In a difficult historical environment for stablecoins given the tightening of international regulations, Tether and its flagship product USDT seem to be getting the better of other competitors in the sector.

Tether (USDT) has made up for all the drop in capitalization it experienced a year ago during the collapse of the UST algorithmic stablecoin and the subsequent crisis of investor confidence in this kind of cryptocurrency.

Let’s take a closer look at what is happening.

Tether and its stablecoin USDT recover the capitalization lost last year

Tether (USDT), the world’s most traded crypto-asset, recovered all the capitalization it lost during 2022, when several apocalyptic events came upon the cryptocurrency sector.

In particular, the collapse of the Terra/Luna ecosystem, the UST stablecoin, and the failure of the FTX cryptocurrency exchange called into question the future of the market and that of USDT.

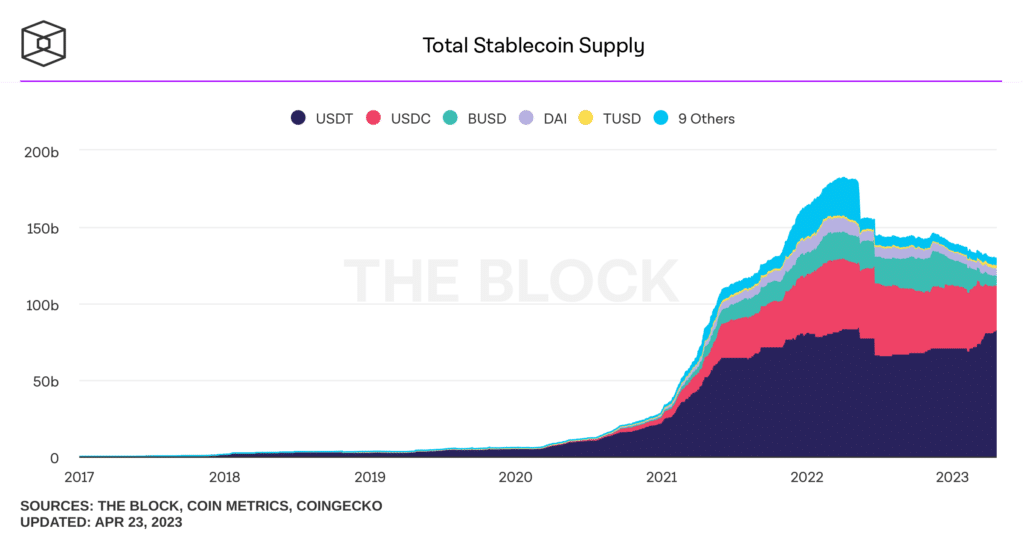

In that context, Tether’s stablecoin, which turns out to be the most popular and widely used among users to store value, lost about 20% of its market capitalization, falling from $83 billion in May 2022 to $65 billion in November 2022.

Only recently, since the start of the first quarter of 2023 have the numbers returned to smiles for Tether’s capitalization, which currently marks $81.4 billion and is approaching its highest figure ever.

In any case, USDT‘s real explosion, which established the stablecoin’s supremacy in the market, occurred starting in January 2021 and lasted until mid-2022, allowing the crypto to grow by nearly $80 billion.

This year’s recovery should be seen as further proof of the strength of Tether’s product.

IMMAGINE _____________________________

It is important to note that when it comes to stablecoins, market capitalization usually coincides with circulating supply, as when new tokens are issued in the market, assets with a countervalue equal to the total issued are allocated in parallel.

Consequently, since the value of a stable is equal to that of a FIAT coin, when the circulating supply grows, so does the capitalization. The only situation in which this “rule” does not apply is when a stablecoin suffers a depeg from its target value.

In that case the capitalization will be less than the circulating supply.

The dominance of Tether (USDT) over the rest of the other stablecoins

Tether’s dominance in the stablecoin market at the capitalization level is supported by the difficulties crypto competitors have faced recently.

Beyond the failure of UST, which was a risky asset given the complexity of the blockchain architecture, it is interesting to note that USDC and BUSD have recently been in the spotlight because of some misfortunes they have suffered.

First, the US Securities and Exchange Commission (SEC) and New York state regulators forced Paxos to terminate the issuance of BUSD, the stablecoin linked to the Binance exchange, having labeled it as an “unregistered asset security.”

The result is that BUSD has lost about 60% of its market share since the beginning of the year, fueling USDT‘s success.

In addition, the bankruptcy of Silicon Valley Bank and the discovery of Circle‘s $3.3 billion exposure on the now defunct bank undermined the credibility and reliability of USDC, which is nonetheless a staple of the DeFi industry.

On that occasion, the stablecoin had de-pegged by about 15% of its value, yet managed to recover later within days.

In this regard Conor Ryder, research analyst at Kaiko, said that:

“Tether has been a great benefactor of the enforcement approach in the United States, as not only does it appear to be insulated by the SEC, but it has not suffered any major incidents in recent times, inspiring confidence among investors.”

Such situations have only strengthened USDT and enshrined its hegemony over the rest of the stablecoins, despite the fact that Tether and its sister company Bitfinex have had a controversial past.

USDT’s reserves have not been independently verified. Several years ago Tether, reached a settlement with New York, paying an $18.5 million fine for commingling funds and lying about reserves.

Tether’s balance sheet on exchanges in decline since the beginning of the year

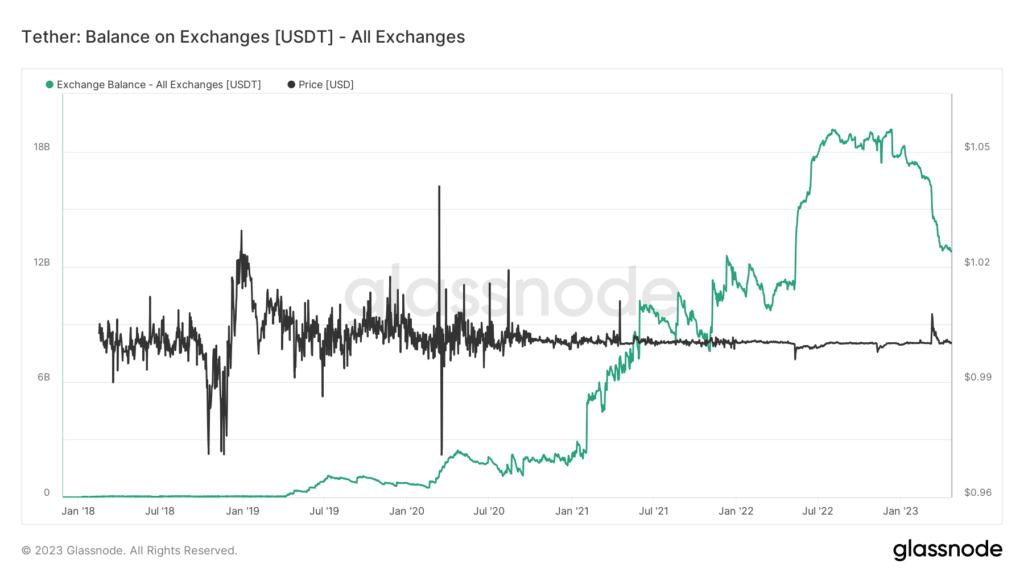

While Tether‘s supply and capitalization are increasing, the same cannot be said for USDT’s balance sheet within centralized exchanges.

Although USDC is more used in DEXs rather than on centralized exchanges, the opposite is true for USDT: the main markets for stablecoin are exchanges such as Binance, Bitfinex, Coinbase, Kraken, Okx Bybit, and offshore venues.

It is worth mentioning in this regard that Tether is based in the British Virgin Islands and hence potentially less threatened by regulators on US markets when compared to US-based competitors such as Circle.

USDT’s balances in crypto exchanges have been declining since the beginning of the year.

This in itself is positive since such events generally occur in conjunction with market rallies or otherwise situations of rising crypto asset prices.

“Supply shock” contexts for stablecoins on exchanges are worth monitoring as indicators of proximity to the bull market.

As of now, reserves on the exchanges are lower by about 5 billion USDT since the beginning of the year, but they are still significantly higher than in 2020, the year in which the conditions for the 2021 bull market start were triggered.

This indicates that most likely the bull run is still just a mirage and we will have to wait to see Bitcoin and other cryptocurrencies revisit their all-time highs.