UAE Blockchain Market Revenue Scope

Key Highlights

| Study Period | 2019 – 2032 |

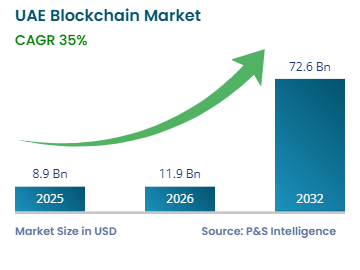

| Market Size in 2025 | USD 8.9 Billion |

| Market Size in 2026 | USD 11.9 Billion |

| Market Size by 2032 | USD 72.6 Billion |

| Projected CAGR | 35% |

| Largest Emirate | Dubai |

| Fastest-Growing Emirate | Abu Dhabi |

| Market Structure | Fragmented |

Market Size

Explore the market potential with our data-driven report

UAE Blockchain Market Outlook

The UAE blockchain market size will be an estimated USD 8.9 billion for 2025, and it will grow by 35.0% during 2026–2032, to reach USD 72.6 billion by 2032.

The growth of the market is driven by strong government initiatives to digitize public services, rising adoption in banking and financial services, and increasing investments in blockchain infrastructure across the country.

The country has emerged as a regional leader in blockchain implementation, particularly in financial services. The Central Bank Digital Currency initiative and ongoing efforts to tokenize real estate and financial assets position the U.A.E. as a blueprint for other nations pursuing blockchain-based digital transformation. Furthermore, the UAE attracted over USD 34 billion in cryptocurrency inflows between July 2023 and June 2024, reflecting strong institutional participation and the country’s emergence as a global hub for digital assets.

The Dubai Blockchain Strategy continues to drive innovation in making Dubai the first city fully powered by blockchain, focusing on three strategic pillars: government efficiency, industry creation, and international leadership. These government-led efforts are not just about keeping up with global trends but actively shaping them, creating unprecedented opportunities for blockchain adoption across various sectors.

UAE Blockchain Market Segmentation Analysis

Component Analysis

The application & solutions category holds the largest market share, of 55%, in 2025. This dominance stems from the high demand for ready-to-deploy blockchain applications across government services, financial transactions, and supply chain management. These solutions enable automation through smart contracts, improve transparency in public administration, and facilitate digital payments and decentralized finance (DeFi) platforms.

The infrastructure & protocols category will have the highest CAGR, of 35.3%, driven by increasing demand for blockchain standards and protocols such as Ethereum, Hyperledger, and enterprise-grade frameworks. The continuous development of Layer 2 scaling solutions and cross-chain networks also supports growth in this segment.

The components analyzed in this report are:

- Applications & Solutions (Largest Category)

- Infrastructure & Protocols (Fastest-Growing Category)

- Middleware

Deployment Mode Analysis

The public cloud category holds the largest market share, of 60%, in 2025, as these organizations offer scalability, flexibility, and reduced infrastructure costs. Major cloud providers like AWS, Microsoft Azure, and Oracle Cloud have introduced blockchain-as-a-service (BaaS) platforms in the UAE, enabling faster deployment and integration with existing systems.

The hybrid cloud category will have the highest CAGR, of 35.4%, as enterprises seek to balance the benefits of public cloud accessibility with the control and security of private infrastructure. This approach is particularly favored by BFSI and government organizations adopting permissioned blockchain networks for sensitive data management.

The deployment modes analyzed in this report are:

- Public Cloud (Largest Category)

- Private Cloud

- Hybrid Cloud (Fastest-Growing Category)

Enterprise Size Analysis

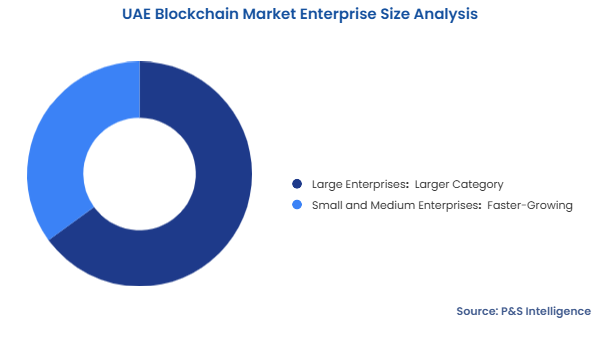

The large enterprises category holds the larger market share, of 65%, in 2025. These organizations possess substantial resources enabling investment in advanced blockchain technologies for supply chain optimization, compliance management, and customer transparency.

The SMEs category will have the higher CAGR, during the forecast period, as blockchain solutions become more accessible through cloud-based platforms. The growing availability of Blockchain-as-a-Service (BaaS) offerings and government support for SME digitization through initiatives such as Dubai SME 100 are fueling adoption. As per an article, SMEs represent over 90% of all operating companies and contribute over 60% of the non-oil GDP in the UAE.

The enterprise sizes analyzed in this report are:

- Large Enterprises (Larger Category)

- Small and Medium Enterprises (SMEs) (Faster-Growing Category)

Application Analysis

The payments category holds the largest market share in 2025, supported by the UAE’s position as a major international trade hub and the increasing adoption of cryptocurrency and digital assets. Financial institutions and fintech startups are using blockchain to improve transaction transparency, reduce processing times, and lower costs in cross-border remittances and settlements.

The digital identity category will have the highest CAGR during the forecast period, due to the UAE government’s strong push for blockchain-based identity verification, initiatives like UAE Pass, and the country’s digital transformation agenda. Growing adoption across banking, healthcare, and public services enhances security, transparency, and efficiency, driving rapid market expansion.

The applications analyzed in this report are:

- Digital Identity (Fastest-Growing Category)

- Exchanges

- Payments (Largest Category)

- Smart Contracts

- Supply Chain Management

- Others

End User Analysis

The BFSI category holds the largest market share, of 50%, in 2025, reflecting blockchain’s transformative impact on payments, clearing, settlement, and regulatory compliance. The adoption of decentralized finance (DeFi) platforms, tokenized assets, and blockchain-based KYC/AML verification is accelerating across UAE financial institutions and fintech startups.

The government & public services category will have the highest CAGR, of 35.2%, as the Emirates Blockchain Strategy 2021 progresses toward its target of digitizing 50% of government transactions by 2031. Additionally, initiatives such as the Dubai Blockchain Strategy, launched by Smart Dubai and the Dubai Future Foundation, are reinforcing blockchain adoption through regulatory clarity and digital infrastructure development across public entities.

The end users analyzed in this report are:

- Banking, Financial Services, and Insurance (BFSI) (Largest Category)

- Government & Public Services (Fastest-Growing Category)

- Energy & Utilities

- Manufacturing

- Healthcare & Life Sciences

- IT & Telecommunications

- Media & Entertainment

- Travel & Hospitality

- Retail & Consumer Goods

- Others

Drive strategic growth with comprehensive market analysis

UAE Blockchain Market Regional Outlook

Dubai Blockchain Market Size

Dubai holds the largest market share, of 45%, in 2025, as it serves as the country’s primary innovation center with world-class infrastructure. Dubai is home to the Virtual Assets Regulatory Authority, which operates specifically within the emirate and provides specialized oversight for digital asset activities. The Dubai International Financial Centre, regulated by the Dubai Financial Services Authority, has crafted a specialized regulatory regime for cryptocurrencies with rigorous standards for digital token trading, custody services, and investor protection.

The Dubai Multi Commodities Centre Crypto Centre supports over 500 Web3 firms, demonstrating the depth and maturity of Dubai’s blockchain ecosystem. The emirate’s business-friendly environment, combined with world-class infrastructure, including Jebel Ali Port and Dubai International Airport, positions it as the primary innovation center driving the largest share of blockchain market revenue in the UAE.

Abu Dhabi Blockchain Market Size

Abu Dhabi will have the highest CAGR, of 35.1%, characterized by aggressive institutional investments and rapid acceleration in adoption rates. In the first quarter of 2025, Abu Dhabi’s Mubadala Investment Company increased its holdings in BlackRock’s iShares Bitcoin Trust to 8.7 million shares worth approximately USD 408.5 million, demonstrating substantial sovereign-level confidence in blockchain assets. This represents a significant increase compared to other state funds globally, reflecting Abu Dhabi’s commitment to establishing itself as a center of institutional adoption.

Abu Dhabi Global Market, regulated by the Financial Services Regulatory Authority, has established a comprehensive framework governing crypto asset activities, including licensing, custody, and operational requirements that prioritize security and high compliance standards. The regulatory clarity provided by FSRA has attracted institutional investors, hedge funds, and family offices seeking secure environments for blockchain operations. Abu Dhabi Airports has pioneered cryptocurrency payment integration, marking the emirate’s push toward mainstream adoption in public infrastructure. The competitive dynamic between Dubai and Abu Dhabi accelerates innovation timelines across both emirates, with Abu Dhabi’s growth trajectory showing steeper ascent from its institutional investment base compared to Dubai’s more mature but steadier expansion.

The emirates of the market are as follows:

- Dubai (Largest Emirate)

- Abu Dhabi (Fastest-Growing Emirate)

- Sharjah

- Ajman

- Ras Al Khaimah

- Fujairah

- Umm Al Quwain

UAE Blockchain Market Share

The market is fragmented due to the presence of both established global technology giants and regional blockchain specialists competing across various application domains and industry verticals. Major global technology companies, including IBM, Microsoft, Oracle, AWS, and Huawei, have established strong footprints in the UAE through their blockchain-as-a-service platforms and regional data centers. These players leverage their existing relationships with UAE enterprises and government entities to secure blockchain implementation contracts. Opportunities exist for new entrants and smaller providers to capture market share by developing industry-specific solutions, particularly in sectors where blockchain adoption remains nascent, such as education, agriculture, and tourism.

Key UAE Blockchain Companies:

- IBM Corporation

- ConsenSys

- Ripple Labs Inc.

- Oracle Corporation

- Accenture PLC

- Alibaba Group Holding Ltd.

- Tata Consultancy Services Limited (TCS)

- Infosys Limited

- Wipro Limited

- R3 LLC

- Microsoft Corporation

- SAP SE