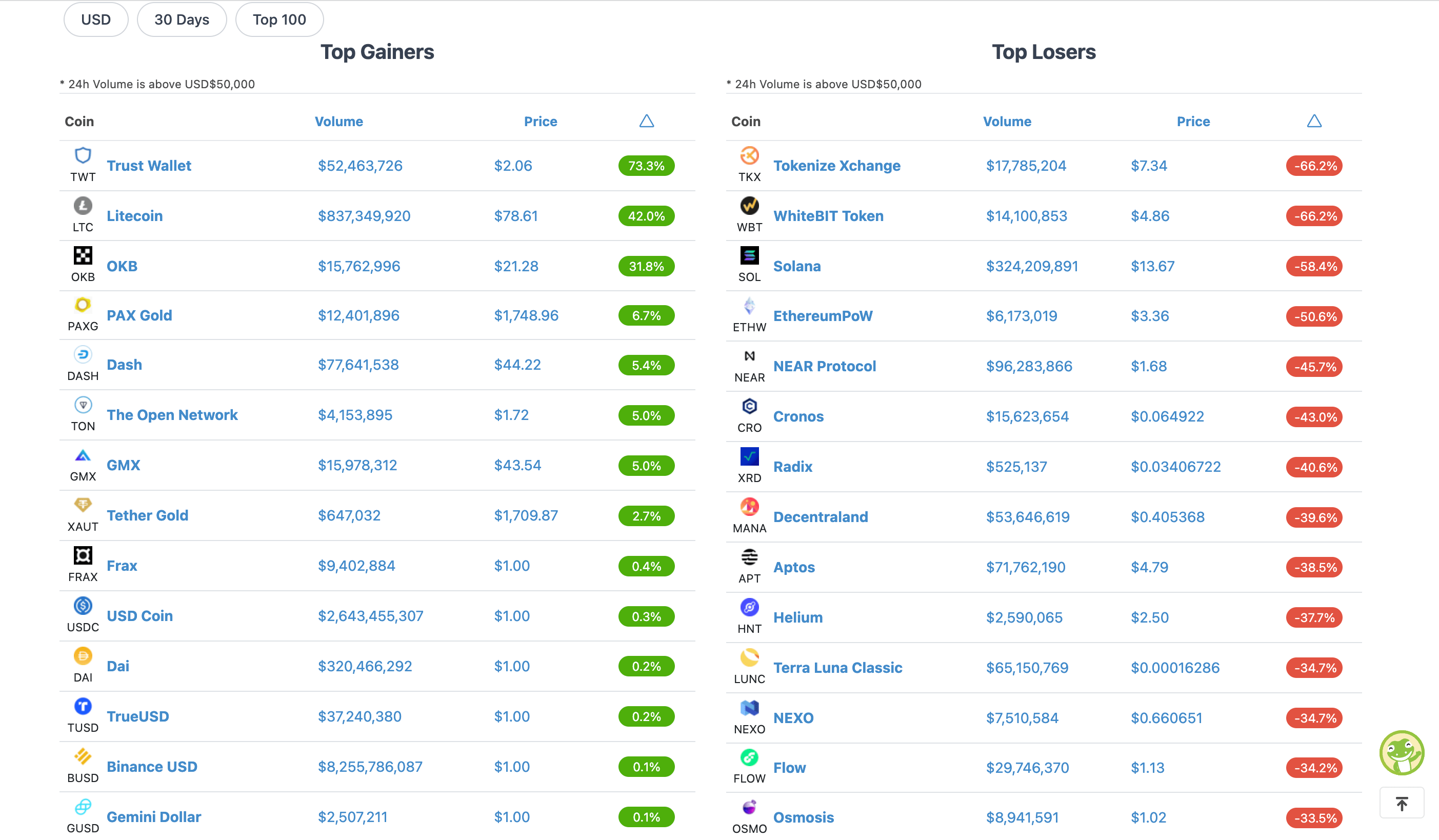

November’s leading gainers and losers in the top 100

The first thing to note here is the percentage size of the top 100’s best gainers and how it drops off markedly beyond OKB. And then the consistently large percentage hits for the biggest losers!

Most months, including October, tend to have a more even spread of gains or losses between the various projects.

But the big three bucking the trend and weathering the FTX cyclone were Trust Wallet (TWT), Litecoin (LTC) and OKB (OKB).

Let’s find out why…

A matter of Trust

The absolute bed-crapping FTX implosion and its subsequent wafting stank which has smothered many nearby crypto firms has actually, remarkably, been a boon for Trust Wallet (TWT).

And that all comes down to the difference between centralised exchanges (FTX, Binance, Coinbase) and centralised lending platforms (Celsius, Voyager, BlockFi and partly Genesis), as opposed to decentralised exchanges, DeFi, and non-custodial wallets.

Trust Wallet is the latter – it’s a non-custodial (which in this sense, actually means self-custodial) way to hold and store your crypto. It’s regarded as a secure way to store, even though it’s an online app. Cold storage (offline) in a hardware wallet is still viewed as the best industry-standard method for keeping your crypto secure, but Trust Wallet has a good rep for a “hot” wallet.

All self-custodial crypto storage options have benefitted this month, with the sale of hardware wallets Ledgers and Trezors going through the roof as crypto investors rushed to remove their precious assets from the likes of FTX (while they still could) and certain other exchanges that have provided cause for concern.

But speaking of CEXs (centralised exchanges), it’s interesting to note that the biggest one by trading volume, Binance, acquired Trust Wallet in 2018. The exchange behemoth’s CEO Changpeng “CZ” Zhao was actually partly responsible for sending the TWT token soaring a couple of weeks back with the following tweet:

We are not just a CEX. We offer choices.

Store crypto yourself? Read this article I wrote from 2 years ago. The 15 minutes read will save you money and headache later. @TrustWallet

Read the same article if you use a CEX, too. @binancehttps://t.co/Kp6VeKirgZ

— CZ 🔶 Binance (@cz_binance) November 13, 2022

Litecoin and OKB

Litecoin (LTC), sometimes referred to as the silver to Bitcoin’s gold, has “woken up”, according to veteran trader John “Bollinger Bands” Bollinger. Some champagne commentary, there.

While $BTC and $ETH have gone to sleep, $LTC has woken up!

— John Bollinger (@bbands) November 29, 2022

Once a regular top five token, Litecoin was created in 2011 from a copy of Bitcoin’s source code and given some updates and changes giving it a faster transactional processing time.

Earlier this month, the Texas-based money-transfer titan MoneyGram announced that its customers can now buy and sell Litecoin on its mobile app – along with Bitcoin and Ethereum.

As for OKB…

The native token of the OKX crypto exchange has fared surprisingly well this month with particularly high trading volume. Business Insider reckons that “might have something to do with the exchange’s announcement of adjusting the position tiers of its perpetual swaps and futures.”

“Furthermore, OKX joined the likes of Binance to announce a recovery fund for projects struggling with liquidity,” added BI, referencing the hole plenty of individuals and crypto firms have found themselves in related to locked-up funds on Sam Bankman-Fried’s now bankrupt FTX exchange.

Solana dumps

Solana (SOL) has had a woeful month dues to its close ties with FTX. Sam Bankman-Fried, in fact, has been one of, if not the biggest, supporters of the layer 1 blockchain and its ecosystem of DeFi tokens and more.

SBF’s investment/trading firm Alameda helped lead a US$314 million funding round for Solana in 2021, and a large amount of the former FTX CEO’s personal wealth was said to be tied up in the SOL token.

The total value locked in the Solana network is down by roughly 70% since early November, with most of that damage naturally occurring after the FTX collapse.

There’s no doubt confidence in the SOL token’s price has been rocked due to the FTX connection and possible token-liquidation events to come (although a good deal of FTX SOL is locked up and vested so dumpage could actually be limited or gradual).

According to Solana founders, though, the project has a good 30 months of financial “runway”, and it still has a large community of supporters and project builders – especially within the still-buzzy, still highly active NFT space.

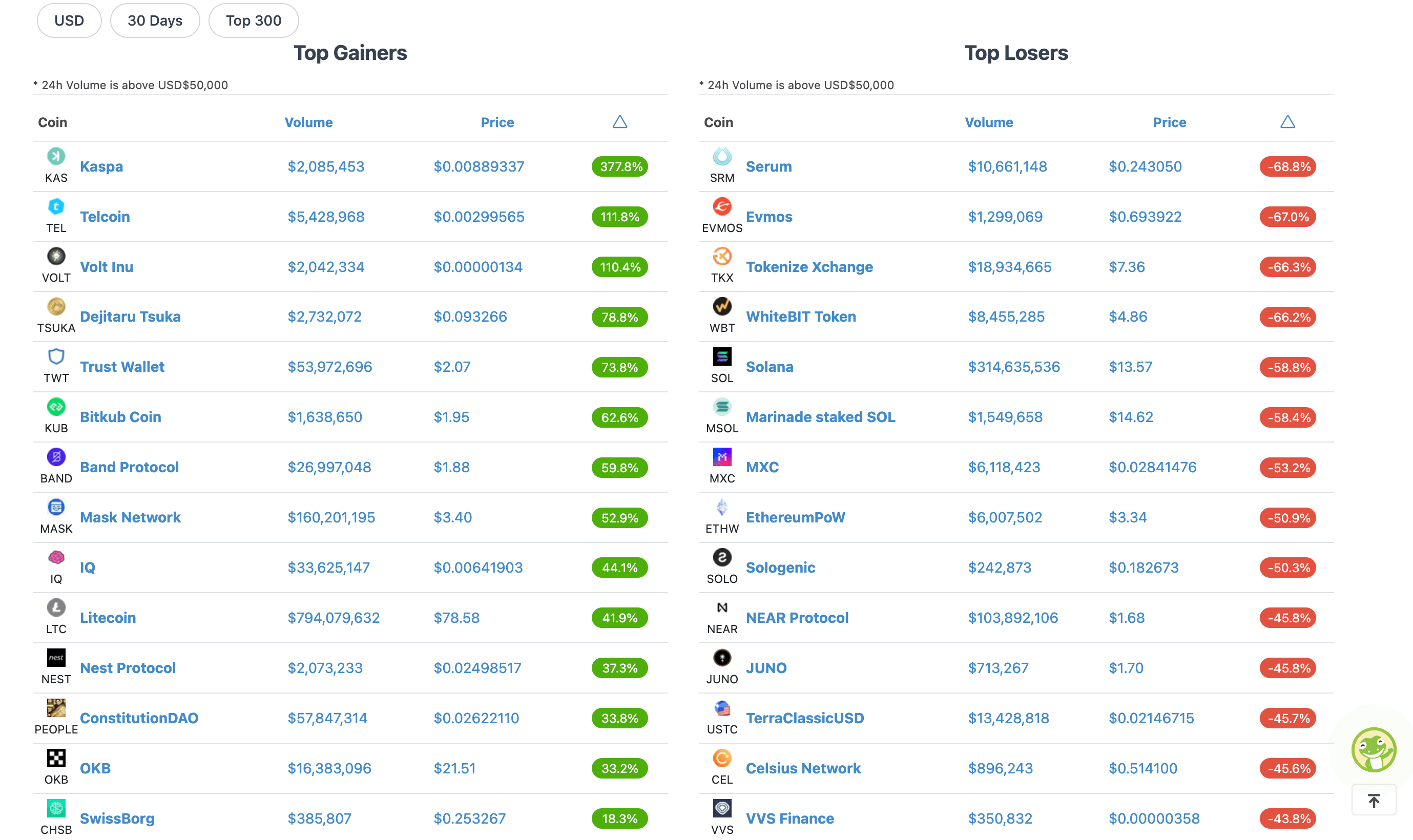

Top 10 gainers and losers in the top 300

Zooming out a tad, here then, were the top 10 winners and losers from the top 300 cryptos by market cap, with thanks again to CoinGecko…

Kaspa (KAS), what a month for it, and what the hell is it?

It’s a proof-of-work (PoW) crypto that implements the GHOSTDAG protocol, which is “a generalisation of Bitcoin consensus” – according to it.

As CoinGecko describes it, it’s an “instantaneous validation transaction sequencing layer. This means that miners can promptly include transaction requests into the blockchain, supporting non-contemporary state updates.”

Look, just tell us what sets it apart in plain English, eh?

“What sets Kaspa apart from other crypto projects,” says CoinGecko, “is its capacity to facilitate high block rates while preserving the level of security provided by other PoW environments. Currently, the protocol boasts one block per second, but its developers plan to increase the capacity to 10 or even 100 blocks per second.”

Guess that’ll more than do. Here’s our take: it’s a fast proof-of-work blockchain. Very, very fast. Why’s it gaining traction this month? Not entirely sure, but the cryptoverse is full of Mavericks who feel the need… the need for speed.

Which, incidentally, is very much a Solana narrative, but in the proof-of-stake realm.