- The cryptocurrency sector valuation advanced to a new all-time high of $3.68 trillion on Monday.

- Bitcoin price rose 3% on Monday, hitting a new peak above $107,000 as investors scoop up BTC ahead of expected Fed rate cut on Wednesday.

- MicroStrategy acquired 15,350 BTC at an average price of $100,386.

Altcoin market updates: Hyperliquid, Ondo Finance, Chainlink surge on US Fed bets

The global crypto market snapped out of a tepid start to the month after hotter-than-expected consumer inflation data sparked hopes of a third consecutive US Fed rate cut. With the next FOMC decision slated for December 18, Hyperliquid, Ondo Finance and Chainlink (LINK) emerged as the top-performing altcoins with investors leaning into yield-bearing DeFi tokens.

- Hyperliquid (HYPE) price gained 7% on Monday to hit the $26 mark, bringing its seven-day time frame gains to a remarkable 110%.

Hyperliquid (HYPE) Price Action, December 16, 2024 | Source: Coingecko

Hyperliquid is a newly-launched Decentralized Exchange that rose in popularity after a $1 billion airdrop executed on December 2. Demand for the HYPE token continues to rise as large investors increasingly lean into the DeFi sector as the US Fed positions itself to further lower rates on fixed-income assets later this week.

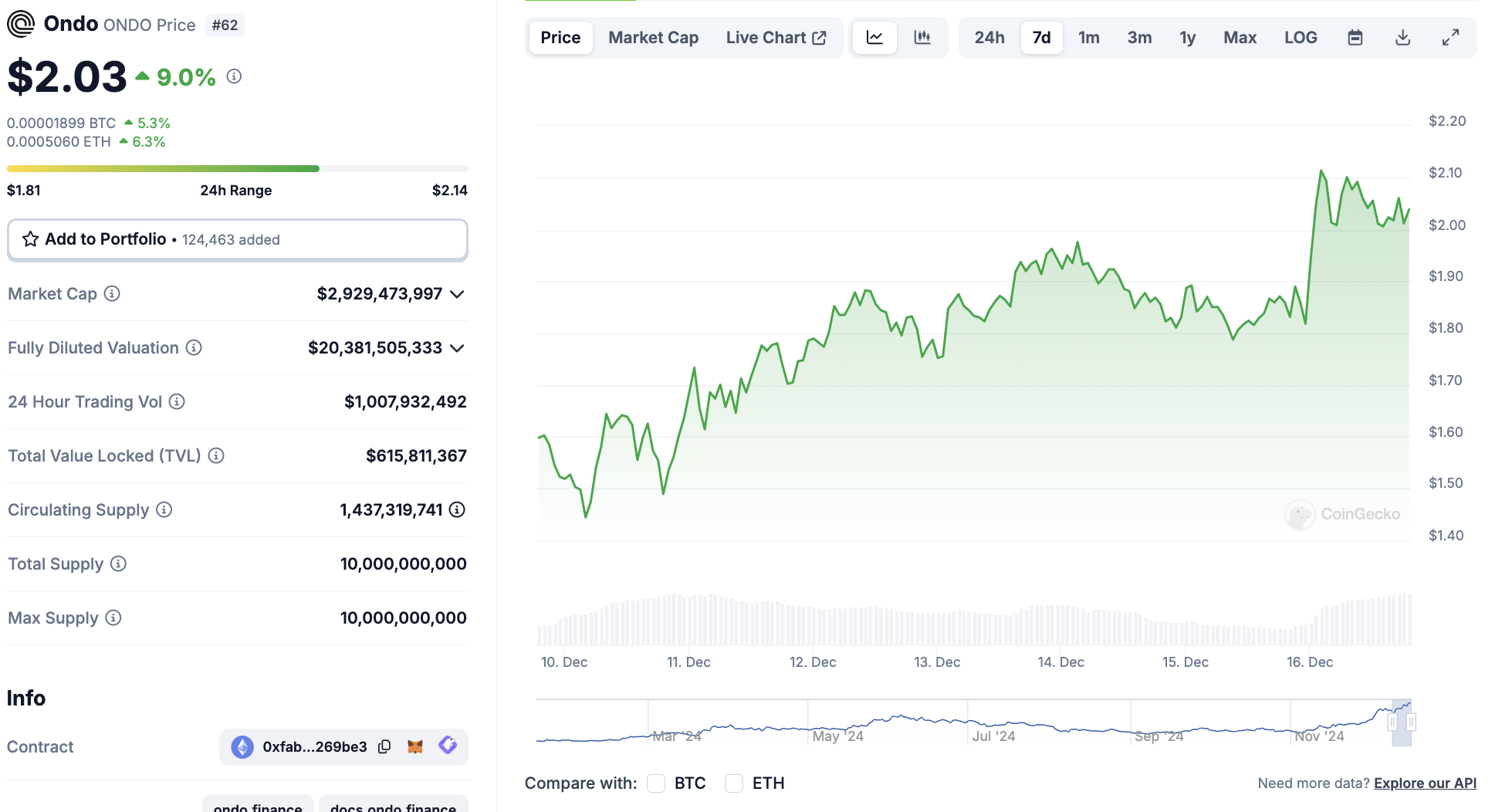

- Ondo Finance (ONDO) also rose 7.6% on Monday, crossing the $2 mark for the first time since it was launched in February 2024.

Ondo Finance (ONDO) Price Action, December 16, 2024 | Source: Coingecko

The Monday rally means that ONDO’s market capitalization is now less than $80 million shy of reaching the $3 billion milestone.

- Chainlink also scored a considerable 1.2% gain on Monday to breach the elusive $30 resistance

Chainlink (LINK) Price action, December 16, 2024 | Source: Coingecko

Chainlink (LINK) Price action, December 16, 2024 | Source: Coingecko

Considering Chainlink’s strategic position at the intersection between the global TradFi and Real World Asset (RWA) sectors, demand for LINK is likely to surge further if the widely-anticipated Fed rate cut triggers more capital inflows toward the DeFi segment in the days ahead.

Chart of the day: Microstrategy buys another $1.5B BTC as Bitcoin price hits $107K resistance

On Monday, Microstrategy announced its latest $1.5 billion acquisition of 15,350 BTC at an average price of $100,386.

Shortly after the announcement, Bitcoin price promptly rose to a new all-time high, trading as high as $107,195 on Binance before retracing.

However, with the purchase price about 5% below Bitcoin’s market price at the time of Michael Saylor’s announcement, it sparked concerns that BTC could take another tumble as observed after MicroStrategy’s last three purchases on November 25, December 2 and December 9, respectively.

MicroStrategy Total Bitcoin (BTC) Holdings as of December 16, 2024 | Source: SaylorTracker.com

However, in an exclusive interview with FXStreet, Gediminas Butkus, CEO of Locked.Money, hinted that MicroStrategy’s purchases may have less influence on Bitcoin prices than the recent price trends suggest.

“In my view, MicroStrategy’s buying isn’t the sole influencer of the market, so I don’t think the BTC price hinges just on Michael Saylor’s acquisitions. Sure, they hold a substantial amount of Bitcoin and keep adding to it, but they aren’t the sole determinant of Bitcoin’s market dynamics. The current price movements reflect typical market behavior, shaped by numerous factors like Market Makers, global news, macroeconomic indices, and ETF netflows.”

– Gediminas Butkus, CEO, Locked.Money

Crypto news updates:

- Coinbase legal team reacts to $1 billion lawsuit over wBTC delisting

Coinbase is grappling with a $1 billion lawsuit filed by BiT Global Digital, which accuses the cryptocurrency exchange of anti-competitive practices surrounding its recent delisting of Wrapped Bitcoin (wBTC).

The lawsuit alleges Coinbase intentionally removed wBTC to promote its own Coinbase BTC (cbBTC), a move that purportedly undermines wBTC’s market position and breaches US antitrust laws.

BiT Global argues that Coinbase’s actions distort fair competition, favoring its proprietary token while disadvantaging rival products.

In response, Coinbase’s Chief Legal Officer, Paul Grewal, firmly dismissed the claims, emphasizing the company’s stringent asset listing standards and transparent decision-making process.

The executive maintained that Coinbase evaluates listings based on market integrity, liquidity and security, denying any bias or favoritism toward cbBTC.

- Ripple’s RLUSD stablecoin set to launch Tuesday as XRP token jumps 8%

Ripple has announced the launch of its USD-backed stablecoin, Ripple USD (RLUSD), on Tuesday, December 17, 2024.

According to product documentations, Ripple plans to integrate RLUSD into its payments network, which has already processed $70 billion in transactions volume globally.

The new stablecoin will initially roll out on major platforms such as Uphold, Bitso, MoonPay, Archax, and CoinMENA, with further listings planned on exchanges like Bitstamp, Mercado Bitcoin, and Bullish.

Ripple’s RLUSD will operate on both the XRP Ledger and Ethereum blockchain, ensuring scalability and interoperability for financial applications.

“Early on, Ripple made a deliberate choice to launch our stablecoin under the NYDFS limited purpose trust company charter, widely regarded as the premier regulatory standard worldwide,”

– Brad Garlinghouse, Ripple Labs CEO.

Fully backed by US Dollar deposits, US government bonds and cash equivalents, RLUSD aims to position itself as a reliable bridge for global payments.

The announcement has triggered bullish momentum for XRP price, which surged 8% to $2.56, pushing its market cap to $146 billion.

- SoftBank CEO to Unveil $100 Billion US AI Investment During Trump Meeting Today

SoftBank Group CEO Masayoshi Son is set to announce a $100 billion investment in US artificial intelligence infrastructure during a meeting with President-elect Donald Trump at Mar-a-Lago on Monday.

The initiative aims to create 100,000 jobs over the next four years, focusing on areas such as semiconductor manufacturing, data centers, and energy infrastructure to support AI development.

Son has described artificial superintelligence (ASI) as his ultimate goal.

“We envision AI chips powering robots and data centers capable of solving complex problems like curing cancer,”

– SoftBank Group CEO Masayoshi Son

The investment will draw capital from the existing SoftBank Vision Fund and new ventures, echoing Son’s $50 billion US investment in 2016.

Additionally, SoftBank is planning to raise $100 billion for Izanagi, an AI chip project aimed at competing with Nvidia.