- Solana NFT staples declined over the last 30 days and so did the count of daily active users.

- SOL, however, managed to perform well both on the price and metrics front.

A Twitter handle by the name Solana Legend recently posted a tweet that talked about the potential and capabilities of Solana’s [SOL] NFT ecosystem.

As per the tweet, Solana outperformed Ethereum in several aspects. This was something that could take the ecosystem to new highs.

One of the key advantages of Solana was its pricing. Solana is the most inexpensive chain to drop NFTs. For comparison, the cost of deploying smart contracts on Ethereum is around $5,000+, whereas it’s $30 on Solana.

0/ It’s a new era in NFTs 👇

Royalties went to 0 or optional on SOL’s main NFT marketplace @MagicEden before @opensea

A thread 🧵 on why Solana iterates faster than Ethereum and will drive a lot of native innovation and surpass the ETH NFT market

This trend has already started

— Solana Legend 🎒 (@SolanaLegend) February 18, 2023

Not only in terms of pricing, but Solana was also ahead of Ethereum in terms of transaction count. Though the NFT sales value remained higher for Ethereum, the average number of transactions per wallet was up to 10 times higher on Solana.

How much are 1,10,100 SOLs worth today?

Everything is not picture-perfect

Despite Solana’s capabilities, things did not work in its favor on the ground. Several data sets indicated that SOL’s NFT ecosystem was failing to grow.

Furthermore, CRYPTOSLAM’s data revealed that Solana’s sales volume declined by more than 57% in the last seven days. Moreover, the number of unique buyers and sellers has also registered a fall since January 2023.

Source: CRYPTOSLAM

Dune’s data also complemented that of CRYPTOSLAM, as it revealed that Solana NFT marketplace’s daily active users registered a decline over the past few weeks.

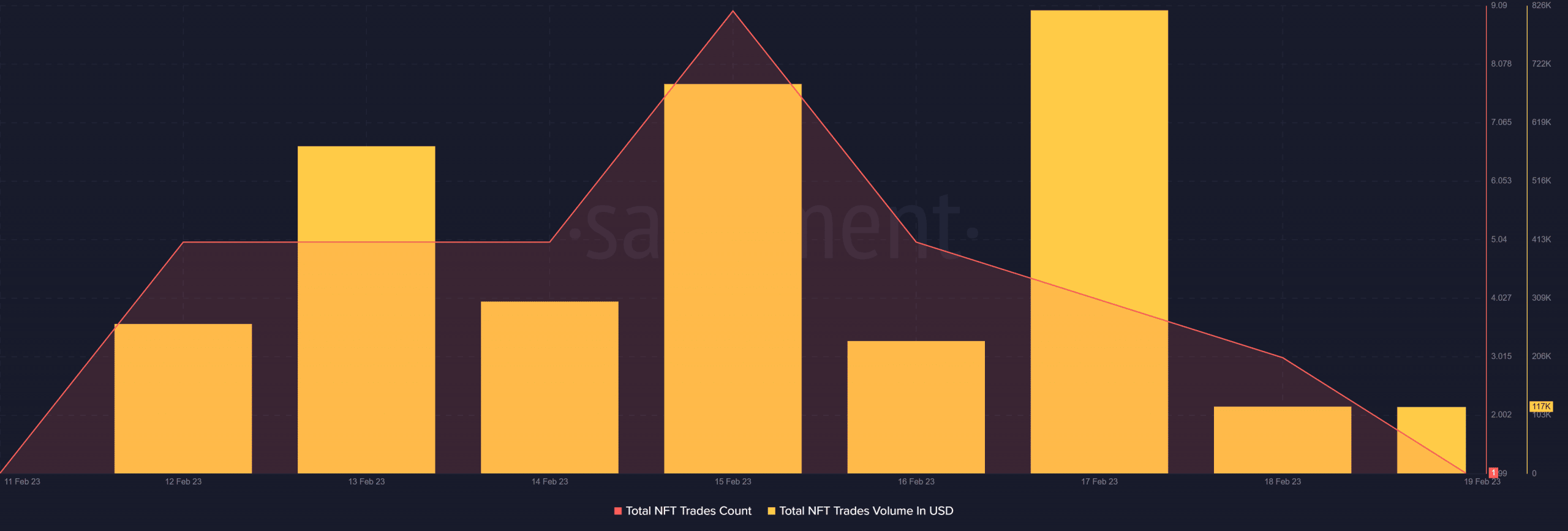

However, Santiment’s chart looked optimistic for the network as it displayed growth in the total number of NFT trade counts and trade volume in USD over the last week.

Interestingly, while most of the NFT-related metrics were negative, growth was noted in the network’s DeFi space as its TVL increased.

Source: Santiment

Realistic or not, here’s SOL market cap in BTC’s terms

State of SOL this month

Solana’s performance on the price front looked in investors’ favor as it registered a weekly increase of more than 12%. According to CoinMarketCap, at the time of writing, SOL was valued at $23.58 with a market capitalization of over $8.9 billion.

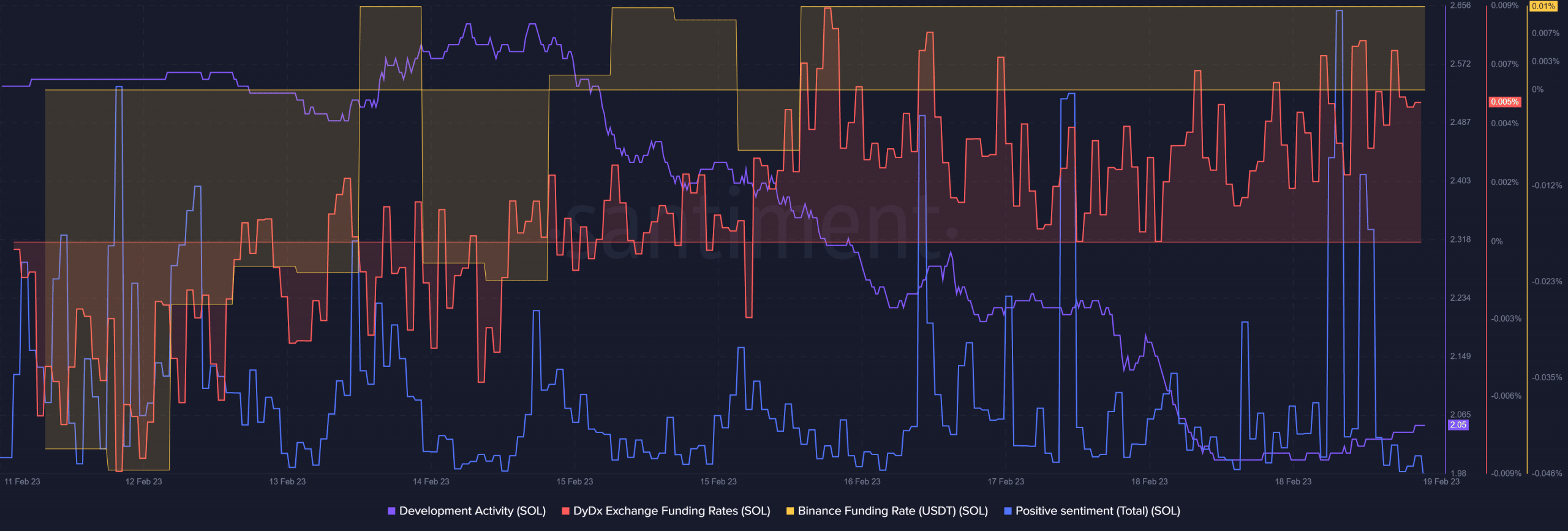

The same was true for SOL’s on-chain metrics, which looked bullish. For example, SOL’s demand in the derivatives market increased, as suggested by its Binance and DyDx funding rates.

Positive sentiments around SOL also spiked, reflecting investors’ confidence in SOL.

Nonetheless, SOL’s development activity was concerning as it declined last week, which by and large, is a negative signal.

Source: Santiment