- 20,000 new tokens are being created on Solana every day.

- Sentiment around Solana remained positive despite spike in number of rugpulls.

Solana’s [SOL] network has outperformed most other protocols in terms of activity over the last few months. One of the reasons for this is the accessibility of the network and cheap fees.

Moreover, the recent memecoin frenzy has also contributed to the growth of the network.

Token creation on the rise

As a result of the combination of these two factors, market participants are creating multiple tokens on the Solana network so that they can benefit from user interest.

Based on new data, over 20,000 new tokens are being generated on Solana each day. Even though this is an indicator of a vibrant ecosystem, the creation of these many tokens on the network can have some pitfalls.

One major drawback of the deployment of such a large number of illiquid tokens would be the possibility of rug pulls occurring to addresses holding these tokens.

Even though this behavior is expected from memecoin launches, it could still impact the overall sentiment around the Solana ecosystem.

To combat these problems SolanaFM has introduced blue checkmarks that have been added to the tokens so that they can be verified. The Decentralized Exchange (DEX) Jupiter has also taken actions to help users check for legitimate tokens.

Source: X

Sentiment remains positive

Despite the uptick in the number of rug pulls on the Solana network, the sentiment around the network remained high.

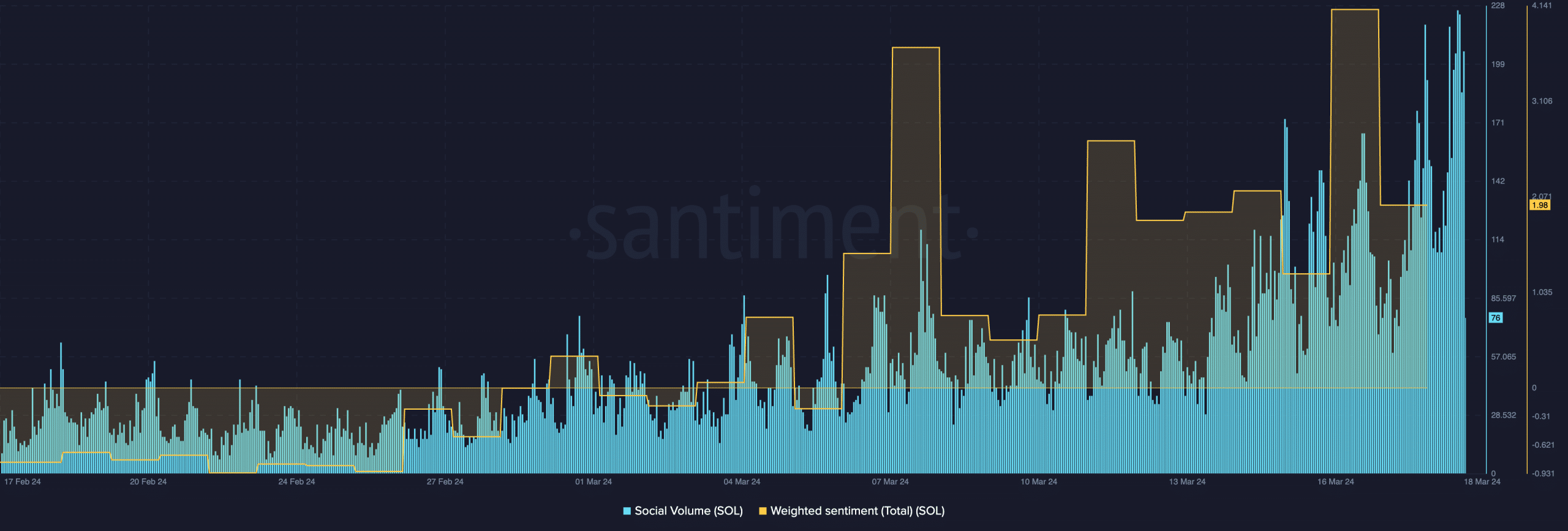

AMBCrytpo’s analysis of Santiment’s data indicated that the weighted sentiment around Solana had grown significantly over the last few weeks. This implied that the number of positive comments around Solana had outnumbered the negative ones at the time of writing.

Coupled with that, the social volume around the Solana network has also grown significantly.

Source: Santiment

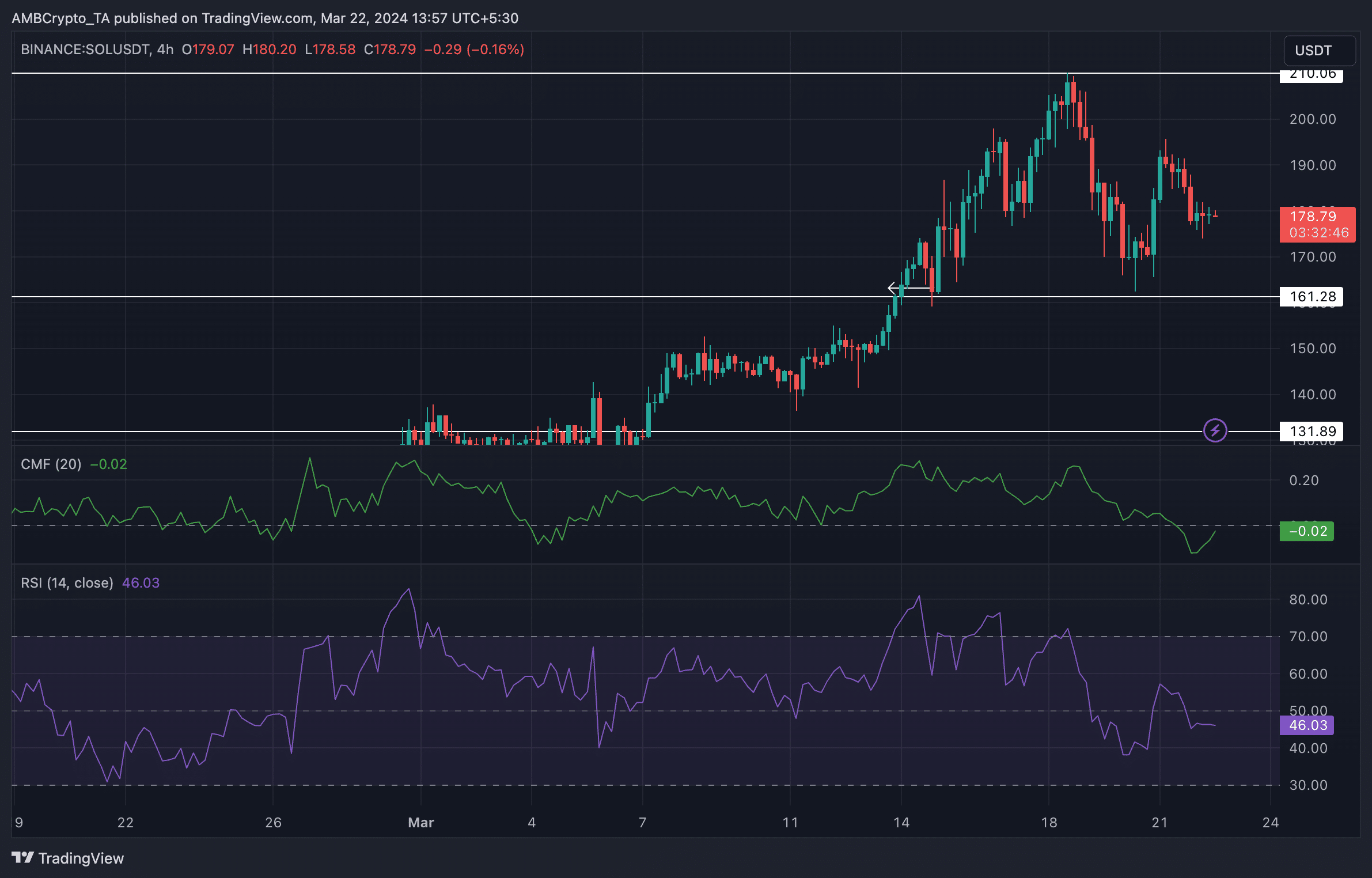

However, the positive sentiment around Solana was not reflected in the recent price movement around SOL. In the last 24 hours, the price of SOL had fallen by 6.21% and it was trading at $179.75 at the time of writing.

How much are 1,10,100 SOLs worth today?

This correction in SOL’s price may be a reaction to SOL crossing past the $200 threshold. If SOL manages to re-test this level it may rally even further.

However, the Chaikin Money Flow (CMF) of SOL decreased during this period. This may indicate a potential decrease in buying pressure for SOL which could impact SOL’s ability to see green going forward.

Source: TradingView