Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- BTC broke below an ascending line.

- The 90-day Mean Coin Age increased despite fluctuating sentiment.

Bitcoin [BTC] dropped sharply on 2 March following Silvergate’s woes. Major crypto clients like Coinbase suspended business with the troubled Silvergate bank sending its stocks to plunge over 50%.

Investors reacted cautiously to the development, as some retreated to stablecoins, leaving most of the crypto market in the red, as shown below.

Read Bitcoin [BTC] Price Prediction 2023-23

Source: Coin360 (Daily crypto market performance on March 3, 2023)

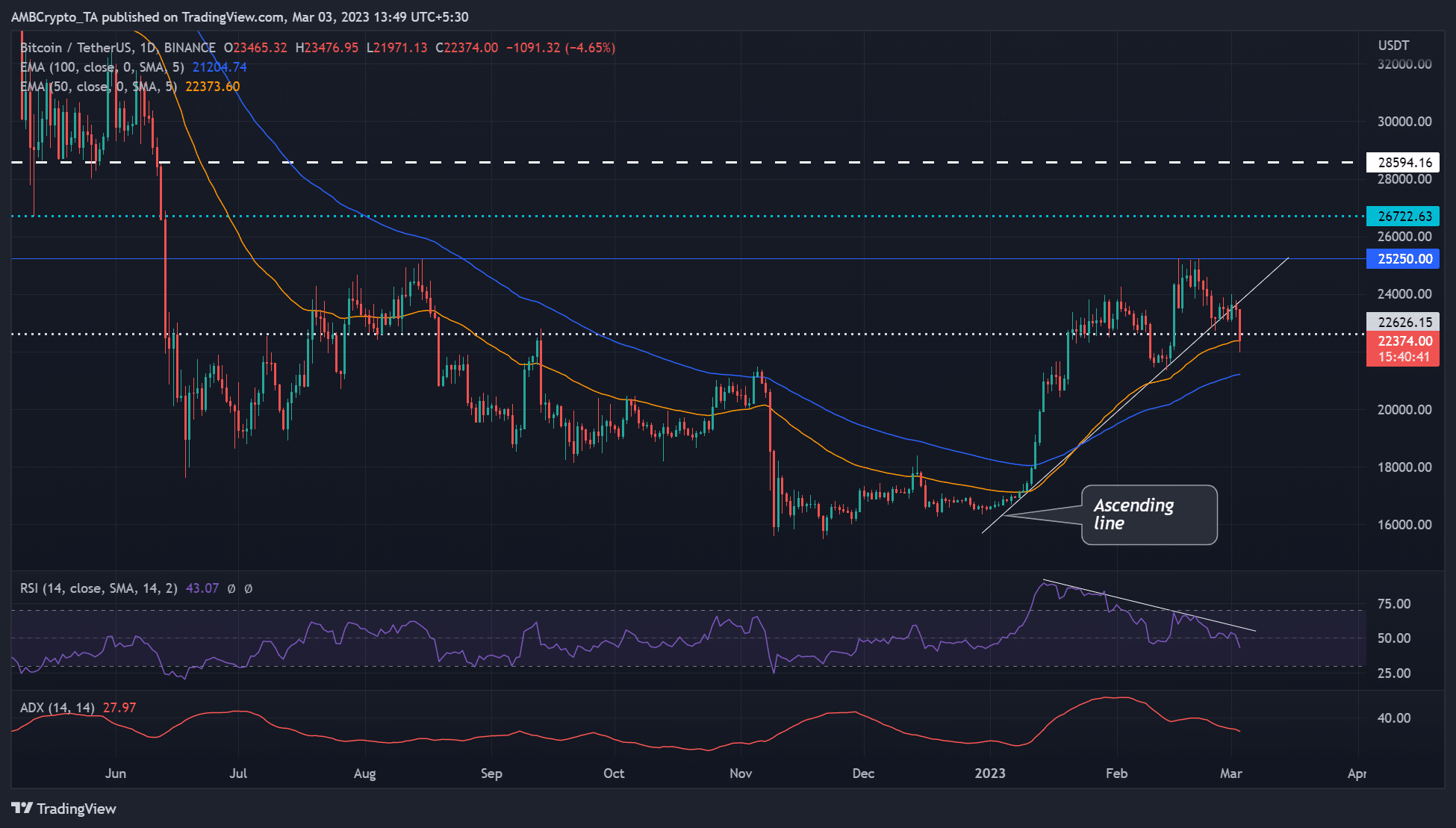

BTC broke below an ascending line

Source: BTC/USDT on TradingView

BTC posted solid gains after jumping from $16.61K in early January to $25.25K in February. In the past few weeks, $22.63K has been steady support, showing bulls weren’t willing to exit yet. However, Silvergate’s woes on 2 March tipped bears to breach the support.

In addition, BTC broke a key ascending line below, flipping the market into a bearish structure. Bears must overcome two hurdles to dent any prevailing bullish sentiment completely.

At press time, they struggled to bypass the 50-day EMA (exponential Moving Average) of $22,373. If bears succeed in pushing BTC below the 50-day EMA, they have another hurdle at 100-day EMA ($21,204) to bypass.

On the contrary, the failure of bears to overcome the above hurdles could attract a new buying spree. It could push the BTC price toward the overhead resistance of $25.25K. But bulls will only gain leverage if BTC price action is above the ascending line and $21K support is solidly secured.

The RSI showed increased divergence with price action since mid-January, reiterating the weakening uptrend momentum. Moreover, the retreating Average Directional Index (ADX) confirms the weak uptrend and suggests a potential retracement or consolidation.

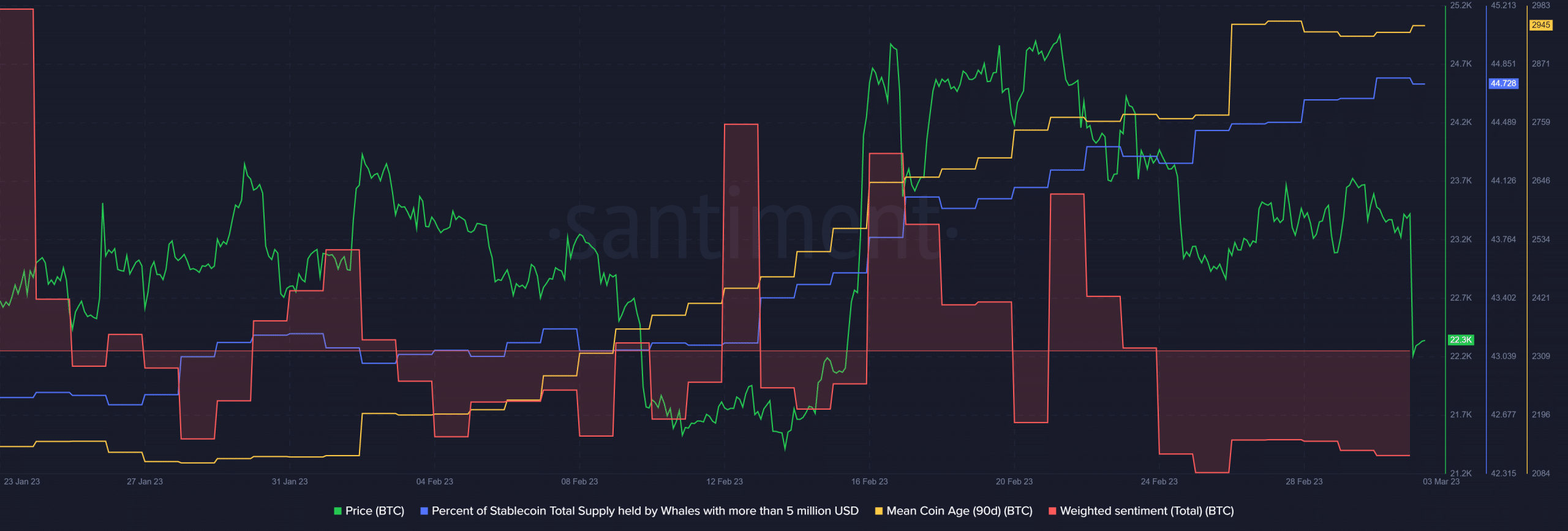

Mean Coin Age rose despite the negative weighted sentiment

Source: Santiment

According to Santiment, BTC’s sentiment remained negative in the past few days after sustaining fluctuations a couple of weeks before.

However, the 90-day Mean Coin Age rose steadily in the same period, indicating a wide-network accumulation – a bullish signal which suggests a potential rally ahead.

Is your portfolio green? Check out the BTC Profit Calculator

Notably, sharp drops in BTC prices are often accompanied by spikes in stablecoins held by investors.

Interestingly, the sharp drop witnessed at press time didn’t correspond to a significant spike in stablecoins held by whales. It shows investors aren’t exiting yet, painting a bullish outlook if bulls defend the $21K support.