The Altcoin Season Index has remained under pressure in the past few months as Bitcoin and most coins have plunged. Data compiled by CoinMarketCap shows that it remains at 31, meaning that Bitcoin Dominance continues.

Crypto Fear and Greed Index Remains in The Red

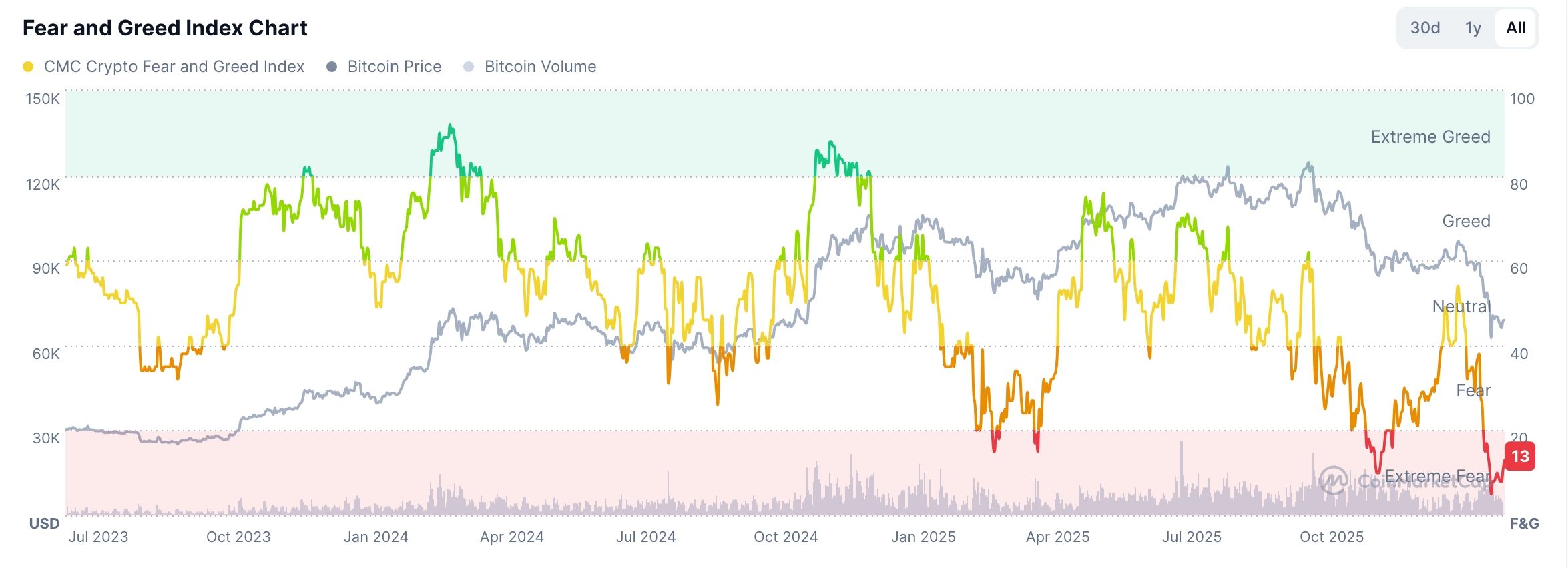

However, the Crypto Fear and Greed Index points to an upcoming rally in the industry, which may lead to an altcoin season. The index remains in the extreme fear zone of 13, slightly higher than the year-to-date low of 4.

The index assesses the sentiment in the crypto industry by looking at various data points like Bitcoin price and momentum, activities in the futures market, and in social media.

In most cases, the index tumbles to the extreme fear zone when Bitcoin and most altcoins are in a steep downward trend. Indeed, most investors are currently bearish on the industry, with Standard Chartered analysts slashing their Bitcoin price prediction from $150,000 to $100,000. The analysts warned that Bitcoin may ultimately drop to $50,000 as the crypto winter continues.

However, on the positive side, most bull runs occur whenever there is extreme fear in the market. A good example of this is what happened early this year. Bitcoin price rebounded to nearly $100,000 in January after the Fear and Greed Index tumbled to 5 in December.

Similarly, Bitcoin rebounded from $74,500 in April last year to $105,000 in May after the index tumbled to the extreme fear zone of 17.

READ MORE: BitMine Stock Forms Bullish Pattern as Tom Lee Insists This is No Crypto Winter

Warren Buffett Recommends Buying When Investors Are Fearful

This view is based on a popular quote by Warren Buffett, who recommends buying when everyone is extremely fearful and selling when everyone is extremely greedy. As the chart above shows, most crypto market retreats normally start whenever the index moves to the extreme greed zone.

Some analysts believe that Bitcoin and cryptocurrencies are on the verge of a strong rebound in the coming weeks, noting that the ongoing bear market has been better than the others. For one, unlike in 2022, no major company in the crypto industry has collapsed this year. In 2022, companies like Terra, OKX, and Voyager Digital collapsed.

At the same time, top cryptocurrency projects like Ethereum, Solana, and BNB Chain are thriving despite the ongoing crypto market crash. For example, Ethereum is now handling over $1 trillion in stablecoin transactions a month, while Solana transactions and fees are in a strong uptrend this year.

READ MORE: Morpho Price Goes Parabolic After Anchorage and Apollo Global Deal