The NFT (non-fungible token) market has seen a massive decline since the buzz of 2021. Several collections are worthless today; mostly newly arrived, making it challenging for collectors to sell their unique digital assets. At the same time digital artists and NFT curators are also losing their patience in the potential of NFT market.

In this article, we will take a closer look at the recent NFT market downturn, the factors fueling the dip, and the future of NFTs. But first, let’s define NFTs. What are they?

Defining NFTs

Unlike fungible tokens such as Bitcoin and Ethereum, NFTs (non-fungible tokens) cannot be replicated as each has unique features. So, when was the first NFT minted? Kevin McCoy was the first to mint an NFT, which featured a video of his wife, Jennifer. The NFT was launched on the Namecoin network.

While the first NFT was a video clip, others like music, tickets to games, art, legal contracts, title deeds, and books have been minted over the years.

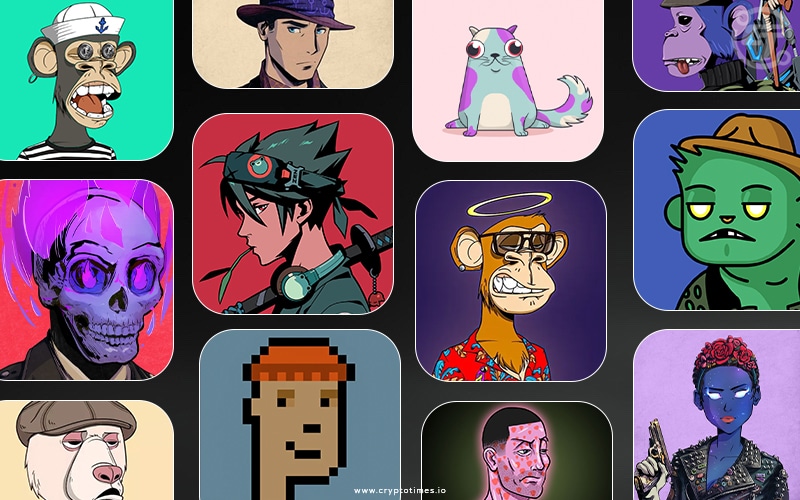

NFTs became popular in 2017 when CryptoKitties launched on Ethereum, the second-biggest blockchain. Four years later, the NFT market reached its peak, with several art prices selling for millions of dollars. For instance, Digital artist Pak sold his “Merge” NFT for $91 million, while Beeple traded “The First 5000 Days” NFT for $69.3 million.

2021 was undoubtedly the most profitable year for NFT creators and collectors. However, the unexpected rise in prices formed a bubble with extremely unrealistic prices for non-fungible tokens, which at the time had little to zero value.

In early 2022, the buzz around NFTs stopped, and the bubble finally popped, causing massive losses for traders who have held their NFTs to date. For example, a few months ago, an X (formerly Twitter) user claimed that Justin Beiber’s Bored Ape Yacht Club (BAYC) NFT, which he bought for $1.3 million, had shed nearly 95% of its value to trade at $59K.

The drop mirrors the BAYC’s pricing as of February 6th, 2024. According to data from NFT Price Floor, BAYC’s floor price is 24.2 ETH, or about $56,144, based on Ethereum’s current price ($2,320).

Bored Apes are not the only NFTs witnessing a downturn; other popular NFTs like Azuki, CryptoPunks, and Nouns have also declined in value.

Factors Causing NFT Market to Dip

Analysts have faulted several factors for the recent dip in the NFT market. These factors include:

1. Wash Trading

Wash trading is considered the most notorious driver fueling the dip in NFT prices. But what is it? Wash trading happens when people trade their own NFT to pump up its price to give a false impression of the token’s actual value. Last year, a report on Dunes Analytics indicated that 70% of the NFT trading volume recorded between January 2023 and June 2023 was from wash trades.

Wash trading has been rampant recently as many NFT marketplaces promise token rewards to NFT traders with the highest trading volumes.

2. Utility Value

While many see NFTs as excellent innovations in the Web3 space, the practical utility and use of these tokens have been largely questionable. That’s because most blue chip (expensive) NFTs are limited to music and artwork, with only a few having utility like being used in gaming.

That said, once the gap in how non-fungible tokens can be integrated into our daily lives is filled, interest in these tokens may be revived.

3. NFT Scams

Bad actors in the market have caused traders to lose interest in NFTs as it’s becoming more challenging to draw a clear line between a genuine and a fake NFT project. Rug pulls are the most common NFT scams. They occur when an NFT creator lures investors to buy their tokens, and once a desired liquidity level is achieved, the creator sells their NFT holdings, draining funds from the liquidity pool and leaving the investors holding worthless NFTs, which they cannot sell.

Also Read: The 10 Most Common NFT Scams and Techniques to Avoid Them

4. Market Cycles

Like fungible tokens, NFTs undergo market cycles. For this reason, some analysts say the current dip in the NFT market is another cycle that will end soon.

5. Global Market Trends

The high inflation rates and struggling global economy are among the factors being blamed for the NFT market downturn. The two have reduced the amount people are willing to spend on highly volatile assets like NFTs.

6. Distribution of Value

Well-known NFTs like Bored Apes have a higher demand than other NFTs. Their prices are also considerably high. The uneven distribution of value in the NFT market leads to instability, where if the prices of top NFT collections plummet, the entire market gets affected.

Adapting to Market Changes with Informed Pricing Strategies

As the NFT market continues to evolve, both creators and collectors must adapt their strategies to navigate these fluctuations. An essential aspect of this adaptation is understanding how to price NFTs effectively. For comprehensive insights and strategies on pricing NFTs in the current market, read the guide on “NFT Pricing Strategy Guide – How To Determine NFT Prices.”

The Future of NFTs

The current dip in prices has several negative and positive implications for the future of NFTs. From a negative point of view, the price downturn indicates that participants can easily manipulate the NFT market through practices like wash trading. This may cause some investors to lose trust in NFTs.

On the positive side, the downturn presents a massive opportunity to solve issues plaguing the NFT industry and embrace innovation. For example, NFT creators can increase the use cases of their tokens by integrating them into sectors such as real estate and the art scene.