The price of Bitcoin has been highly volatile in recent days due to the uncertainty surrounding Tether, the world’s largest stablecoin. Tether has been facing legal issues, which have led to fear, uncertainty, and doubt in the cryptocurrency market, causing BTC to drop to the $22,000 level.

Meanwhile, several well-known cryptocurrencies, including Litecoin (LTC) and Dogecoin (DOGE), have also seen slight price declines.

The recent decline in the crypto market could be attributed to the release of US manufacturing numbers and concerns surrounding the accessibility of banking services for crypto companies in the US.

In this article, we will examine the current state of the cryptocurrency market and make a Bitcoin price prediction for the coming days.

Silvergate Uncertainty, Weakening Crypto

After the market closed on Wednesday, Silvergate filed a report with the Securities and Exchange Commission (SEC), announcing a delay in the submission of its annual report as it assesses the impact of several events on its operations.

As a result, the value of cryptocurrencies, including Bitcoin, fell sharply and has been showing mixed signals. It is worth noting that the Silvergate event has had a significant impact on the value of cryptocurrencies.

It is noteworthy that Silvergate Capital (SI) announced on Wednesday night that it would delay the submission of its annual report due to losses incurred from the November FTX crash and several regulatory probes.

Consequently, this had a detrimental impact on market sentiment, causing investors and traders to lose faith in the stability and security of the crypto industry, which could result in a widespread sell-off in the market.

Moreover, the backlash faced by Silvergate Capital has led to increased regulatory scrutiny of the cryptocurrency industry, making authorities more hesitant to issue licenses to crypto-related businesses. This could potentially limit the industry’s growth and expansion.

Risk Aversion In The Bitcoin Market

The global cryptocurrency market is poised to end the week on a bearish note due to a range of factors. The release of robust US economic data has raised speculation that the Federal Reserve may take more aggressive action to combat persistent inflation by raising interest rates.

Investors and traders are closely monitoring economic indicators in preparation for potential rate hikes and inflation. With the economy performing well and inflationary pressures still present, it is likely that the Federal Reserve will increase its policy rate to a level higher than anticipated in late last year.

Bitcoin Price

Bitcoin is currently priced at $22,357 with a 24-hour trading volume of $18.5 billion, showing a 0.25% drop in the last 24 hours. Similarly, Ethereum is trading at $1,570 with a 24-hour trading volume of $6.7 billion and has dropped by 0.15% in the last 24 hours.

According to technical analysis, the BTC/USD pair may break the symmetrical triangle pattern at the $23,250 level. In such a scenario, the BTC price may get exposed to the $22,046 support zone. A further breakdown below this support zone may lead BTC to drop to $21,450.

Moreover, the presence of a bearish engulfing candle indicates a strong selling bias. However, if the candles close above this level, a bullish bounce-off may occur, targeting $22,800 or higher, toward the $23,750 mark.

Buy BTC Now

Bitcoin Alternatives

Investors who are interested in purchasing Bitcoin may want to explore alternative options that provide greater potential for short-term growth.

Cryptonews has conducted a comprehensive analysis of the top 15 cryptocurrencies that investors should consider for 2023. Click on the link below to learn more.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

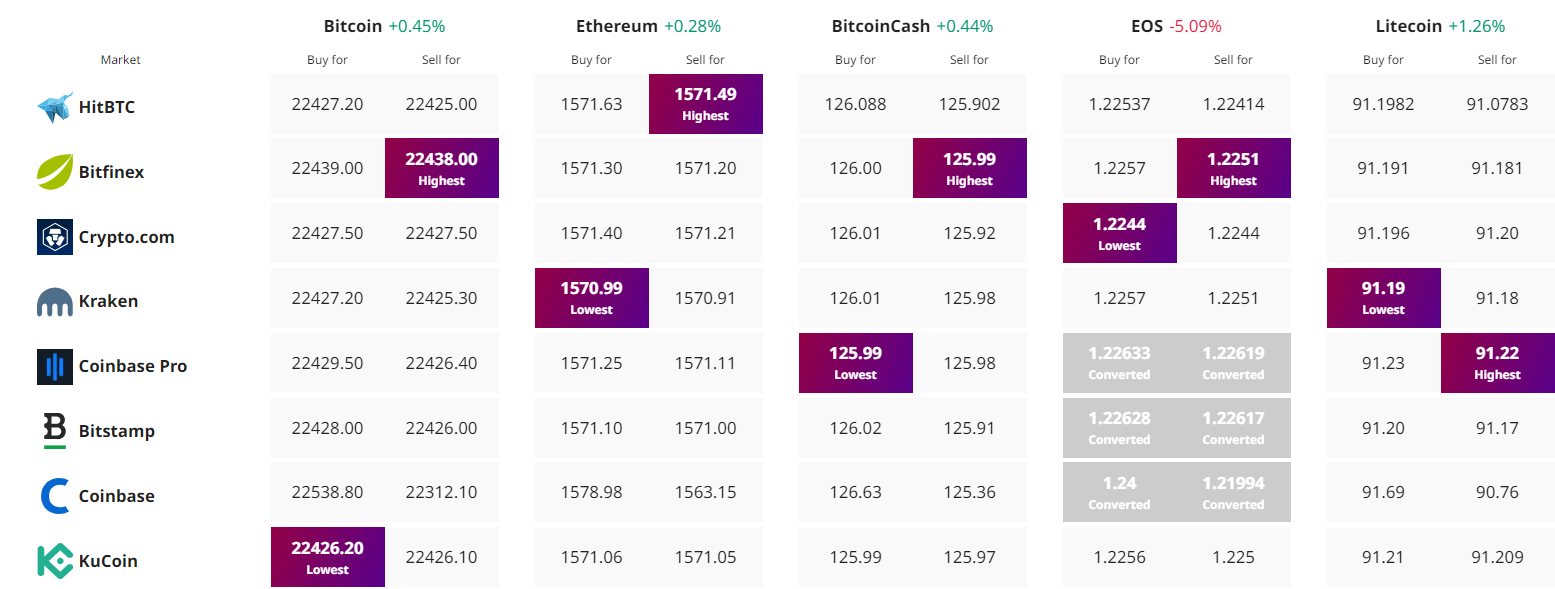

Find The Best Price to Buy/Sell Cryptocurrency