- Polarys announced its integration with Chainlink

- LINK managed to garner whale interest, but active addresses and network growth declined

Chainlink [LINK] has taken another step forward in increasing its adoption with its new integration. Polygon’s latest collaboration with Polarys will help convert digital asset prices to USD when users mint community NFTs and transact on Polarys NFT marketplaces.

Read Chainlink’s [LINK] Price Prediction 2023-24

The CEO and co-founder of Polarys mentioned that they chose Chainlink because of its expertise and credibility.

.@PolarysDAC—a no-code #NFT platform for athletes and sports clubs—is using #Chainlink Price Feeds to help display digital asset prices in USD.

Discover how Price Feeds create a more seamless UX for #Web3 newcomers ⬇️https://t.co/ETbDSlMn2T

— Powered by Chainlink (@SmartContract) January 9, 2023

NFTs and more…

Chainlink also witnessed growth in its NFT ecosystem over the last week. This was because LINK’s total NFT trade count and total NFT trade volume in USD remained consistently high, according to Santiment.

Source: Santiment

Not only the NFT ecosystem, but LINK’s performance on the price front was optimistic as well. In the last 24 hours, LINK’s price surged by 7%. According to CoinMarketCap, at the time of writing, LINK was trading at $6.09 with a market capitalization of more than $3 billion.

In addition, LINK remained one of the top choices of whales, as it was on the list of the most used smart contracts for the top 100 biggest Ethereum whales as on 10 January.

🏆 MOST USED smart contracts for the top 100 biggest #ETH whales today

🥇 $USDT

🥈 $ETH

🥉 $USDC

4️⃣ $RAI @reflexerfinance

5️⃣ $LINK @chainlink

6️⃣ $UNI @Uniswap

7️⃣ $stETH

8️⃣ $AURA @aurafinance

9️⃣ $BAL @BalancerLabs

🔟 $MATIC @0xPolygon pic.twitter.com/huA2wxMs9H— WhaleStats (tracking crypto whales) (@WhaleStats) January 10, 2023

How many LINKs can you get for $1?

Are the tables turning for Chainlink?

Apart from the current bullish market condition, a few on-chain metrics revealed the possible reason for the price pump.

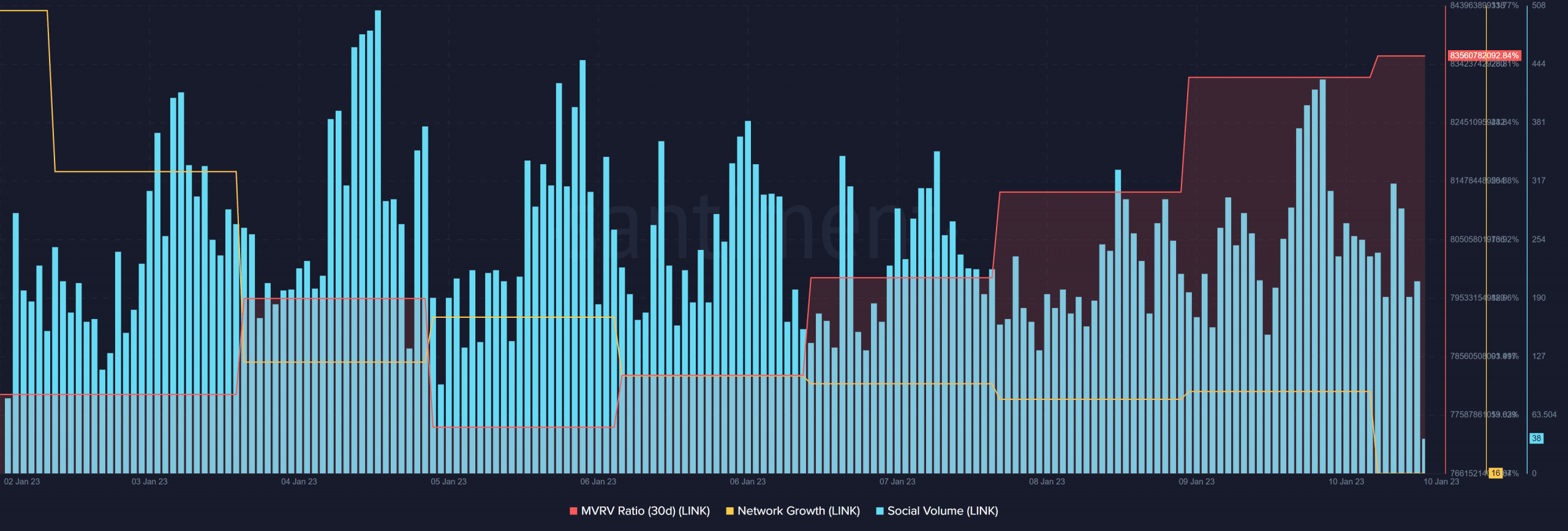

For instance, LINK’s Market Value to Realized Value (MVRV) Ratio registered an uptick, which was bullish. LINK’s social volume also remained relatively high, reflecting its popularity in the crypto space.

Source: Santiment

As per CryptoQuant’s data, LINK’s net deposits on exchanges were low compared to the seven-day average. This indicated less selling pressure. However, not everything was picture perfect as the rest of the metrics increased the possibility of LINK’s bull run coming to a halt.

LINK’s network growth has decreased drastically over the last few days, which was a negative signal for a blockchain. Moreover, LINK’s active addresses were also decreasing, indicating a lower number of users.