Ethereum’s native token is showing fresh signs of strength after rebounding sharply from its September lows.

Over the past two weeks, Ethereum has climbed more than 15%, recovering from $3,435 to nearly $4,000 – and several indicators suggest the rally might just be getting started.

Traders are now watching a potential bull flag formation that has been developing since the summer highs near $4,950. The pattern, paired with solid support around the 200-day EMA at roughly $3,500, points to renewed upside momentum. Historically, Ethereum’s price has often rebounded from this zone during strong market cycles.

If momentum continues, ETH could test resistance near $4,450–$4,500 before the end of October. Some analysts, like FOUR and Luca, argue that a clean break above this level could open the door to $5,000 or even higher in November. Conversely, falling below $3,550 would likely invalidate the bullish setup and put the next major support around $3,000 in play.

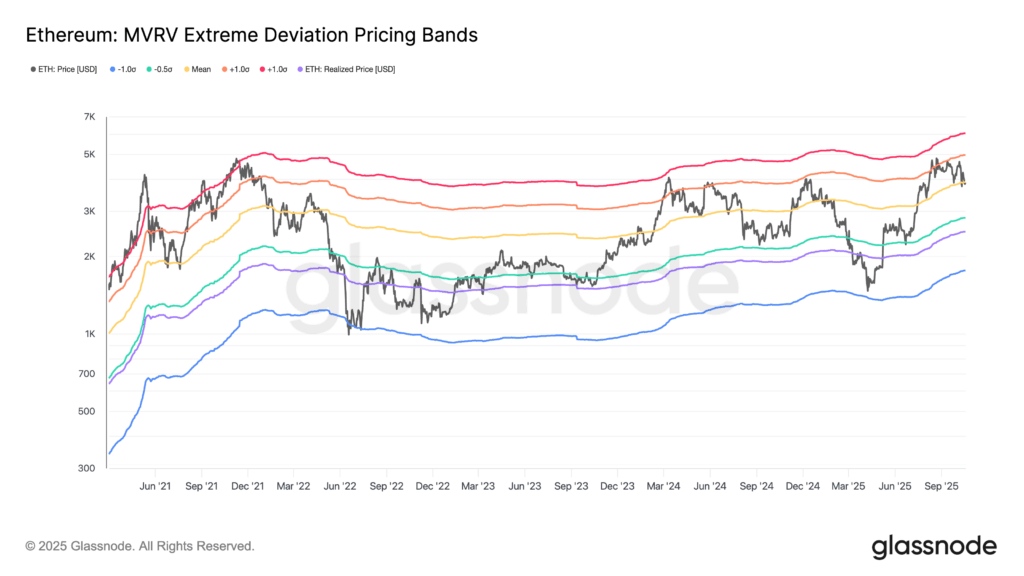

Adding fuel to the optimism, onchain data from Glassnode shows Ethereum’s MVRV deviation bands holding steady near the mean at $3,900 – a level that has repeatedly marked the start of new rallies over the past few years. Each bounce from this band has historically pushed ETH toward the upper deviation line, currently hovering around $5,000.

Taken together, both technical and onchain signals paint a picture of resilience rather than exhaustion. If Ethereum holds its current footing, a move back toward $4,500–$5,000 this month seems increasingly within reach.