Nikada

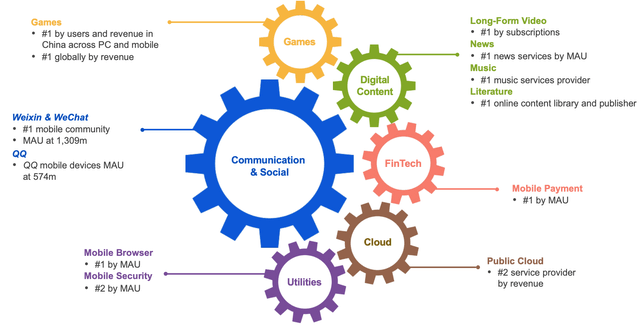

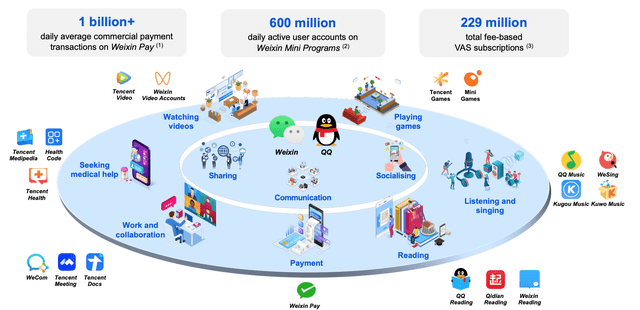

Tencent (OTCPK:TCEHY) (OTCPK:TCTZF) is the largest gaming and social media company in China. The company has been dubbed the “Facebook of China” but it is so much more. Tencent is the number one gaming company by users and revenue in China. It has the number one mobile community with 1.39 billion monthly active users on its WeChat platform which is like WhatsApp on Steroids and a true super app.

Tencent Business (Q3, 22 report)

The company also owns the number one long-form video platform, the number one music platform, the number one mobile payment platform (WeChat Pay) and is even the number two player in the Cloud.

Tencent Ecosystem (Q3 22 report)

But that is not all, Tencent has major investments into big technology companies such as Tesla (TSLA), NIO (NIO), JD.com (JD), Spotify (SPOT) and many more with a fair value of ~$75 billion. The company’s expertise and leadership in social media, gaming and the cloud means Tencent is the ideal stock to play the “Metaverse”.

Tencent Metaverse (Tencent)

In this post, I’m going to break down the company’s financials and valuation. Let’s dive in.

Third Quarter Financials

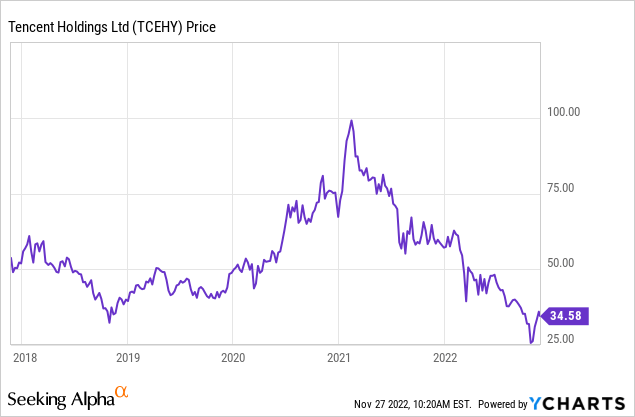

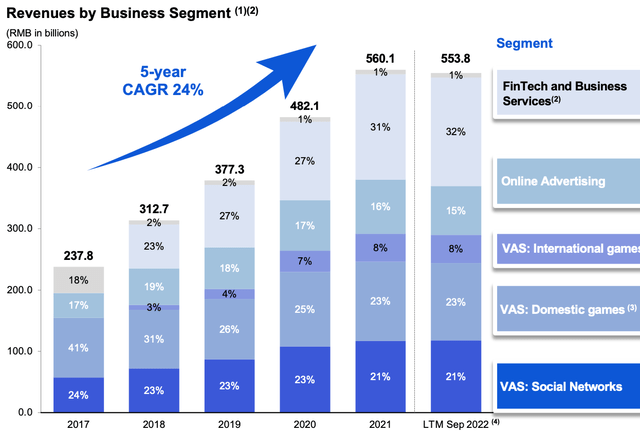

Tencent reported mixed financial results for the third quarter of 2022. Total revenue was $19.7 billion (RMB140.1 billion) which declined by 2% year over year, but this did increase by 5% quarter over quarter. Tencent makes the majority of its revenue (52%) from Value Added Services [VAS] which consists of social networks (21% of revenue), domestic games (22% of revenue) and international games (9% of revenue). Online advertising contributes to 15% of revenue and its FinTech and Business Services segment contributes to 32% of revenue.

Tencent Revenue 2 (Q3 22 report)

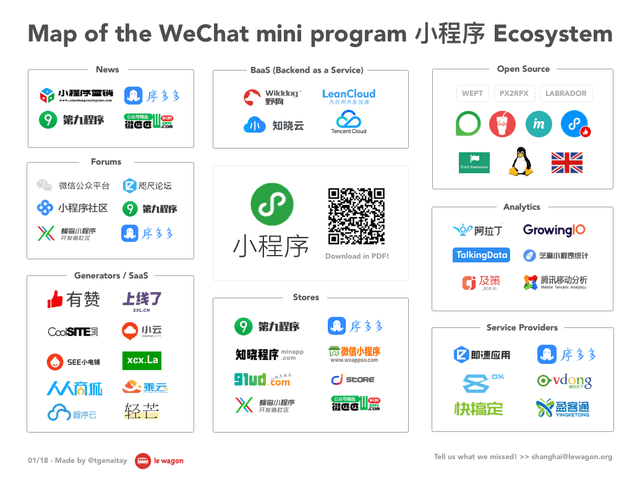

The Value Added Services segment reported revenue of $10.1 billion (RMB 72.7 billion), which declined by 3% year over year. This was primarily driven by a 2% decline in social networking revenue to $4.2 billion. A positive for social networking was the growth of Tencent’s “Mini Programs”, which was a platform launched in 2017 to enable developers to create mini versions of applications built directly on top of the WeChat ecosystem. In the third quarter of 2022, Mini Programs surpassed 600 million daily active users and increased by a rapid 30% year over year, with daily mini programs increasing by 50% year over year. As a side note, I am surprised that Meta Platforms (META) hasn’t introduced a similar platform for WhatsApp in order to create a “Super App”.

WeChat Mini Programs (ie wagon)

WeChat’s Mini Programs platform has begun to gain popularity with brick and mortar retail brands and food stores that wish to bridge the gap between offline and online. The “Health Code” mini-programs have also proven to be extremely popular since the pandemic as they help to verify a user’s health and travel ability.

Tencent has also continued to build out its Metaverse by offering virtual spaces with brands such as Gucci and KFC, as part of its QQ app.

Tencent’s gaming business is vast as the company owns major gaming studios such as Riot Games, while also having investments into studios such as Epic Games and the popular Roblox (RBLX) social game. Its owned brands include the popular League of Legends, Honor of Kings, CrossFire, and many more.

Despite the strong gaming business, domestic game revenue declined by 7% year-on-year to $4.4 billion (RMB 31.2 billion). This decline in revenue was driven by the Chinese government’s regulation which aims to stop children under the age of 18 from playing games during the week. This regulation may seem overly controlling to those of us in the west, but the Chinese government has a heavy focus on breeding smart, focused children. There were also calls from parents to help stop gaming addiction, which is prevalent in China and Asia. Either way, this is bad news for Tencent, as gaming time from users under 18 years old has subsequently declined by an eye-watering 92% year over year. The good news is adult gamers (daily active users) increased by double-digit percentages year over year. This was driven by existing game titles such as Honor of Kings, Peacekeeper Elite, and CrossFire, in addition to new game titles such as Wild Rift and Arena Breakout. International gaming increased revenue by 3% per year to $1.6 billion, which wasn’t too bad given the gaming industry is going through a cyclical decline after a boom during 2020. This is a common trend I have seen when analyzing companies such as Microsoft (MSFT) with its Xbox sales and even Nvidia (NVDA) with its gaming graphics cards for PCs.

Gaming (Q3 22 report)

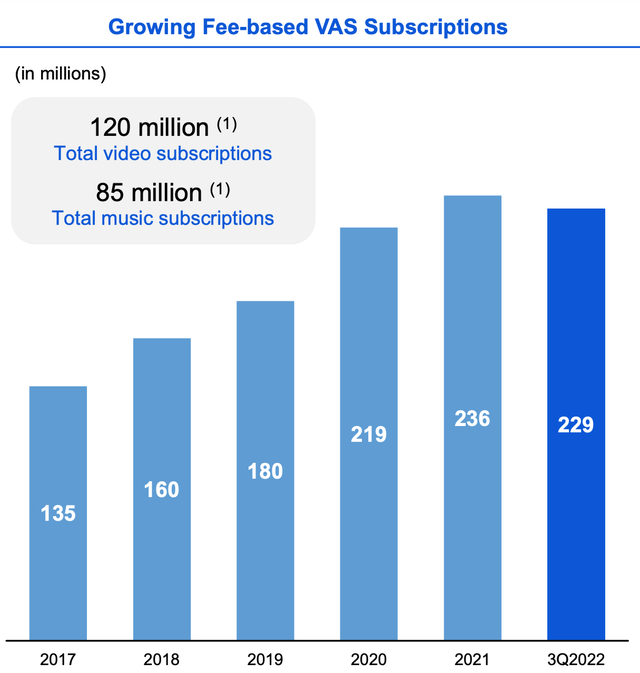

Tencent’s music subscription revenue increased year over year as paying users increased. Its video subscription revenue declined slightly year over year due to content scheduling delays. This was slightly offset by an increase in member pricing which increased average revenue per user. Total video subscriptions reached 120 million with total music subscriptions of 85 million. To put the scale of the music subscriptions into perspective, the world’s largest music streaming provider (outside of China) Spotify had 138 million paying subscribers. Tencent is also an investor into Spotify, so it benefits from the growth in international music streaming.

VAS Subscription (Q3 22 report)

Tencent’s FinTech business, which includes WeChat Pay, lending and wealth management services, continued to grow. Commercial payment volume grew by double digits year over year, with growth in groceries, dining and transportation.

China has a growing middle-class population that is becoming more “cash rich”, therefore Tencent is in a prime position to capture more of this economic activity with its FinTech business.

Fintech (Q3 22 report)

Tencent’s video conference platform “Tencent Meeting” crossed 100 million MAU. To put things into perspective, Zoom (ZM) has ~300 million monthly active users outside of China, although the vast majority of these are free-tier users.

Tencent cloud has continued to build out its infrastructure across 26 regions and 70 availability zones. This segment is also number 1 communication PaaS (Platform as a Service) by revenue in China, according to a Gartner report cited in the Tencent annual report.

The cloud industry in China is forecasted to triple by 2025, driven by the digital transformation of China’s legacy manufacturing industry.

Profitability and Expenses

Tencent reported gross profit of $8.6 billion (RMB 62 billion), which declined by 1% year over year but increased by 7% sequentially.

Operating profit was $7.2 billion (RMB 51.6 billion), which declined by 3% year over year but increased by over 70% sequentially. This growth was driven by 32% lower marketing expenses as the company tightened its spending in this area to adjust to economic conditions. The company also improved its business services margin and optimized its bandwidth and server utilization to reduce video account operating costs. Management even “optimized” its workforce by slashing headcount, following the likes of many technology companies such as Meta Platforms (META) and Twitter (TWTR).

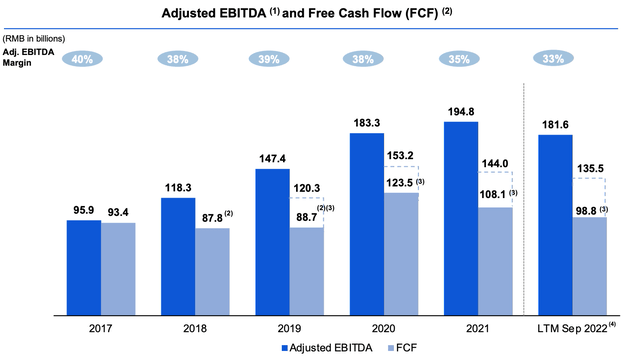

Diluted earnings per share were $0.56 (RMB 4.1), which increased by 0.7% year over year or a substantial 114% quarter over quarter. Free cash flow was $13.8 billion (98.9 billion RMB) in the trailing 12 months prior to September 2022, which was down 8.6% year over year. Adjusted EBITDA margin has also been squeezed from 35% in 2021 to 33% in 2022.

Adjusted EBITDA (created by author Ben at Motivation 2 Invest)

Tencent has a strong balance sheet with $44.5 billion in gross cash and stakes in listed companies such as Tesla, JD.com, and Spotify with a fair value of a staggering $75 billion. In addition to stakes in unlisted companies with a value of $48 billion.

The company has a fairly high debt of $51.6 billion, but “just” $1.9 billion of this is current debt due within the next 2 years.

Advanced Valuation

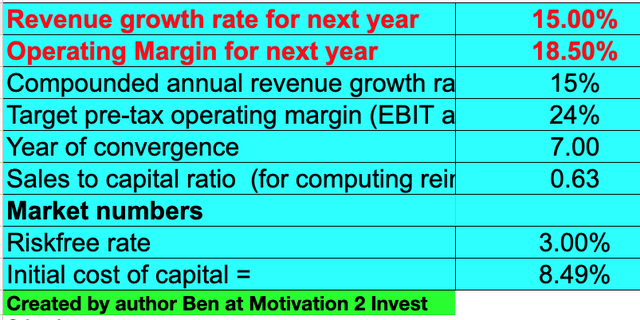

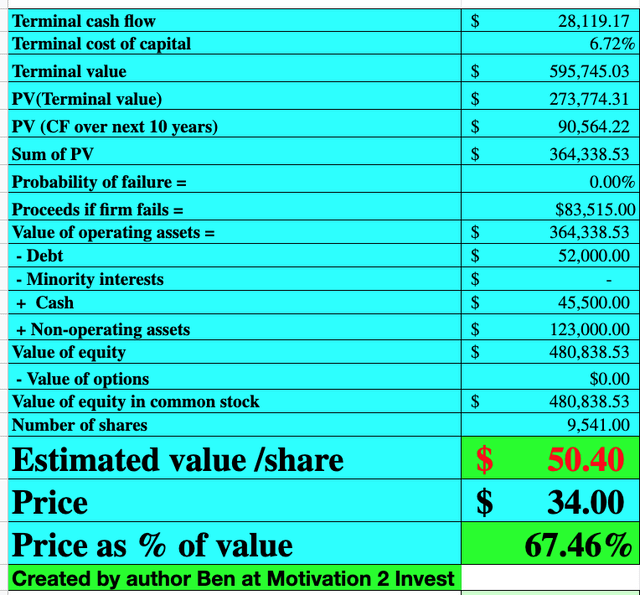

Valuing Tencent is challenging given the complex nature of the business, its multiple investments and market leading position. However, I have plugged the latest financials into my discounted cash flow model in order to give an indication of value. In addition, I have included Tencent’s fair value investment figures to increase the accuracy. I have forecasted a 15% revenue growth rate over the next 1 to 5 years, as international gaming revenue rebounds, advertising spend recovers and its fintech and cloud segment continues to grow.

Tencent stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted that management’s cost-cutting initiatives will continue to pay off, and as growth resumes, the operating margin will expand to 24% in 7 years. Given Tencent effectively runs a giant software company, it should have high operating leverage long-term.

Tencent stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $50.4 per share. The stock is trading at $34 per share at the time of writing and is thus 33% undervalued.

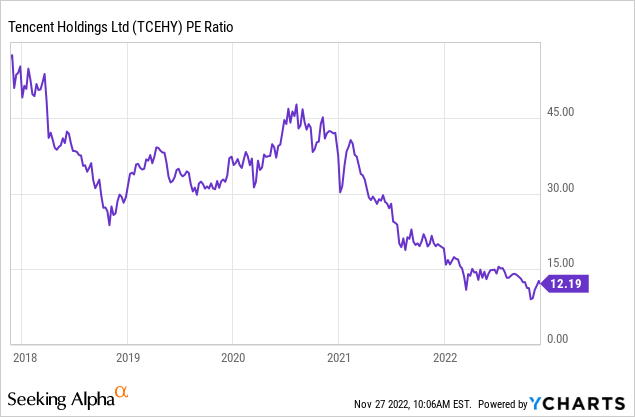

As an extra data point, Tencent trades at a P/E ratio = 13.6, which is significantly cheaper than historic levels of over 30.

Risks

Chinese Government Risk/U.S. Tensions

Any investment into China involves three parties, you the investor, the company and the Chinese government. The Chinese Communist Party [CCP] has cracked down on big tech giants in the past and previously slapped Alibaba (BABA) with a $1.2 billion fine. Indirectly Tencent is being impacted by the latest regulation regarding gaming curfews implemented in China. Also, international investors should note that an investment into Tencent is an investment into an ADR (American Depository Receipt), through a foreign entity. I discussed more on this in my previous posts and alternative methods to get exposure to Tencent.

Final Thoughts

Tencent dominates the social media and gaming landscape in China and is poised to continue its reign. The company is facing short-term headwinds from curfew regulation and the cyclical gaming market, but long-term, Tencent is in an ideal position to benefit from the growing middle class. The stock is undervalued intrinsically at the time of writing and thus could be a great long-term investment.