- Avalanche experienced positive growth in transaction count.

- The developer activity metric just concluded in November with a sharp upside.

2022 has been a bearish month for AVAX and the rest of the crypto market in general. Despite this, Avalanche has achieved positive growth in other areas as highlighted in its latest update.

Read Avalanche’s (AVAX) Price Prediction 2023-2024

Avalanche noted in its latest update that it experienced positive growth in transaction count. It particularly pointed out that the network’s monthly transactions peaked above 68 million in October. The report highlighted the contrast between network growth in terms of transactions on the network and AVAX’s price action.

In the last few months, Avalanche experienced all time highs with monthly transactions exceeding 68 million (Sept. 2022) and total transactions exceeding 450 million.

dApp users can enjoy the fastest, most reliable Web3 experience thanks to Avalanche. #AvalancheStandsApart pic.twitter.com/OIF4pzZJvk

— Avalanche 🔺 (@avalancheavax) December 1, 2022

But what does this mean for Avalanche moving forward?

The common expectation is that positive network growth has a direct correlation with price action. That has not been the case for AVAX price action which was largely bearish in the last 11 months. But is this new update enough to stimulate renewed investors’ interest?

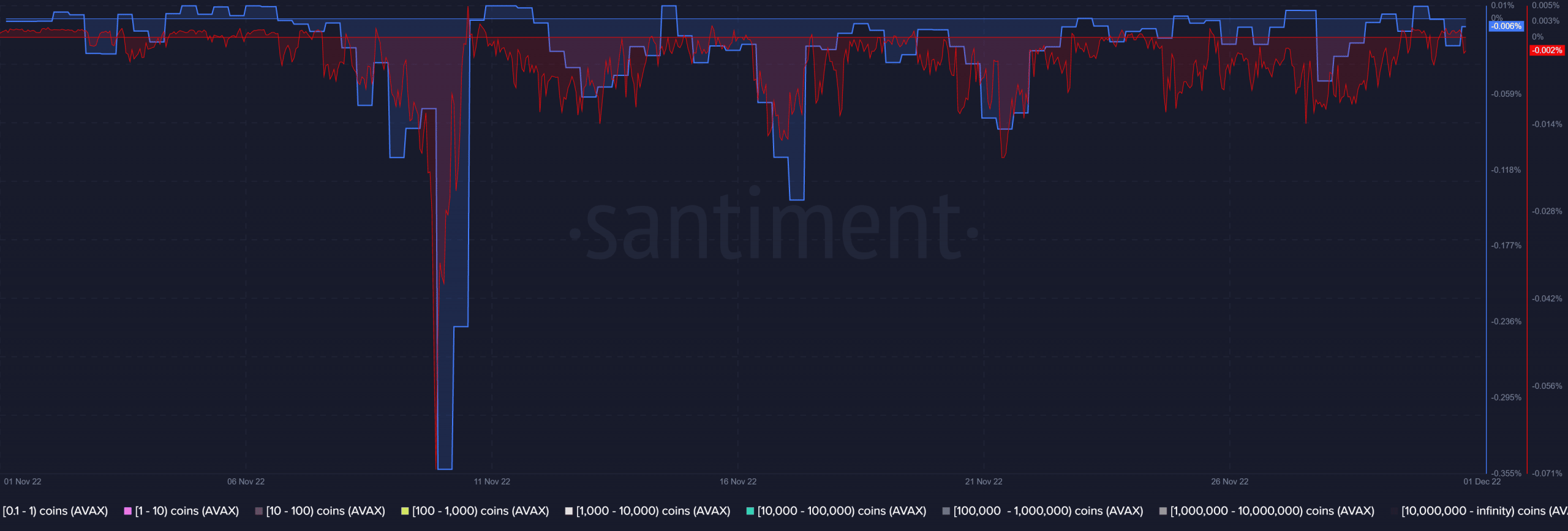

AVAX’s weighted sentiment experienced a noteworthy surge in the last week of November. This is a confirmation that investors are now taking up a more bullish stance toward cryptocurrency. The positive report may also offer a boost to investors’ sentiment and improve the outlook for December.

Source: Santiment

The improved weighted sentiment also resulted in improved demand, especially from the derivatives market. A look at the Binance and DYDX funding rates confirms this. Both metrics have improved significantly towards the end of the month, especially compared to their 4-week lows.

Source: Santiment

The currently improving AVAX investor sentiment may also be backed by healthy development. The developer activity metric just concluded in November with a sharp upside. This observation adds to the list of factors currently favoring AVAX bulls, which may also underscore its performance for the remainder of 2022.

AVAX price action

AVAX just concluded November with a 13% upside from its current monthly low. Despite this, its $13.02 press time price is still close to its current 2022 low, and here’s why this is important for investors.

Source: TradingView

AVAX’s money flow already indicates noteworthy accumulation from its current bottom range. It has also regained some relative strength but the current upside indicates a lack of strong momentum. This is likely because investors are still cautious about the potential for more downside.

Conclusion

Low whale participation has also resulted in a weak bullish recovery. Nevertheless, the market sentiment is gradually improving. If this remains the case, then there is a significant probability of a strong bullish resurgence for the remaining part of the year.

AVAX might also be slated for a strong long-term recovery since it will be backed by the robust organic utility during the next major bull run.