Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The price of Polkadot approached a support zone that could offer a buying opportunity.

- DOT is likely to perform well over the next week, provided Bitcoin can push above $21.6k.

Polkadot [DOT] shot past the $5 resistance level last week when Bitcoin [BTC] broke above the $17.6k mark. DOT continued to have a bullish outlook on the higher timeframes. Both the market structure and the momentum favored the buyers on the daily timeframe.

Read Polkadot’s [DOT] Price Prediction 2023-24

Polkadot saw some bullish enthusiasm evaporate over the past week after the pullback from $6. However, the retest of $5.6 as support could have a significant bullish reaction in the days to come.

Polkadot sweeps liquidity above the $6 mark before pullback but is ripe for another move upward

Source: DOT/USDT on TradingView

The $5 level was a psychological area of significance for traders, as a move above this level meant that the bulls were in control. The area of liquidity highlighted in red served as support in mid-December and was later flipped to resistance. An encouraging factor for bulls was the sharp move beyond the $5 resistance on 11 January.

The following week saw DOT climb further higher to reach resistance at $6.06. A swing high at $6.52 was formed, which likely indicated that early short positions were wiped out on the move upward to grab liquidity.

Is your portfolio green? Check the Polkadot Profit Calculator

On 5 December, the price climbed to $5.68, and thereafter, selling pressure took control. Bears drove the prices as low as $4.2 in late December. Recent price action saw the same level retested as support. This meant that there was a strong likelihood of a surge northward for Polkadot.

The RSI dropped from the overbought territory but continued to show bullish momentum. The OBV also took a hit, but most gains from January were intact.

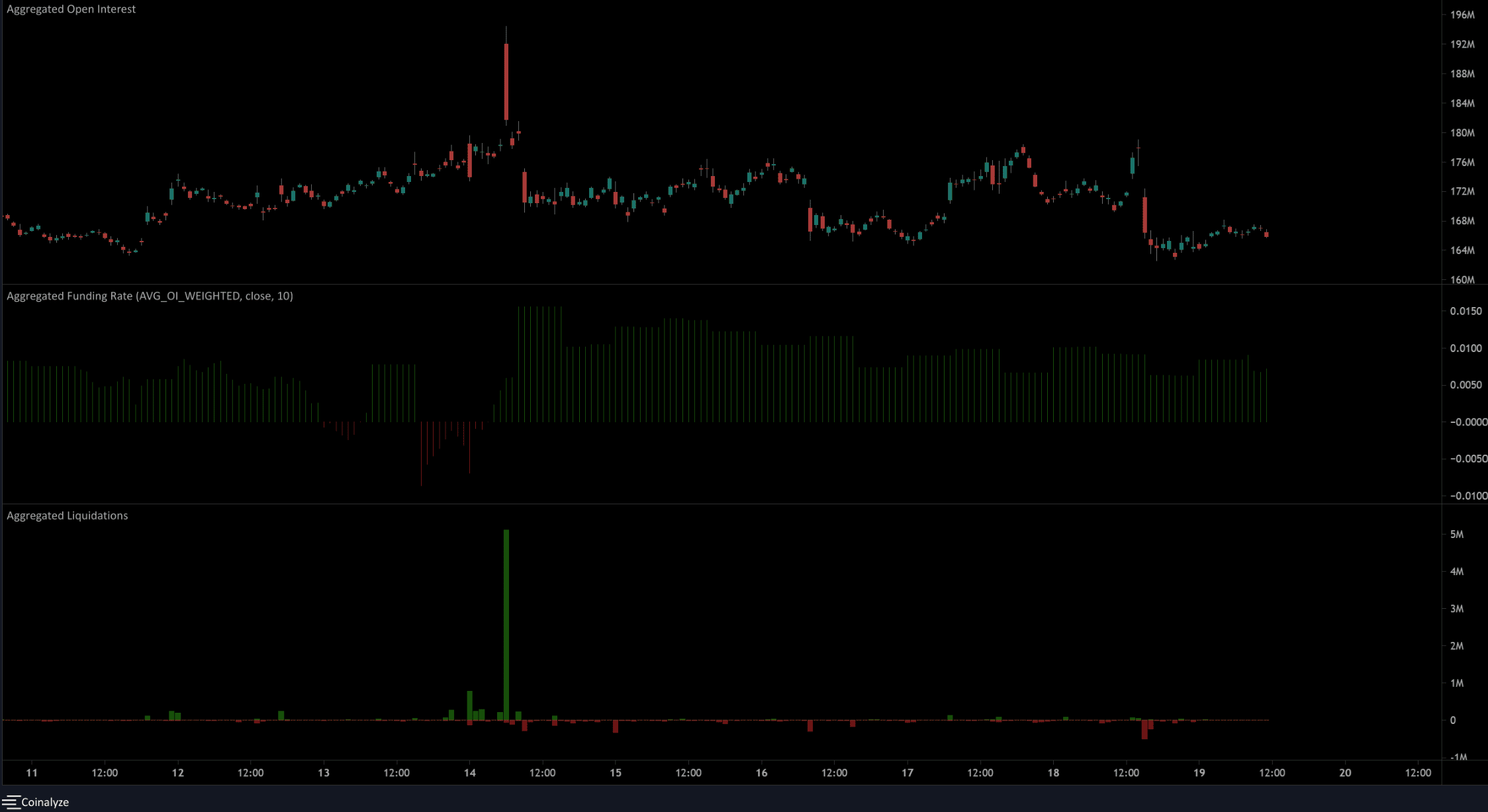

Large liquidations last weekend indicated liquidity grab is a valid idea

Source: Coinalyze

14 January saw the liquidation of $5.1 million Polkadot short positions. This was when the price climbed to $6.52 before it met a wall of selling. In recent days, however, significant numbers of long positions did not see liquidations, with 18 January seeing $500k longs liquidated.

In the past few days, the Open Interest has declined alongside the price which showed bearish sentiment. A rise in OI is likely to accompany the next rally. The funding rate remained positive, which suggested the possibility of more upside.