Derick Hudson

Meta (NASDAQ:META) reported Q4 earnings last week and investors were wowed by the $40B buyback, reduced CapEx spending, and the fact the stock soared higher.

However, flying under the radar was a key victory in a California federal court room that paves the way for Meta to resume its planned purchase of a virtual reality based fitness platform called Within.

The FTC challenged Meta’s $400M acquisition of Within, largely based on the idea that Meta would buy its way into a dominant position in the VR ecosystem. The ruling is key for Meta, as it likely allows the company to continue a strategy of buying “smaller” VR firms as Meta attempts to build out the metaverse. Additionally, Meta has proven it can create significant shareholder value via acquisitions given the success of Instagram and WhatsApp.

Unfortunately for Meta investors, the Within acquisition is not going to move the needle on earnings in any significant way. Last year, Meta announced that total app spend on the Oculus totaled $1.5B over 3 years. Similar to Apple (AAPL) and Google (GOOG) (GOOGL) Meta collects a “tax” on these revenues which amounts to 30%. That means in 3 years Meta has collected just $450M in revenue from the Oculus App Store.

For a company that does $30B+ in quarterly revenue, the Oculus App Store revenue is less than a rounding error on the company financials. Even if you believe the Oculus will one day reach Microsoft (MSFT) Xbox scale, the $15.56B in Xbox revenue Microsoft recognized in 2022 is less than half of Meta’s Q4 revenue total.

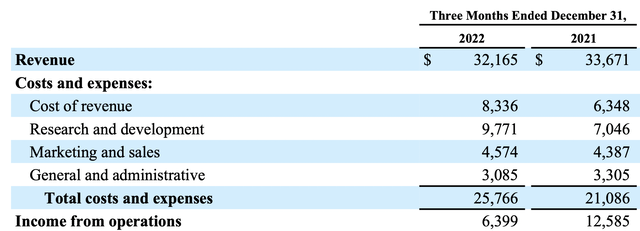

Meta Q4 Operating Results (Meta Q4 Earnings Press Release)

Over the past year on a quarterly basis, Meta’s operating profits have essentially been cut in half despite similar revenue.

Meta is responding by guiding for lower operating costs in 2023 than was initial anticipated. The CFO says full year expenses will fall between $89B and $95B versus the previous outlook of $94B to $100B and $87.7B in 2022.

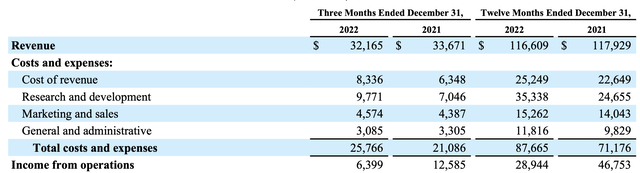

Meta Q4/Full Year Operating Results (Meta Q4 Earnings Press Release)

Based on Wall St. analyst estimates for full year revenue in 2023, investors can already anticipate where Meta’s 2023 operating profits will come in.

| 2023 | Revenue Est | Operating Profit Est |

| Low Revenue Est | $117.79B | $22.79B – $28.79B |

| Mid Revenue Est | $122.34B | $27.34B – $33.34B |

| High Revenue Est | $126.85B | $31.85B – $37.85B |

Revenue Data: Seeking Alpha

On the low-end, Meta is set to end 2023 with lower operating profits despite all analysts believing Meta will end the year with higher revenue. Even towards the high-end, Meta will still be well below the marks set in 2021.

This is primarily due to the fact Meta is burning through cash trying to develop the metaverse.

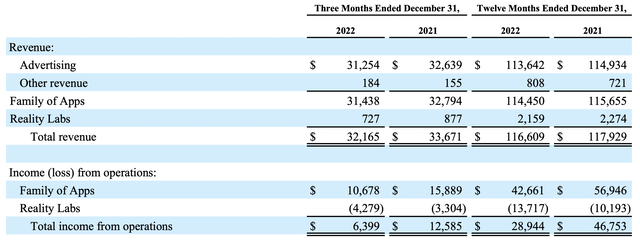

Meta Q4 Press Release

Despite all the attention, and the fact Meta launched a new device in Q4 – revenues for the Reality Labs segment of the business declined both in the quarter, and for the full year.

The decline in revenue was matched by an increase in operating losses from the segment – up over 30% to $13.7B in 2022.

Regardless where you stand on the future of Meta’s metaverse plans, so far the results have been a disaster financially.

That is why the ruling allowing Meta to grow this segment of the business via acquisition can be viewed two ways. First, it will likely allow Meta to acquire more startups in the metaverse space to help turn the tide of negative revenue growth and operating profits.

However, a more cynical view is that it allows Meta to continue to spend on a project that financially has proven it’s a big loser in terms of revenue and profits. Recall that Meta acquired Oculus nearly 9 years ago for $2B and the Reality Labs business unit in 2023 had just $2.16B in revenue.

The fact Meta continues to invest in a business unit that hasn’t delivered any significant results can be viewed as reckless by some investors and will likely outweigh the excitement of the $40B buyback and lower operating expenses in the coming weeks.

Conclusions

I appreciate that a federal judge ruled in favored of Meta. If the FTC is allowed to block $400M acquisitions in industries that are nascent and have historically lost billions for Meta investors, it would have given the agency free rein to go after just about any corporate buyout.

However, Meta is burning $1B+ per month on Reality Labs – all for a segment that showed negative revenue growth Q/Q and Y/Y. The market is clearly rejecting the Oculus product and metaverse idea. Any suggestion that it will turn around is speculation.

I sold Meta on the recent move higher and will revisit the company each quarter to see if any evidence materializes that Reality Labs justifies the massive investment.