A closely followed crypto trader is issuing a warning to Bitcoin holders, saying that BTC could see a cascade of long liquidations in the near future.

Justin Bennett tells his 111,300 Twitter followers that he believes Bitcoin is likely trading in an expanding wedge pattern and that it could correct to around $20,000 after hitting the formation’s diagonal resistance.

“A bit higher than I thought we might see, but I still think we get the pullback from BTC.

Apes gonna ape.”

Bennett also notes that billions of dollars worth of long positions are waiting to be liquidated below $20,800, suggesting that market makers could drive the price of Bitcoin down to tap into the deep liquidity area.

“Over $100 billion (yes, billion) worth of BTC longs left untouched at $20,800. What could it mean?”

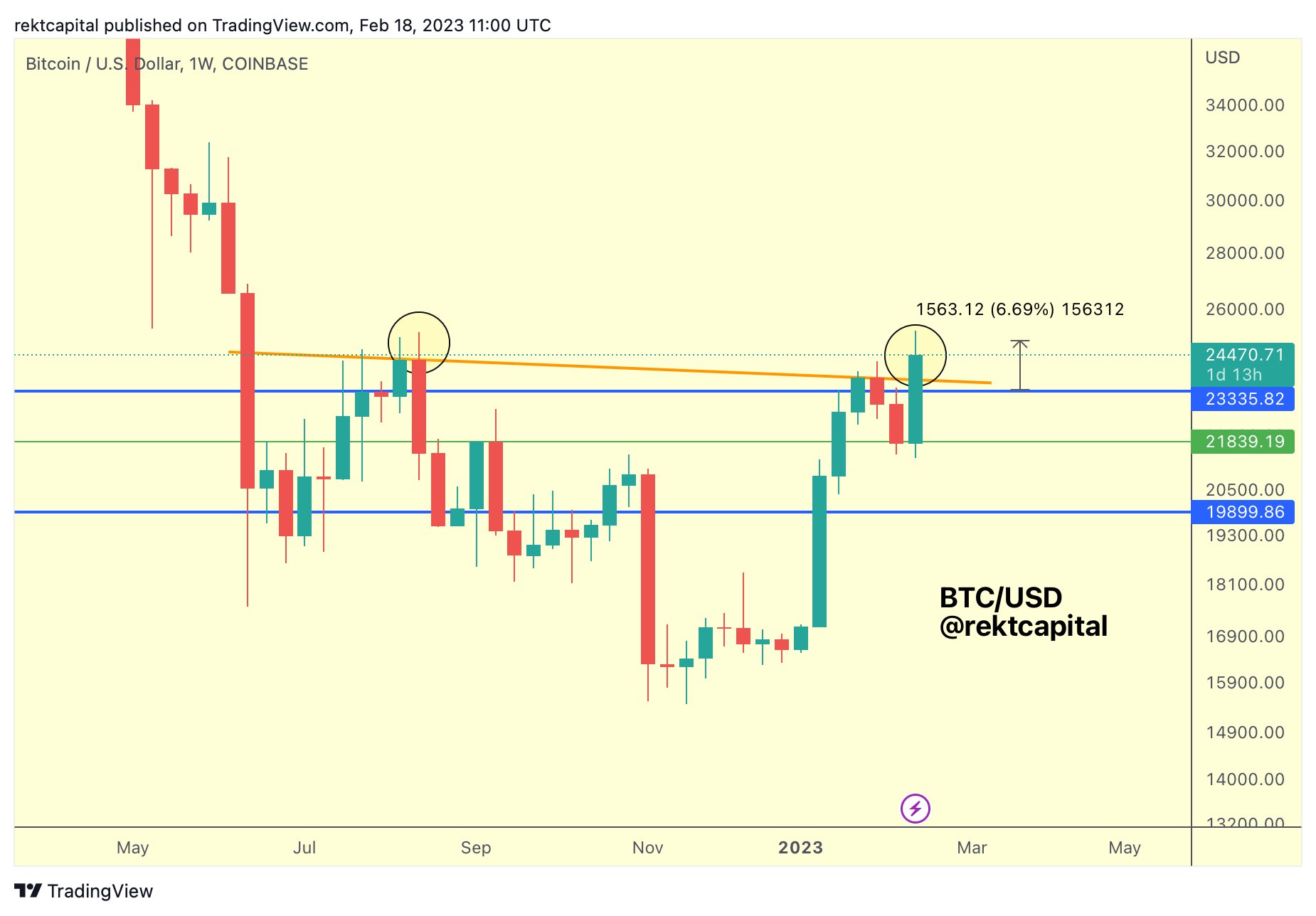

While Bennett sees a significant corrective move for Bitcoin, fellow analyst Rekt believes that BTC could be gearing up for a big breakout on the monthly timeframe.

“Looking forward to the next few months for BTC.”

Looking at the trader’s chart, he appears to be suggesting that BTC could be mirroring its late 2014 and early 2019 price action. In both instances, Bitcoin broke down from a descending triangle pattern before eventually taking out a key diagonal resistance.

In the short term, Rekt predicts that Bitcoin could retest resistance at around $23,300 before continuing its current uptrend.

“BTC performed a successful retest of the confluent resistance area on the daily [chart].

That being said, there could still be another dip to that same area after a weekly close.

That would constitute a healthy technical retest setup but this time on the weekly [timeframe].”

At time of writing, Bitcoin is trading for $24,711, a fractional increase on the day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Liu zishan