- Pi Network holds steady above $0.2700 following the 2% rise from the previous day.

- Pi Network announced new DeFi features, including DEX, AMM liquidity pools, and token creation, on its Testnet.

- The shift to real-world use cases could arrive on the PI mainnet with the Stellar protocol version 23 upgrade.

Pi Network (PI) edges higher by 1% at the time of writing on Thursday, following the 2% rise from the previous day. The recovery in PI is driven by its co-founder, Chengdiao Fan, attending the Token2049 event and the launch of new Decentralized Finance (DeFi) features on its testnet.

New DeFi features bring real use cases to the Pi ecosystem

Moments after Chengdiao Fan delivered a speech on Web3 utility at the Token2049 in Singapore on Wednesday, Pi Network announced the launch of multiple DeFi features on its testnet. These include a Decentralized Exchange (DEX), an Automated Market Maker (AMM) liquidity pool, and token creation.

Pi developers can test token swaps, liquidity pools, and other DeFi tools on the DEX. Furthermore, the core team emphasizes a focus on real-world utility over meme coins, utilizing the token creation feature.

The ongoing development of Stellar’s version 23, bringing the smart contract functionality, is crucial for these features to come live on the PI Mainnet. As of Thursday, version 23 is live on Testnet 1 with the roadmap from Testnet 2 to Mainnet.

Pi Network prepares for a lift-off from a key support base

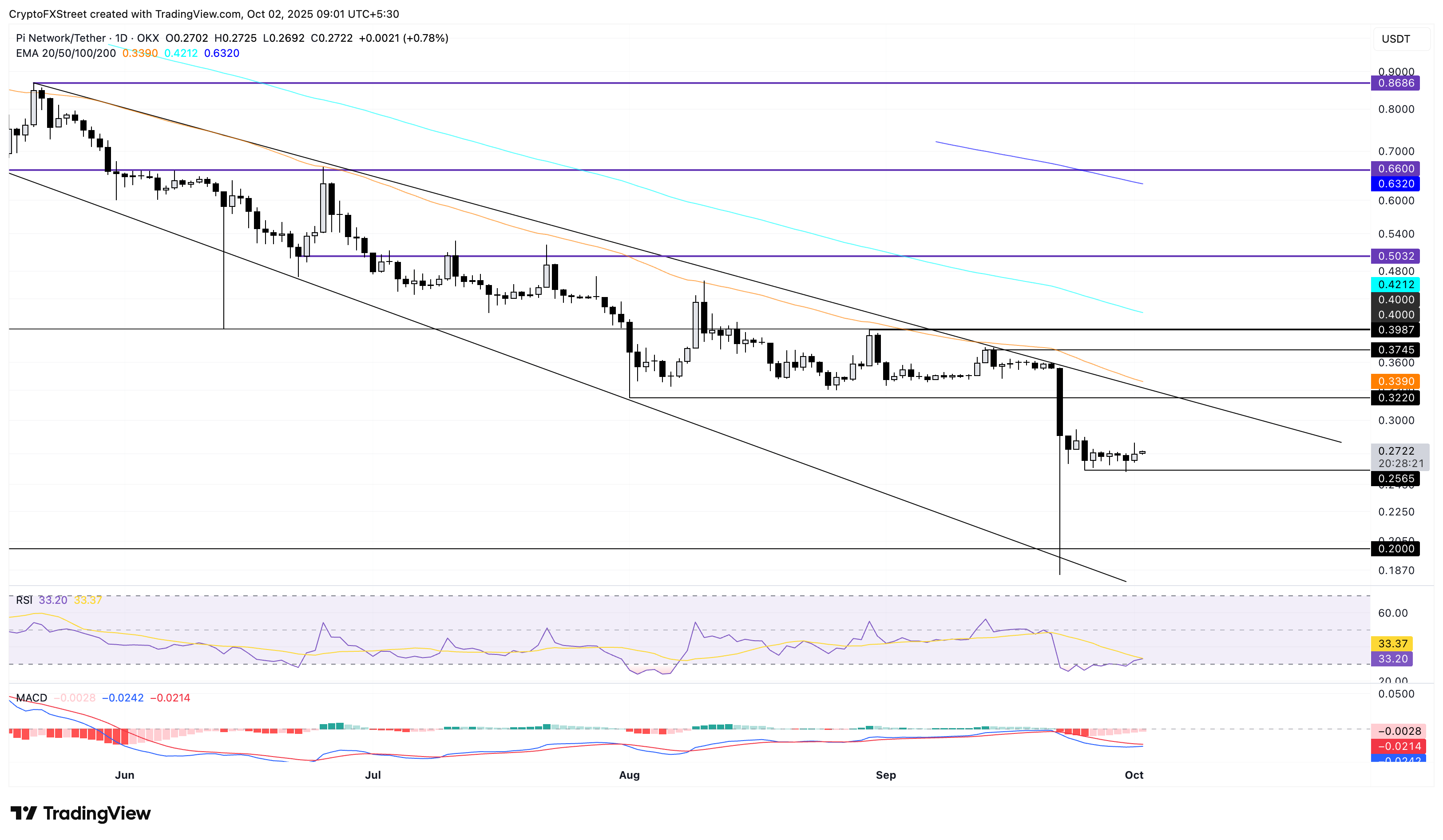

Pi Network holds above $0.2700 level, extending the consolidation above the $0.2565 support level marked by Thursday’s low. The sideways shift on the daily chart reflects the muted effect of Chengdiao’s attendance at Token2049 and the launch of DeFi features.

Still, the technical indicators on the daily chart suggest a gradual decline in selling pressure, which could pave the way for the next reversal run in the PI token. The Relative Strength Index (RSI) reads 33, resurfacing from the oversold zone. Additionally, the Moving Average Convergence Divergence (MACD) is approaching its signal line, signaling a potential crossover, which would indicate a bullish shift in PI’s trend momentum.

On the upside, the $0.3220 low from August 1 could act as a critical resistance, which remains close to the falling channel’s resistance trendline.

PI/USDT daily price chart.

However, if PI dips below $0.2565, it could extend the decline to the $0.2000 round figure.