Olemedia

Bitcoin (BTC-USD) on Friday was on track to end the week 13.8% higher, in stark contrast to broader equity markets which were weighed down by concerns over the future of the Federal Reserve’s rate hikes.

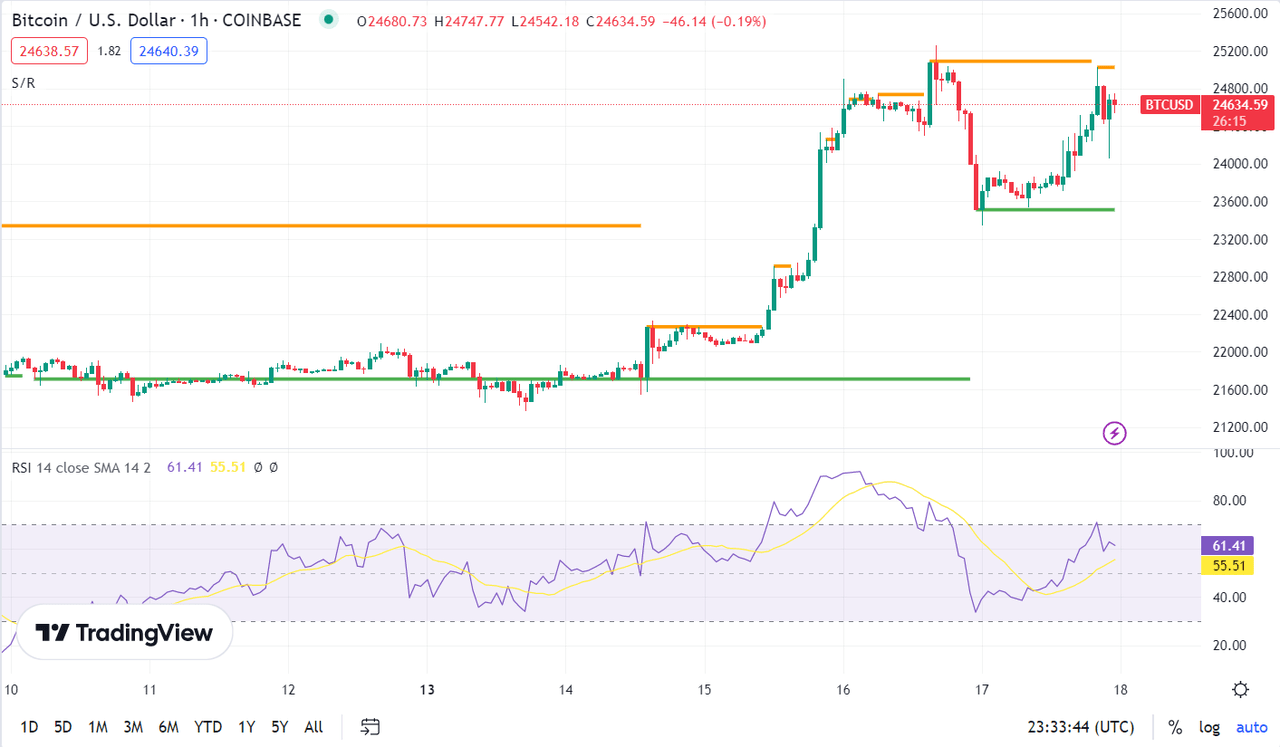

The weekly rally staged by the world’s largest cryptocurrency by market capitalization saw it surge past the $25K mark on Thursday to touch a multi-month high. Part of the bounce has been due to a so-called “short squeeze” that has resulted because of more short liquidations than normal, according to Coinglass data on Wednesday.

In a rare dynamic, the surge in prices across cryptocurrencies this week has diverged from the price action of broader U.S. stocks. Crypto traders appeared to have major appetite for risk and seemed to shrug off concerns over more rate hikes from the Fed after hotter-than-expected consumer price index and producer price index reports.

“Bitcoin is in the retreat at the end of the week, not immune it seems to the sharp shift in risk appetite throughout the markets. That comes after an immense rally earlier this week that saw it hit an eight-month high on Thursday,” said OANDA analyst Craig Erlam.

“Regardless, bitcoin bulls will no doubt be excited by recent developments in the price and may feel more optimistic that they have since 2021,” Erlam added.

Some of the sheen was taken off the rally on Friday, with cryptocurrencies weighed down by headlines surrounding Binance (BNB-USD) (BUSD-USD), which was reportedly weighing cutting off its ties with certain U.S. business affiliates.

“Many crypto traders are paying close attention to the report that Binance might exit relationships with US companies as pressure from regulators intensifies,” said OANDA analyst Edward Moya.

“Binance is the world’s largest exchange and if it abandons key US relationships, that is a major setback for the cryptoverse,” Moya added.

The news about Binance came a day after the Wall Street Journal reported that the exchange was expecting to pay fines to settle U.S. regulatory and law enforcement investigations of its business.

Looking at the broader picture, Bitcoin’s (BTC-USD) weekly surge buoyed the global crypto market cap, which currently stands at $1.12T, up 3.3% over Thursday, according to CoinMarketCap.

SEC Pressure Continues

The weekly rally in cryptocurrencies came despite continued regulatory crackdown from the U.S. Securities and Exchange Commission (SEC). Some of its actions this week include:

- On Friday, the SEC said it had brought charges against NBA Hall of Famer Paul Pierce surrounding misleading statements about tokens sold by EthereumMax.

- On Thursday, the SEC charged Terraform Labs PTE and Do Hyeong Kwon with allegations of conducting a multi-billion dollar crypto asset securities fraud.

- On Monday, Bloomberg reported that the SEC had prepared a draft proposal that could make it had for hedge funds, private equity firms and pension funds to work with cryptocurrency-related firms.

- Also on Monday, the Wall Street Journal reported that the SEC would potentially bring charges against stablecoin issuer Paxos Trust over breaching investor protection laws. Paxos was also ordered by the New York Department of Financial Services to end its relationship and stop the issuance of new dollar-pegged BUSD (BUSD-USD) tokens.

- The SEC actions this week come in the wake of the Commission’s crackdown on crypto exchange Kraken last week.

Countries Act on Crypto

- The Bank of Russia will launch a pilot program for the country’s central bank digital currency at the start of April, according to report on Friday. Meanwhile, the Bank of Japan said it would launch a pilot program in April to test out its digital yen.

- CoinDesk on Thursday reported that cryptocurrency exchanges operating in Canada will come under increased regulatory scrutiny.

- United Arab Emirates capital Abu Dhabi on Wednesday said that its technology ecosystem, referred to as Hub71 Digital Assets, had committed more than $2B of capital to back web3 startups and blockchain technologies.

- The UK’s financial regulator on Tuesday said it was taking enforcement action against unregistered cryptocurrency ATM operators.

Other Notable News

- Exchange traded funds related to bitcoin (BTC-USD) and to the blockchain in general have skyrocketed in 2023, with a few names having jumped close to or more than 100%.

- Katie Stockton, founder and managing partner of independent research provider Fairlead Strategies, told CNBC that stocks and crypto were likely to see retracement amid “greedy” sentiment.

Bitcoin Price

- Bitcoin (BTC-USD) was up 3.5% to $24.63K at 1841 ET and ether (ETH-USD) was higher by 3.2% to ~$1.70K.

- SA contributor Kevin George on Monday warned that though investors have cheered the January rally in bitcoin (BTC-USD), the bounce was technical in nature and nothing had changed fundamentally in the world’s largest cryptocurrency.

Here is the performance of some crypto-related stocks on Friday: Coinbase (COIN) -0.6%, Marathon Digital (MARA) +6.8%, MicroStrategy (MSTR) +3.5%, Riot Platforms (RIOT) +3.6%, Bakkt Holdings (BKKT) +0.6%, Hut 8 Mining (HUT) +1.5%.