Dogecoin (DOGE) holds near support at $0.1000 at the time of writing on Wednesday, as bears tighten their grip on assets across the crypto market. The leading meme coin remains on the back foot, weighed down by risk-off sentiment, low retail activity and weak technicals.

Dogecoin extends sell-off amid retail exodus and weak sentiment

Dogecoin faces a weakening derivatives market, with futures Open Interest (OI) falling to $1.16 billion on Wednesday, down from $1.27 billion the previous day.

Dogecoin’s futures OI surged to a record $6 billion on September 14, a stark contrast to the current weak status of the derivatives market.

A persistent decline in OI adds to selling pressure, as traders increasingly close positions rather than open new ones. Conversely, OI expansion would support a bullish outlook in Dogecoin amid improving market sentiment.

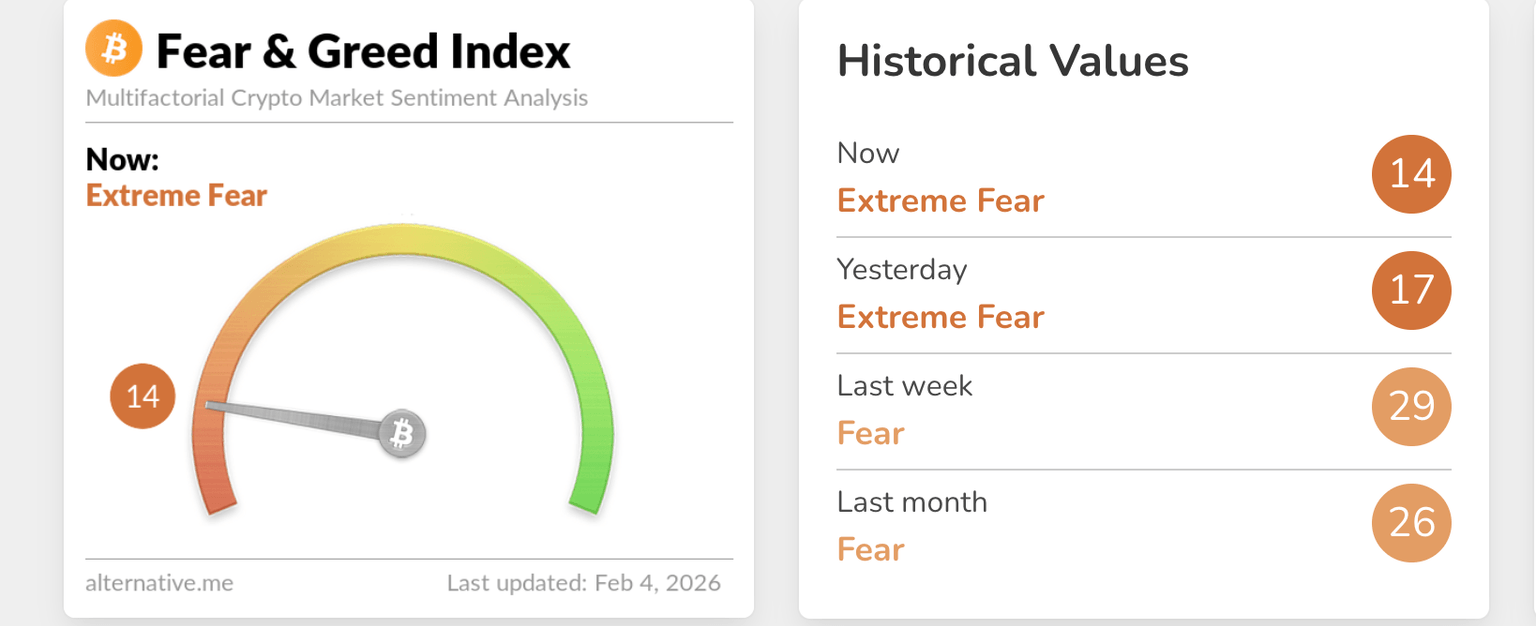

Meanwhile, Alternative shows that sentiment is down to 14 on Wednesday, from 17 on Tuesday, indicating extreme fear gripping the crypto market. Investors remain cautious amid the persistent sell-off, with fewer traders opening new positions. Still, extreme fear can be used as a strategy to seek fresh exposure, as extended rebounds often follow sell-offs.

Technical outlook: Dogecoin trades under increasing downside risks

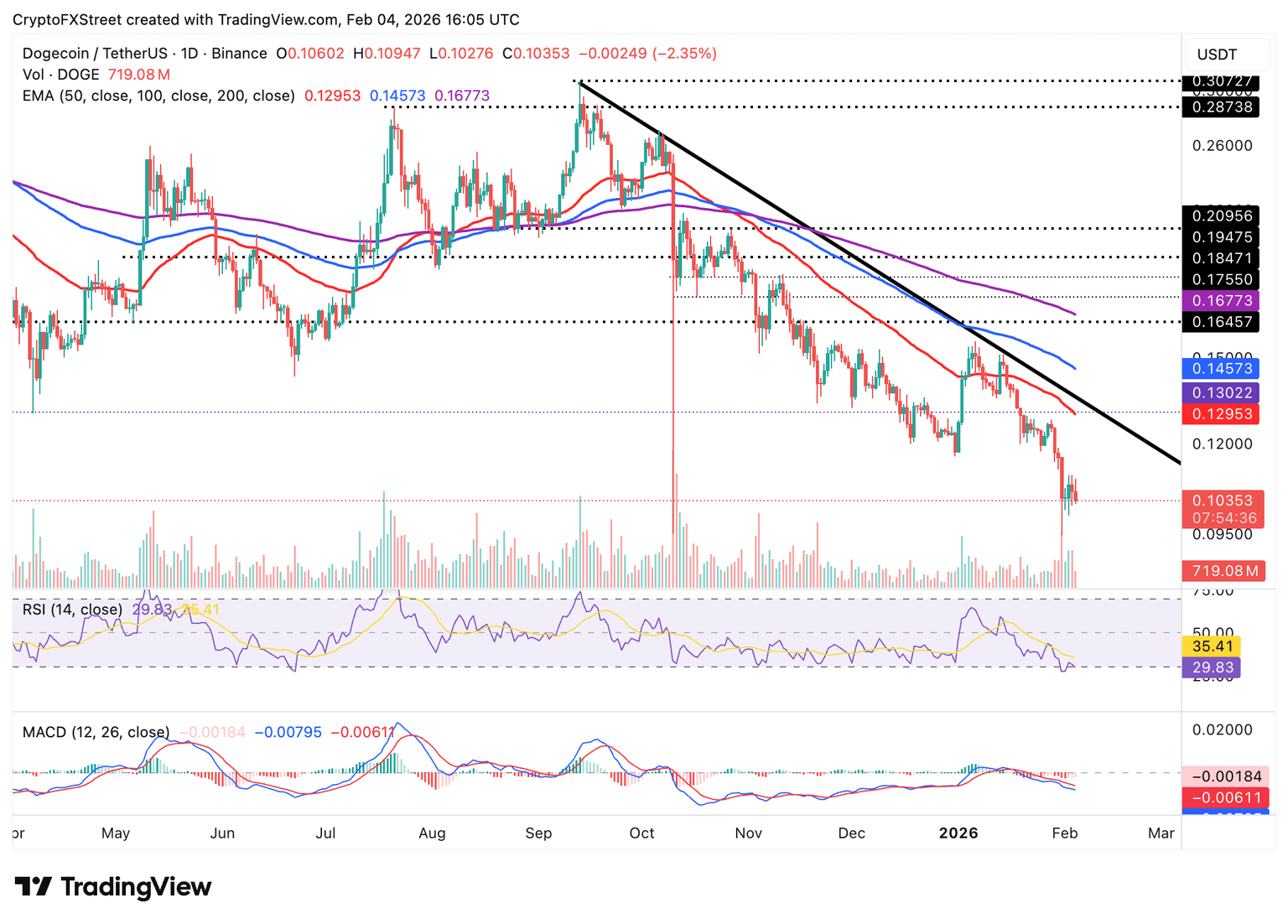

Dogecoin is edging lower toward $0.1000 support as the 50-day Exponential Moving Average (EMA) at $0.1295, the 100-day EMA at $0.1457 and the 200-day EMA at $0.1677 confirm a persistent bearish outlook.

The Relative Strength Index (RSI) has reentered oversold territory, suggesting that bearish momentum is building up. An extended dip into this region would keep the meme coin largely in bearish hands.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator remains below its signal line, while the red histogram bars prompt investors to sell DOGE.

If the MACD histogram bars contract, they could signal a reversal in Dogecoin price as bullish momentum returns. Holding support at $0.1000 intact could also increase the odds of a rebound. A break above the 50-day EMA at $0.1295 and the descending trendline would mark a potential transition from the bearish to a bullish phase.