- Ethereum’s development activity jumped sharply over the past week.

- The number of long positions for ETH increased substantially over the past two days.

The Ethereum [ETH] community was upbeat about the upcoming Shanghai Upgrade which would enable the withdrawal of staked ETH, marking an end to a two-year wait.

In the build-up to the upgrade, Ethereum developers provided key updates on the testing front.

Ethereum developers have started to test MEV-Boost, builder, and relay software a few test networks where the Shanghai upgrade has been activated like the Zhejiang testnet and Devnet 7. MEV-Boost software is being tested alongside staked ETH withdrawals and so far, no issues have… https://t.co/b9nNNlPACA

— Wu Blockchain (@WuBlockchain) February 24, 2023

One of the developers gave an update about testing staked ETH withdrawals on the Zhejiang testnet and stated that no issues were found.

The team was working towards Shanghai Upgrade on the Sepolia testnet before the much-awaited launch on the Ethereum mainnet in March.

With a major upgrade around the corner, ETH developers sprung into action. The development activity jumped sharply over the past week, data from Santiment showed.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2023-24

Stakes are high!

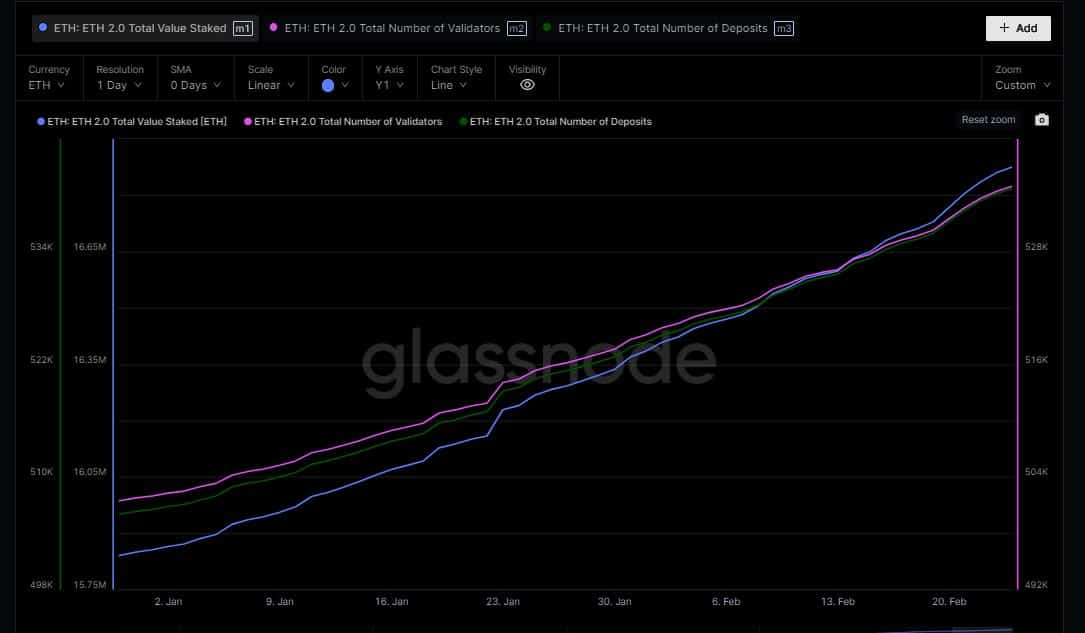

In anticipation of the Shanghai Upgrade, the Ethereum ecosystem recorded a spurt in staking activity. As per data from Glasssnode, the total value staked and the number of stakers rose steadily over the past few weeks.

At the time of writing, more than 16 million ETH were locked in the network’s smart contracts, representing a growth of 6% since the start of 2023.

Source: Glassnode

The other reason behind the growth in staking could be the jump in validators’ revenue. As per Staking rewards, the revenue surged almost 40% over the last 30 days, incentivizing users to participate in staking activity.

Source: Staking Rewards

Will ETH see a bullish pivot?

ETH dipped below $1600 at press time, data from CoinMarketCap showed. The coin was under considerable stress over the past week, having shed nearly 6% of its value.

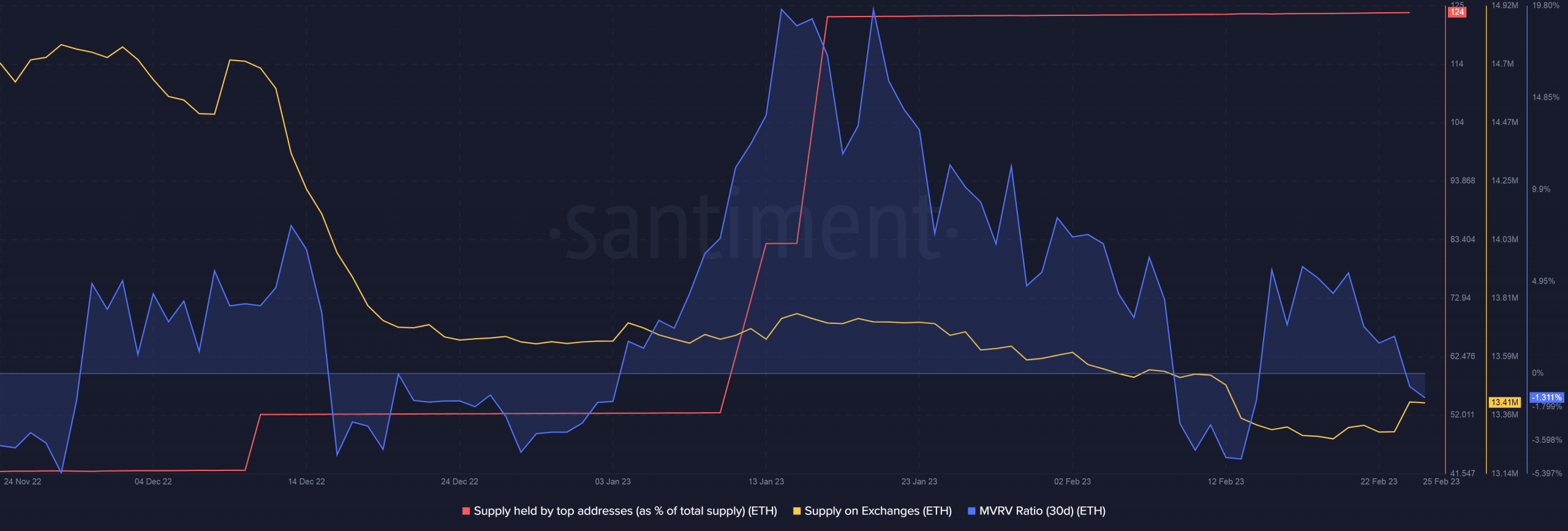

Having said that, big addresses were bullish on ETH’s price, which was evidenced by the increasing supply held by top addresses. The dip in total supply on exchanges lent more credence to the accumulation idea.

The 30-day MVRV Ratio went into negative territory, indicating that sales won’t give back profits to ETH holders. This could keep selling activity in check and pump ETH’s price in the days to come.

Source: Santiment

Is your portfolio green? Check out the Ethereum Profit Calculator

Additionally, the number of long positions for ETH increased substantially over the past two days, implying that investors expected ETH to pump in the coming days.

Source: coinglass