The pre-programmed Litecoin halving event is one of the most significant events in the 2023 altcoin calendar and will halve the volume of LTC awarded to miners. But what does it mean for investors? And what impact will the Litecoin halving have on the wider cryptocurrency landscape?

Litecoin shares a similar halving mechanism to Bitcoin, which also undergoes a halving event every four years. Like Bitcoin, these events typically cause a series of price movements surrounding the cryptocurrency that can impact other crypto assets.

What Is a Halving Event?

Firstly, let’s take a look at what a halving event is.

Halving events are pre-programmed into cryptocurrencies like Bitcoin and Litecoin. Because these assets are created when miners add new transactions to blocks, each miner receives a fixed number of LTC and transaction fees included within the block.

This cyclical event is in many ways similar to Bitcoin’s own halving event, which effectively “halves” the volume of BTC rewarded to miners every four years. However, unlike Bitcoin’s network, where new blocks are added around every 10 minutes, Litecoin’s blocks are added faster at approximately every 2.5 minutes.

Although Litecoin’s halving events are cyclical, they’re only programmed to take place after every 840,000 blocks are mined. Because of its 2.5-minute block mining rate, Litecoin’s halving event occurs roughly every four years.

Previously, Litecoin’s halving events took place in 2015 and 2019, respectively. When Litecoin was launched, its block reward for miners stood at 50 LTC. However, the 2015 halving event lowered the payout to 25 LTC and down to 12.5 LTC in 2019.

What’s the Purpose of a Halving Event?

In the cryptocurrency world, halving events can act as an effective hedge against inflation. In conventional fiat currencies, printing extra money can lead to inflation rates increasing, with federal interventions like interest rate hikes being utilized as a form of brake pedal to help to control the value of a domestic currency.

However, no such systems exist in the decentralized cryptocurrency ecosystem, which is why early assets like Bitcoin and Litecoin utilized a halving system to control their scarcity. As a result, the total supply of LTC will be 84,000,000. Much like with Bitcoin, once this limit is reached, no more new supply of LTC can occur, boosting the asset’s scarcity.

Halving events lower the volume of blocks produced on Litecoin’s network as a means of slowing the mining of LTC down as we approach this number.

Today, Litecoin’s circulating supply stands at more than 72 million, meaning fewer than 12 million LTC are still to be minted.

What Does the Halving Event Mean for the Value of LTC?

So, what does this halving event mean for investors? When it comes to dominant assets like Bitcoin, halving events are big business. Historically, BTC has rallied to significant levels in the months following its halving events.

Following Bitcoin’s May 2020 halving event, BTC underwent a parabolic rally that saw its price increase from a value of less than $10,000 to an all-time high of $69,044.

For Litecoin, however, such correlations are historically harder to track. As the chart below shows from LTC’s price movements, the cryptocurrency has been influenced more heavily by the rallies of BTC than its own post-halving bull runs.

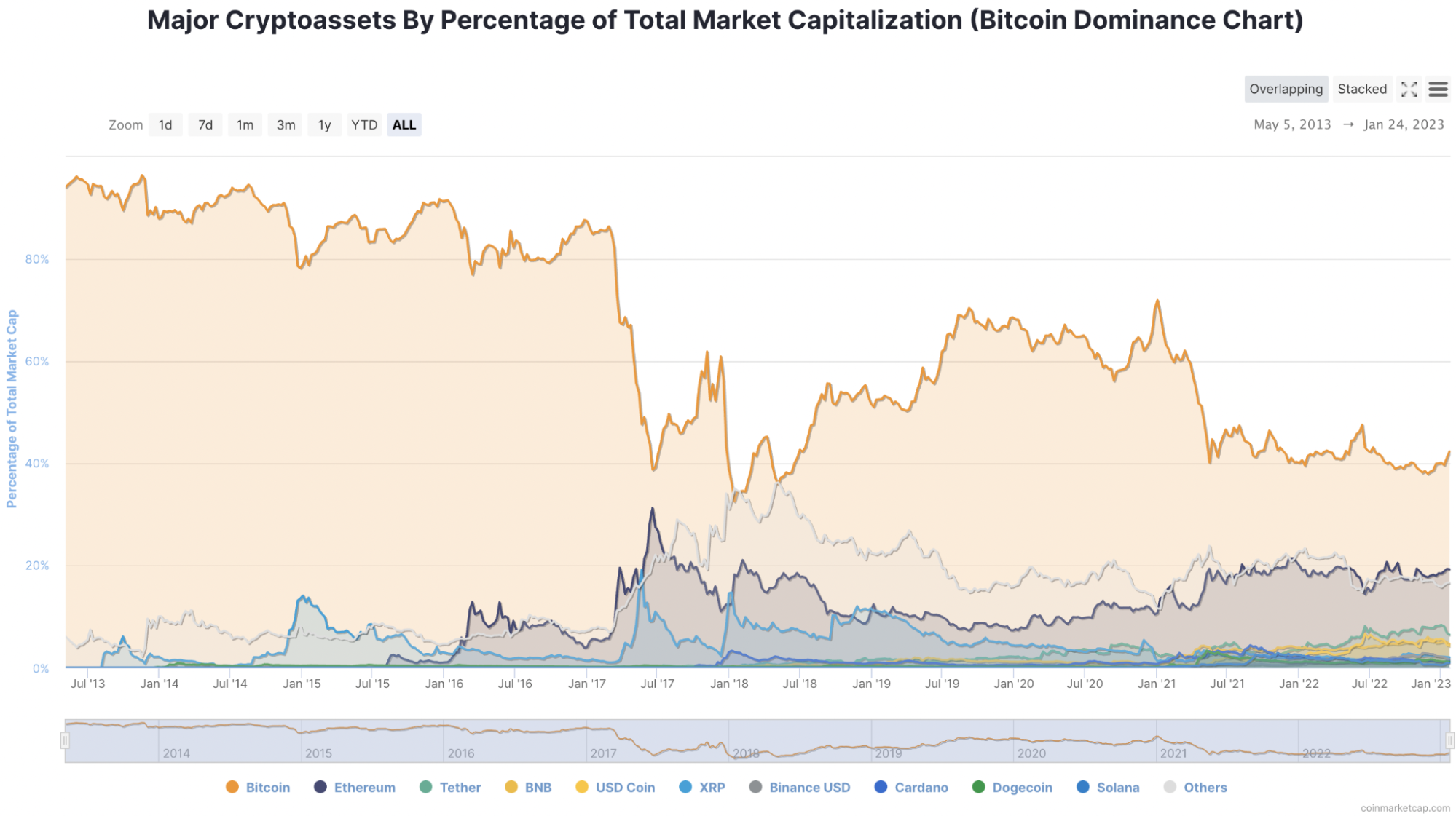

While it can be difficult to understand why a separate entity’s halving cycle can be more influential to a cryptocurrency than its own, the reason for this lies in Bitcoin’s market dominance.

As an asset that’s spent the entirety of its lifecycle as the single largest cryptocurrency based on market capitalization, BTC is simply so large that other altcoins operate within its orbit.

However, this spell of dominance is coming into contention in 2023, as the age of decentralized finance and Web 3.0 assets like NFTs are drawing larger transaction volumes to newer, more advanced cryptocurrency networks.

Should Bitcoin’s market capitalization become contested, assets like Litecoin and its halving cycles will command more attention.

Already, we can see investors looking to Litecoin as a catalyst for future bull markets, and the coin has seen an influx of investment throughout January 2023, leading to a rally of over 35% in the early months of 2023.

The Litecoin Halving Is Giving Hope to Investors

Whether this fresh optimism for Litecoin can grow into a catalyst for a long-awaited wider bull market remains to be seen, but in its upcoming 2023 halving event, there appears to be plenty of hope for investors that the coin’s added scarcity will bring more long-term prosperity to one of the ecosystem’s oldest and much-loved assets.