Tether (USDT) has traded at a premium against the U.S. Dollar since the banking crisis began in March, continuing a trend that has seen its supply and market dominance rise to previous highs.

According to CoinMarketCap data, USDT is trading at $1.0007 after gaining 0.06% in the last 24 hours. This price performance is not a one-time occurrence, as the stablecoin mostly traded at a premium against the U.S. Dollar throughout April on centralized exchanges, according to blockchain analytical firm Kaiko.

USDT Dominance: Supply Returns to Previous Highs

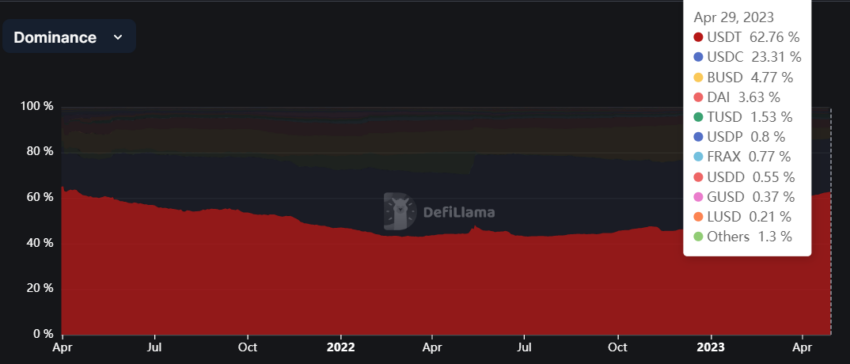

USDT’s supply and dominance have returned to their highest level since Terra’s UST collapse in May 2022, according to BeInCrypto data.

Per the data, USDT’s supply has increased by over $15 billion on the year-to-date metrics to $81.67 billion, while its market dominance rose to roughly 63% from 48% recorded at the beginning of the year. USDT’s growth has coincided with the regulatory and banking troubles for its major competitors, USDC and Binance USD (BUSD).

Tether’s incredible growth has divided opinion within the community. Some industry players have pointed out its opaque reserves as a grey area that must be addressed. A crypto investor Mario Antretter said:

“Tethers growth is extremely scary and dangerous who audits those funds and are they really insured or backed?”

However, a statement from the stablecoin issuer said it has been the target of “outdated, inaccurate, and misleading coverage and allegations.”

Meanwhile, USDT dominance might be good for BTC as analysts claim there is a correlation between USDT supply and the rise in Bitcoin price. A study by BDC Consulting shows that USDT supply features “a strong and statistically significant correlation” with BTC price.

USDC and BUSD Struggle

While Tether has continued to fly high in 2023, USDC and BUSD have struggled considerably after battling different issues.

BUSD’s supply has fallen to less than $7 billion after peaking at $22 billion in November 2022. Its issues began in February when the New York Department of Financial Services (NYDFS) ordered Paxos to stop other mints. Its adoption and usage further slipped when Coinbase delisted it and Binance removed its zero-trading fee feature.

On the other hand, USDC lost its dollar peg in March following the U.S. banking crisis. BeInCrypto reported that the stablecoin’s issuer Circle held part of its reserves at the failed Silicon Valley Bank. While USDC has regained parity with the dollar, crypto investors’ confidence remains low.

According to BeInCrypto data, USDC’s supply shrunk by over $14 billion in 2023.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.