The Polkadot (DOT) price broke down from long- and short-term support levels, indicating that it is still in a bear market.

The Polkadot price had decreased under a descending resistance line since Nov. 2021, when it was trading at an all-time high of $55.09. The DOT price reached a low of $4.41 on Dec. 21.

The downward movement caused a breakdown from the $5.90 horizontal support area. The area is now expected to provide resistance. At the time of the breakdown, the area has been in place for 805 days.

Furthermore, the DOT price drop invalidated a bullish divergence in the weekly RSI (green line). Since the divergence had developed over five months, its invalidation is a decisive bearish sign.

If the downward movement continues, the next closest support area would be at $3.85.

Conversely, breaking out from the descending resistance line would invalidate this bearish price forecast.

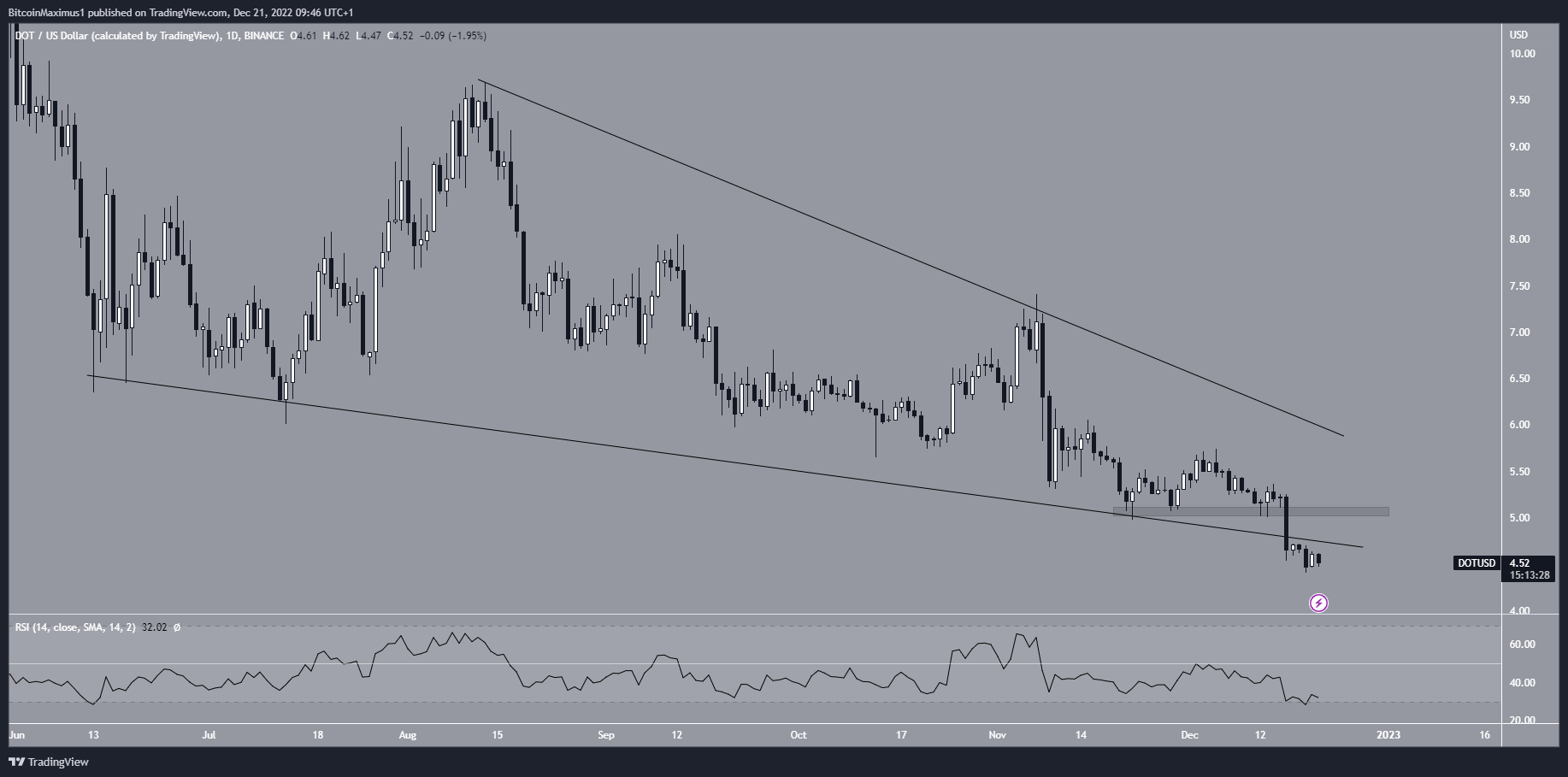

Short-Term Polkadot Price Breakdown

The technical analysis from the daily time frame shows that the DOT token decreased below the $5.10 support area on Dec. 16 and broke down from a descending wedge during the next 24 hours. Since the descending wedge is considered a bullish pattern, its breakdown is a bearish development that invalidates the possibility of an upward movement. It is also in alignment with the readings from the weekly chart.

While the daily RSI reached oversold levels, it has not generated any bullish divergence. As a result, the most likely scenario is the continuation of the downward movement toward $3.85. Reclaiming the support line of the wedge and $5.10 area would indicate that a bullish reversal has begun instead.

To conclude, the Polkadot price is bearish due to a breakdown from both long- and short-term horizontal and diagonal support levels. Moreover, technical indicators do not show any bullish reversal signs. A decisive movement above $5.10 would be required to negate these bearish signals.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.