- Avalanche to add the USP stablecoin into its list of offerings.

- The battle between AVAX bulls and bears intensifies as sell pressure threatens to erase recent gains.

The crypto market just concluded an interesting week marked by an extension of the bullish momentum at the start of this year. Avalanche just made things more enjoyable after a major announcement wherein it revealed that it will host a new stablecoin.

Avalanche has officially confirmed that it will support the stablecoin USP created by Platypus DeFi. The latter previously confirmed that the stablecoin will be in Avalanche’s main pool which will play an important role in USP’s stability. In addition, its collateralization mechanism will use other stablecoins.

🧐 How does the Adaptive Peg Stabilizer implementation maintain $USP’s peg to 1 dollar? Let’s find out in this thread!

USP #stablecoins will be listed in the Main Pool, and one of the major factor that affect USP’s price is its coverage ratio in the said pool. 🧵 pic.twitter.com/6W8r5TMP8f

— Platypus 🔺 (🦆+🦦+🦫) (@Platypusdefi) December 22, 2022

Even more interesting is the potential impact of the stablecoin on the demand for Avalanche’s native cryptocurrency AVAX. The stablecoin rollout will facilitate more utility for the Avalanche network. A move that will likely fuel more demand for AVAX. The timing of the announcement is also worth noting particularly due to AVAX’s latest price action.

AVAX bulls wrestle with the 200-day Moving Average

AVAX just concluded a strong run-up for the second week in a row. It managed to climb by as much as 74% from its January low at $10. However, it pulled back to a $17.05 press time, with sell pressure manifesting after briefly crossing above the 200-day Moving Average.

Source: TradingView

While the 200-day MA may have acted as a psychological sell zone, it is not the only indication of a potential pivot. The price also happens to be in overbought territory, where many investors are likely to start taking profits.

Should we expect a major pullback?

A strong selloff might be on the cards if AVAX holders, especially whales start offloading heavily. This would trigger a bearish cascade that would likely result in a sizable retracement.

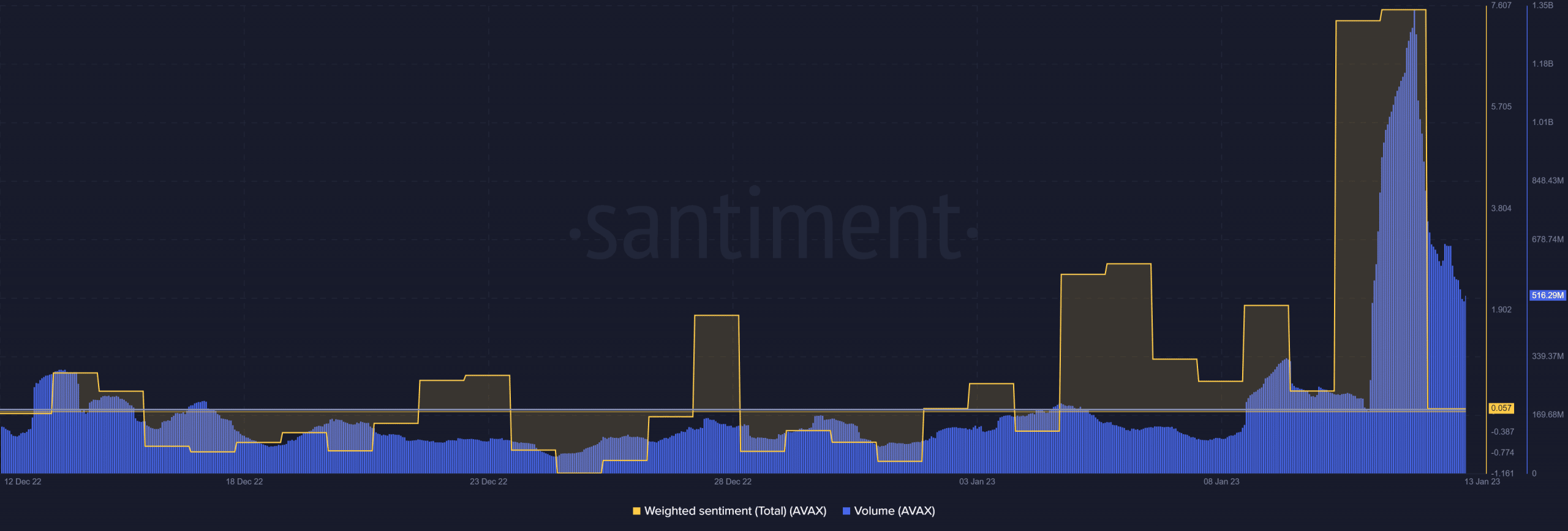

Perhaps some of Avalanche’s metrics may help paint a better picture of the potential outcome. For example, it just experienced a major volume surge between 11 and 13 January.

This was the largest surge it has experienced in the last four weeks but the volumes have tapered off now. The volume increase was preceded by an uptick in the weighed sentiment metric. The latter reflects the massive liquidity inflow that entered into AVAX.

Realistic or not, here’s AVAX’s market cap in BTC’s terms

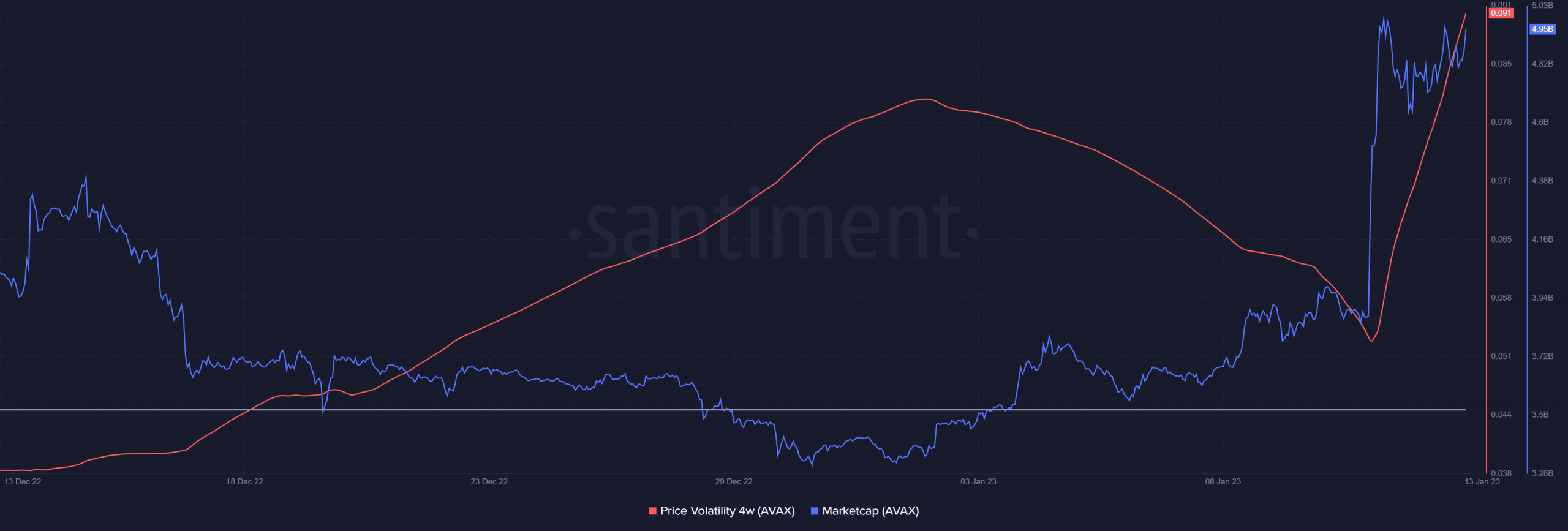

The same weighted sentiment metric has tanked, indicating another sudden sentiment shift favoring the bears. The entire time AVAX volatility was also up and so was the market cap reflecting the strong accumulation.

Source: Santiment

AVAX’s market cap did experience a slight dip after the recent peak before recovering. This is a sign that there was some selling pressure at the top.

The previously mentioned volume surge may have resulted from investors FOMOing in that has created enough liquidity to shield AVAX from more price slippage. Whether the same will hold will depend on whether the bulls can ward off the bears.