As Dogecoin continues to capture the attention of the cryptocurrency market, a recent development has raised eyebrows among investors and enthusiasts.

Elon Musk, the influential billionaire and Tesla CEO, is now facing an insider trading lawsuit specifically related to his tweets and statements about Dogecoin.

The lawsuit alleges that Musk’s actions and endorsements may have manipulated the price of Dogecoin, leading to questions about his intentions and whether he is intentionally pumping meme coins for personal gain.

This lawsuit adds a new layer of uncertainty to the future of Dogecoin and prompts speculation about its price trajectory.

In this Dogecoin price prediction, we will delve into the implications of the lawsuit and examine its potential impact on the price of Dogecoin.

Dogecoin Price Prediction

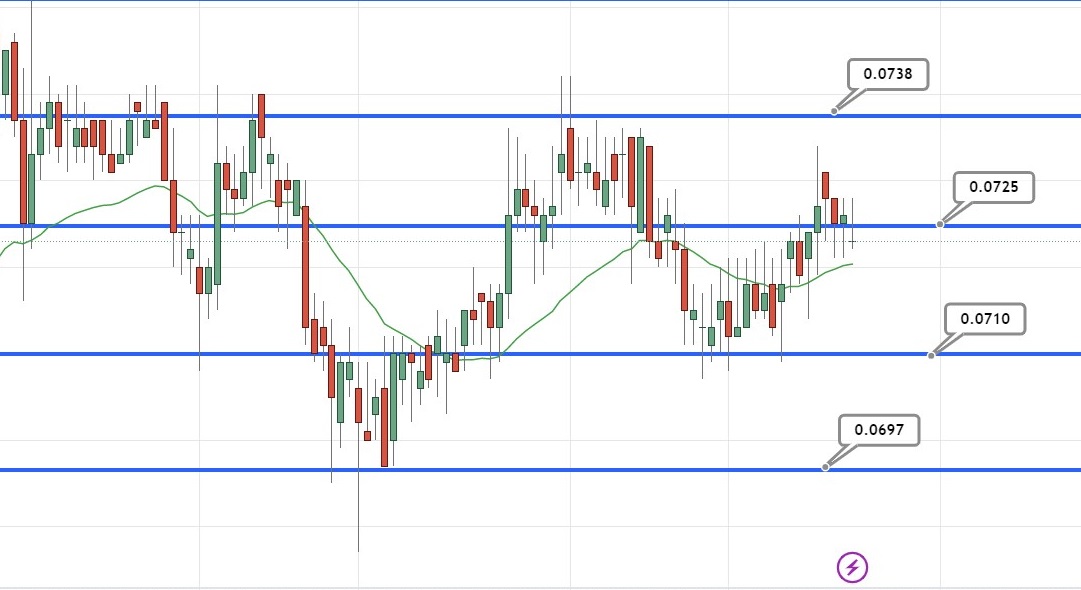

Dogecoin is currently displaying uncertainty in the market, as indicated by the formation of spinning top candles in the four-hour timeframe.

The immediate resistance level for DOGE is around 0.0725, potentially reaching the next target at $0.0740 if this level is surpassed.

However, there is a notable obstacle in the 0.0745-0.0740 range, which has previously acted as strong resistance.

If the bullish sentiment prevails and DOGE successfully breaks above 0.0740, the next target could be 0.0750 or even 0.0755.

When considering key technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), both indicators are within favorable ranges, suggesting the potential for the upward trend in DOGE to continue.

If DOGE maintains support above 0.0710, there is a good chance of upward movement.

The 50-day exponential moving average also supports the 0.0715 level, indicating a continuing upward trend.

However, a breakdown below the 0.0709 level may lead to further support levels around 0.0697 and possibly even lower towards 0.068.

Traders and investors should closely monitor price action and adapt their strategies accordingly to navigate the dynamic nature of the market.

Elon Musk Faces Insider Trading Lawsuit Over Dogecoin Tweets

Investors have filed a lawsuit accusing Elon Musk, the CEO of Tesla, of insider trading related to his tweets and statements about Dogecoin.

The lawsuit alleges that Musk’s actions manipulated the price of Dogecoin and seeks compensation for investors who suffered losses.

According to a complaint filed in a federal court in Manhattan on Wednesday, the plaintiffs alleged that Elon Musk and his company, Tesla, unlawfully made billions of dollars at the expense of millions of American workers by promoting the meme token.

This development has raised concerns about Musk’s intentions and whether he is purposely promoting meme coins for personal gain.

The lawsuit adds uncertainty to the future of Dogecoin and raises questions about its price prediction.

The Potential Impact of Elon Musk’s Tweet on WSM Coin Price

Speculating on the potential connection between Elon Musk’s support for meme coins and his recent tweet about WSM, it raises concerns about whether he might possess insights or knowledge related to WSM and its coin price.

Elon Musk’s influence on the cryptocurrency market is well-known, and his tweets have often caused significant movements in coin prices.

Given his history of involvement in the crypto space and his ability to capture the attention of millions of followers, it’s plausible to wonder if his mention of WSM could indicate a potential surge in its coin price.

However, it’s important to note that this is mere speculation, and further analysis and information would be required to assess the actual impact of Elon Musk’s tweets on WSM and its market performance.

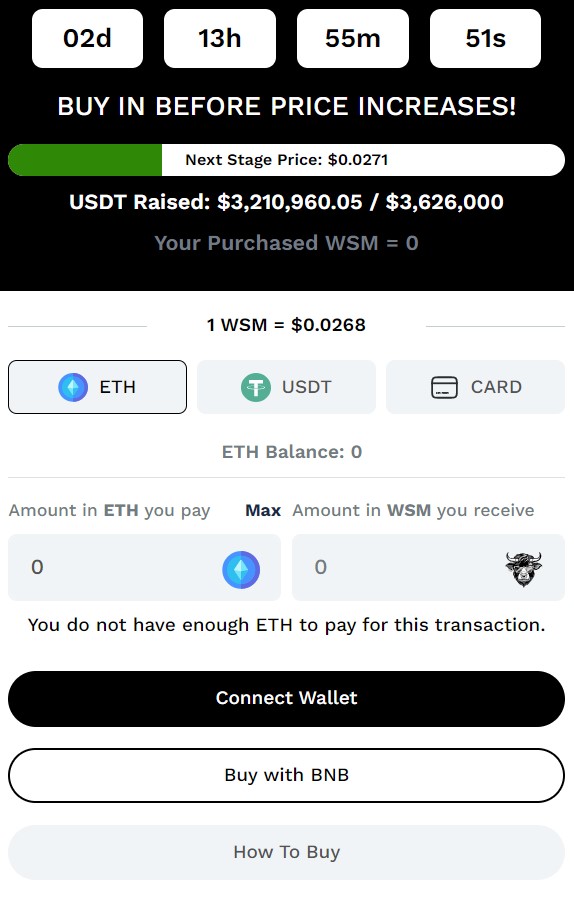

So far, Wall Street Memes (WSM) has raised an impressive $3.2 million. Buy Wall Street Memes now and be part of an exciting and rewarding venture!

Buy $WSM Here