- A wallet seemingly belonging to Justin Sun accumulated a substantial amount of ETH.

- Market sentiment and most indicators looked bullish on ETH.

Ethereum [ETH] has been sitting comfortably above $3,000 over the past 24 hours, thanks to its bullish price action.

The trend seems to have carried forward to this week, as ETH’s daily chart was green, too. Meanwhile, whale activity around the token also increased.

Is the next target $3.2k?

Ethereum’s price dropped under $3k during the last few days, but the king of altcoins was quick to recover.

AMBCrypto had earlier reported how ETH reclaimed the $3k mark once again as the token’s price surged by more than 2% in the last 24 hours.

At the time of writing, ETH was trading at $3,103.84 with a market capitalization of over $372 billion.

The recent price uptrend hinted that the Ethereum price might as well touch $3.2k in this fresh week. When ETH’s price gained bullish momentum, whales used that opportunity to buy more ETH.

As per Lookonchain’s tweet, a whale bought 14,632 ETH, worth $45.5 million, from Binance [BNB] and staked it in the past six days.

Apart from that, on the 25th of February, a wallet reportedly belonging to Justin Sun bought 13,780 ETH, worth $41.24 million at the time of the tweet.

Source: X

These metrics suggested that buying pressure on the token was high. Therefore, AMBCrypto checked Ethereum’s metrics to gauge the overall sentiment.

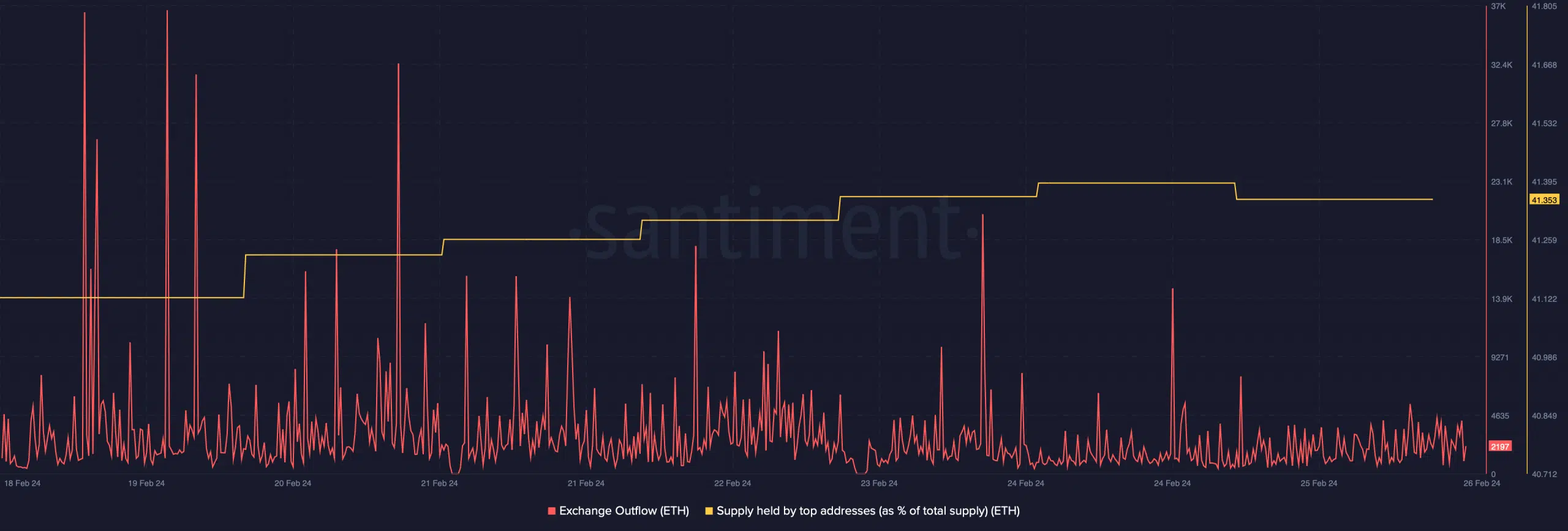

Our analysis of Santriment’s data revealed that whales were buying ETH as its supply held by top addresses moved up last week.

However, its exchange outflow dropped, meaning that buying sentiment was not dominant.

Source: Santiment

Will whale activity be enough?

Apart from high whale accumulation, another key metric looked bullish on ETH. As per the latest data, ETH’s Open Interest was nearing its 2021 all-time high.

Whenever Open Interest rises, it shows an increased likelihood that the current price trend will continue. Since ETH’s daily and weekly charts were green, it seemed that ETH could touch $3.2k this week.

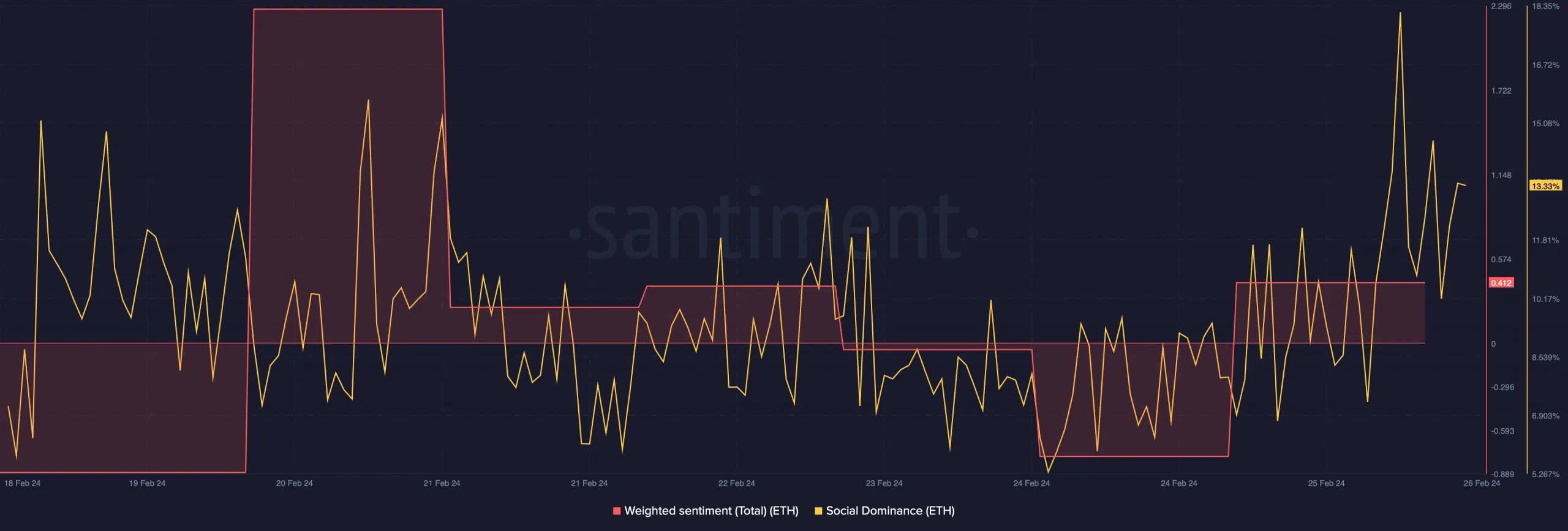

Market sentiment around ETH remained bullish, as evident from the slight rise in its Weighted Sentiment. The altcoin’s Social Dominance also spiked, reflecting its popularity.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2024-25

The king of altcoins’ MACD displayed a clear bullish upper hand in the market, suggesting a continued northward price movement.

However, the Relative Strength Index (RSI) looked troublesome as it was resting in the overbought zone. This can exert selling pressure on the token and put an end to its bull rally.

Source: TradingView