- Ethereum price falling by 13% led to whales accumulating $1.8 billion worth of ETH in five days.

- Centralized exchanges like Coinbase, Huobi and Kraken have observed the highest net outflows since the Shanghai upgrade.

- SEC taking action against the exchanges and associated entities has resulted in pessimism towards these CEXes.

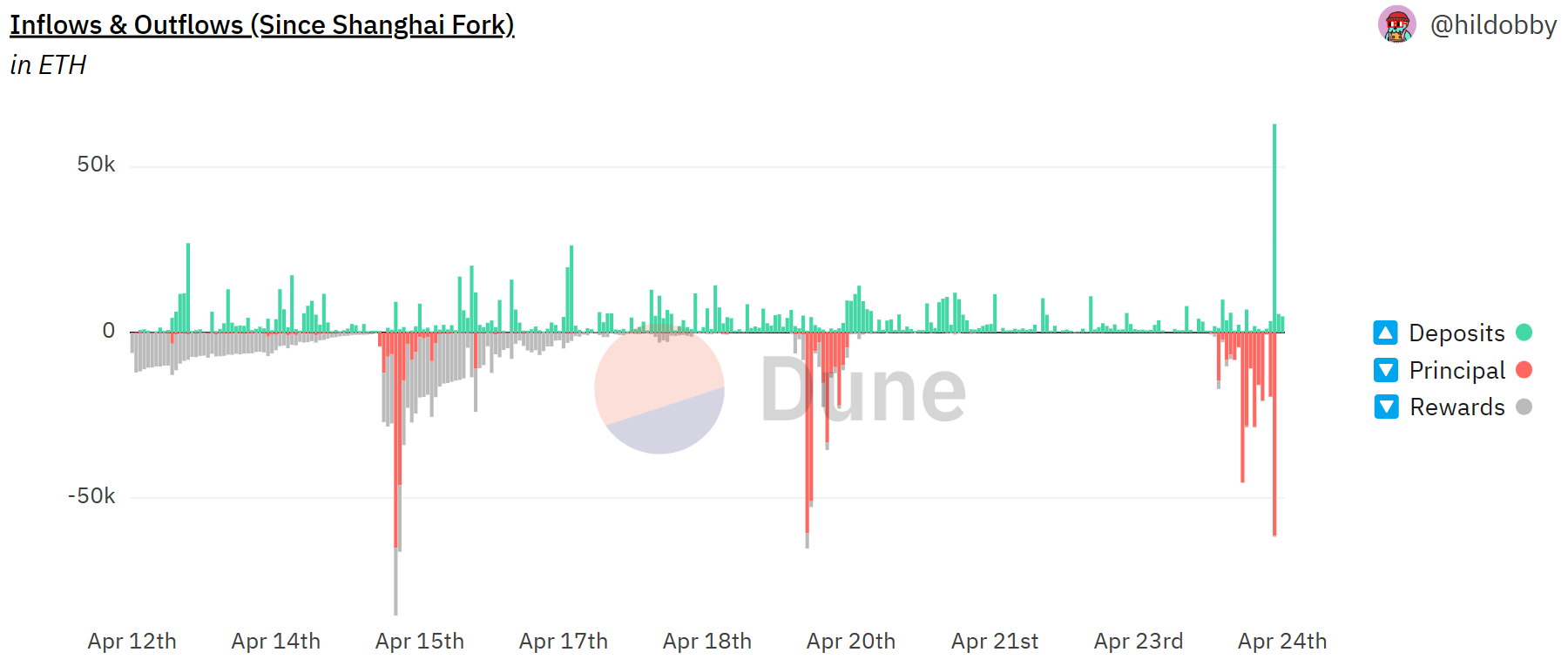

Ethereum has seen a slew of withdrawals since the Shanghai hardfork went live on the mainnet on April 12. But at the same time, the amount of deposits has been countering the ETH being taken out of staking platforms. However, while the sector is observing net inflows, one sector is only observing outflows, which the Securities and Exchange Commission (SEC) can be blamed for.

Ethereum investors prefer DeFi for staking

Ethereum staking has been mostly concentrated on Decentralized Finance (DeFi) applications (Dapps) at the moment. According to the data obtained since the Shanghai hardfork went live, the likes of Lido DAO, Staked.us, and more have been the foremost recipient of ETH deposits.

Even though these platforms have been registering significant withdrawals, their net ETH flows are positive. On the other hand, the top three platforms to observe the most withdrawals are centralized exchanges (CEXes), Huobi, Coinbase and Kraken.

Ethereum deposits and withdrawal net flows

The reason that the three of them are noting such negative flows is due to the broader market events that shook the confidence in centralized exchanges. The collapse of FTX last November 1 triggered some pessimism, and soon after, these exchanges became the victims of regulatory crackdowns.

Huobi is on the list due to Tron founder Justin Sun who has a significant stake in the exchange company. Sun was recently charged by the Securities and Exchange Commission (SEC) for violating securities law.

Similarly, even though Coinbase did not face charges, it did receive a Wells notice from the SEC warning of potential charges. This led to the exchange announcing its plans to shift its operations out of the United States.

Kraken happened to note the highest withdrawal as the SEC shut down the exchange’s staking services two months ago. The regulatory body also fined the company $30 million for four years of illegal activities. However, this has not resulted in all CEXes bearing the brunt, as OKX is observing net inflows to the tune of 31,616 ETH.

Interestingly, most of the withdrawals have been observed to occur at a four-day interval as and when the Ethereum price paints red on the charts. Instances include the 0.44% drop from April 15, the 8% crash from April 19 and the 1% fall of April 24.

Ethereum withdrawals and deposits

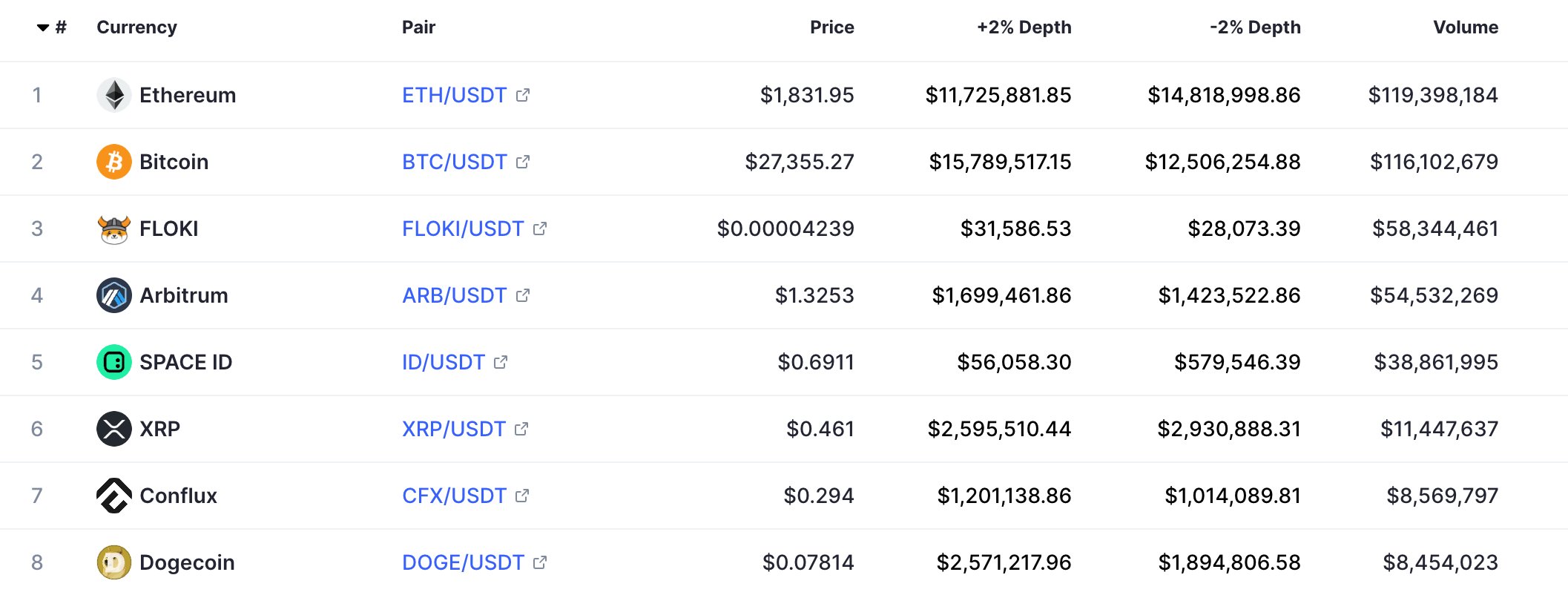

Even so, the Ethereum Shanghai hardfork hype is still dominating the market as ETH continues to witness investors’ interest. The cryptocurrency has noted the most volume traded in a 24-hour window on crypto exchange Gate.io, surpassing even Bitcoin.

Gate.io 24-hour trading volume

Plus, the positive response to staking withdrawal has resulted in whales’ accumulation that intensified in the last few days after ETH crashed by 13% to trade at $1,842 at the time of writing. This is reflected in the balance of the addresses holding 100k to 1 million ETH. This cohort has amassed over 1 million ETH in the same duration, currently worth $1.8 billion, suggesting support for recovery.

%20[05.22.35,%2025%20Apr,%202023]-638179787346677076.png)

Ethereum whale accumulation

As for Ethereum price, the altcoin is still primed for recovery since it has not lost the 200-day Exponential Moving Average (EMA) support yet.

ETH/USD 1-day chart

This level tends to act as one of the most important support levels and would indicate a fall in prices should a daily candlestick close below it. If ETH does not observe the same, it would be safe from further decline.