hamzaturkkol

Raise Rates = Bullish Bitcoin?

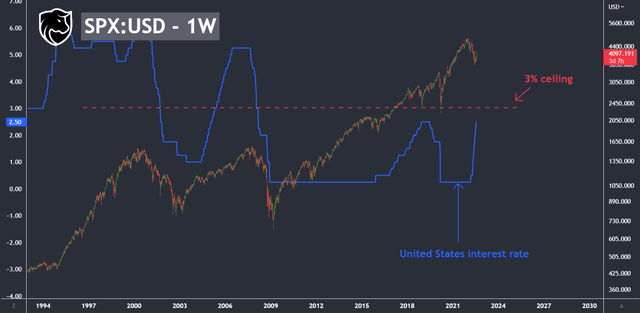

The Federal Reserve raised interest rates by 0.75 basis points during Wednesday’s (7/27) FOMC meeting, moving its benchmark rate to 2.25%-2.5%. Immediately afterward, risk-on assets turned bullish as investors interpreted the Fed’s plan as dovish. During his speech, Jerome Powell stressed two overarching points:

- Talking tough on inflation.

- The likelihood of further hikes and an unusually large increase in September.

With the Fed’s explicit intent to kill inflation, markets know this will require rate cuts afterward. Although the Fed’s words were literally hawkish, risk-on assets shifted bullish in anticipation of rate cuts in 2023.

Furthermore, markets assume a maximum of 50 – 100 basis points before the Fed stops raising. Plus, Powell stressed the importance of inflation data leading into the September FOMC – meaning that if inflation lowers, the Fed will be inclined to take a more dovish stance.

SPX:USD (Weekly) vs US Interest Rate (TradingView 8-2-2022)

Following the previous week’s bullish cryptocurrency price action, investors have interpreted the Fed’s actions as a signal that altcoin season is starting. Consequently, we expect Bitcoin (BTC-USD) and many altcoins to trade bullish until September 20th, 2022, when the FOMC meets again.

How To Trade This Altcoin Season

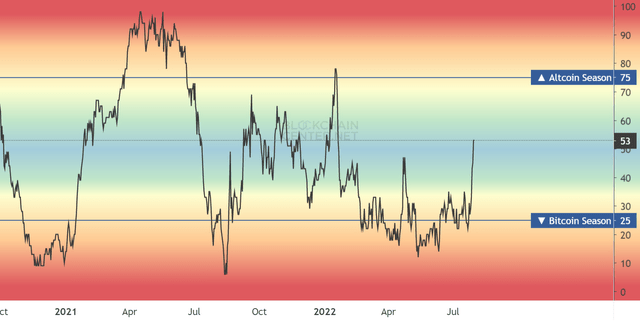

Altcoin Season (blockchaincenter.net 7-31-2022)

The chart above calculates Bitcoin’s market capitalization dominance percentage to determine whether it is more beneficial for investors to hold altcoins or Bitcoin. Observably, the last “altcoin season” occurred during the first half of 2021. This previous altcoin season was mainly powered by Covid-19 stimuli and loose monetary policy that promoted speculative investments.

With the recent spike in altcoin dominance, we believe the cryptocurrency market is shifting into a new utility-driven altcoin season. This time, altcoin price rallies will be powered by:

- Rate cut expectations: every altcoin season requires loose monetary policy powered by Federal Reserve rate cuts (or expectations of rate cuts).

- Ethereum’s 2.0 upgrade: this should drive the ETH-BTC chart upwards and benefit both Proof-Of-Work and Proof-Of-Stake altcoins.

- High-revenue, transparent DeFi protocols: after the Terra Luna and Celsius debacles (both centralized entities), digital asset investors are now incentivized to use decentralized and provably secure protocols.

- Corporate adoption of digital assets: we expect big-tech corporations will increasingly utilize tokenization, metaverse, and NFT protocols to draw-in revenue.

August – September Altcoin Season Roadmap

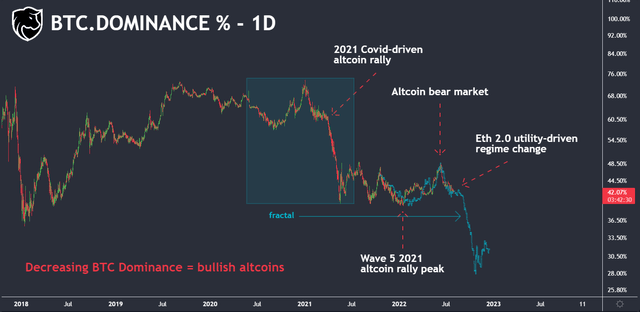

Bitcoin Dominance Roadmap (TradingView 7-31-2022)

- To maximize profit potential, we think it’s wise to cycle into cryptocurrencies that provide high-revenue utility generated by real-world use.

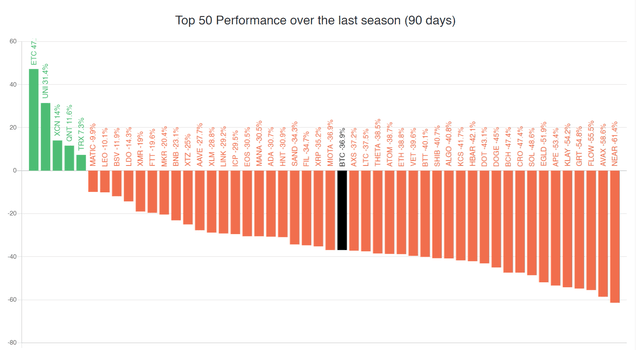

By observing the previous week’s cryptocurrency price action, we can infer that this year’s altcoin season began on Wednesday (7/27), directly after the FOMC meeting. At the time of writing, blockchaincenter.net reports the following top 50 price movements over the past 90 days:

Top 50 Market Cap Performance Over Past 90 Days (blockchaincenter.net 7-31-2022)

Notably, “altcoin seasons” run on narratives rather than fundamentals. Accordingly, the altcoins that fit the most popular narratives typically see the most significant gains. As previously stated, we believe the most bullish altcoin investment narratives include the Ethereum (ETH-USD) 2.0 merge (which affects both Proof-Of-Work and Proof-Of-Stake coins), high-revenue DeFi protocols, and metaverse/NFT projects.

Proof-Of-Work vs. Proof-Of-Stake Coins

The ETH1 clone network Ethereum Classic (ETC-USD) was the biggest gainer after Wednesday’s Fed meeting. In our view, this indicates that Proof-Of-Work vs. Proof-Of-Stake will be a hotly debated topic following Ethereum’s 2.0 merge. We expect this debate will draw in new investors to both sides, causing PoW and PoS coins to trend bullish. Some Proof-Of-Work coins (besides Bitcoin) that can benefit from this dynamic include:

- Ethereum Classic (ETC-USD) / RavenCoin (RVN-USD)

- Monero (XMR-USD)

- Filecoin (FIL-USD) / Chiacoin (XCH-USD)

Notably, Filecoin and Chiacoin utilize PoSt (proof-of-spacetime) algorithms to manage decentralized blockchain security. Proof-of-spacetime serves as the basis for an intrinsically valuable and environmentally-friendly version of proof-of-work. We believe decentralized storage networks utilizing this technology have a bright future.

Alternatively, some Proof-Of-Stake coins we’re watching include:

- Ethereum 2.0 (ETH-USD)

- Polygon Network (MATIC-USD)

- Binance Coin (BNB-USD)

- Hedera Hashgraph (HBAR-USD)

High-Revenue DeFi Protocols

A second popular altcoin narrative includes high-revenue and provably secure DeFi protocols.

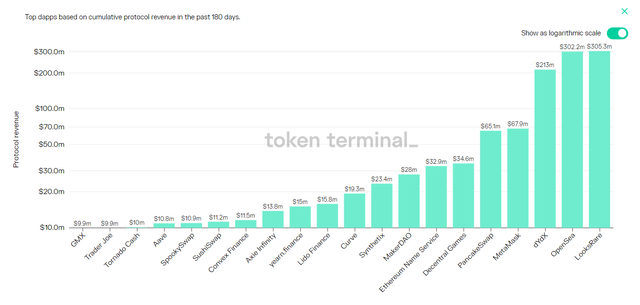

The chart below shows that LooksRare, OpenSea, dYdX, MetaMask, and PancakeSwap are currently the cryptocurrency market’s highest revenue dApps.

Top Dapps Total Protocol Revenue (Token Terminal 8-1-2022)

Token Terminal uses data from The Graph (GRT-USD) to help investors sift between the truth (protocol revenue) and marketing exaggerations (market capitalization). Regarding DeFi applications, the most significant revenue earners in the cryptocurrency market are:

- OpenSea

- Uniswap (UNI-USD)

- dYdX

- Convex Finance

- Lido Finance

- Synthetix (SNX-USD)

- Aave (AAVE-USD)

As stated in our previous Bitcoin article, we strongly believe in the long-term growth potential of DeFi applications. By eliminating intermediaries, decentralized applications can single out and benefit from any inefficiencies within legacy technology networks. As a result, we think DeFi will eventually develop into a trillion-dollar industry.

Metaverse / NFT Projects

Lastly, we believe that metaverse, NFT, and play-to-earn gaming protocols have massive upside. Presently, most retail investors seem too distracted to realize the growth potential behind these digital asset sectors. For example, on July 13, 2022, Verified Market Research reported that the metaverse is projected to reach $824 billion by 2030, growing at a CAGR of 39.1% from 2022 to 2030. Similarly, JP Morgan (JPM) recently reported a projection that the metaverse can earn over $1 trillion yearly revenues by 2030.

At BitFreedom Research, we believe a significant portion of future metaverse revenue will be captured by The Sandbox (SAND-USD), Ethereum (ETH-USD), and Polygon Network (MATIC-USD).

Bitcoin Technical Analysis

The above passages explain some of the best investment opportunities for this altcoin season (if it happens). We will now conclude this piece by using Bitcoin’s technical analysis metrics to determine how long the altcoin season can last and where Bitcoin can bottom.

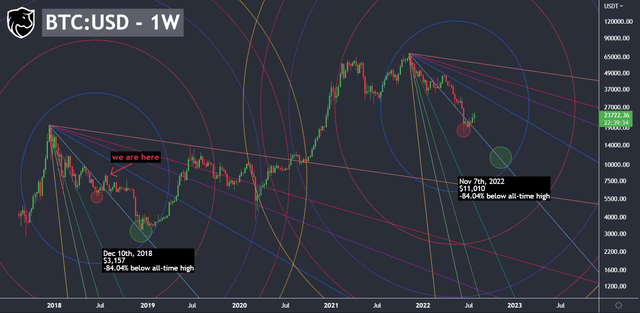

Bitcoin Weekly Harmonics (TradingView 7-29-2022)

The chart above uses Fibonacci circle and Gann fan analysis to track Bitcoin’s previous cycle and predict Bitcoin’s current cycle. In the last cycle, Bitcoin peaked at approximately $19,783 on December 17th, 2017, then bottomed 84.04% lower at $3,157 on December 10th, 2018. With Bitcoin’s current price structure, the chart is signaling two possibilities:

- The bottom is in. Bitcoin’s >40% crash in June 2022 appears eerily similar to Bitcoin’s final crash in November 2018. If Bitcoin continues to follow this fractal, this will make $17,644 on June 18th, 2022, Bitcoin’s macro-bottom.

- Bitcoin’s bear market is only halfway complete. During the previous two cycles (in 2013 and 2017), Bitcoin dropped by over 80% approximately one year after reaching its peak. If Bitcoin is destined to follow this movement again, then this means Bitcoin will bottom at roughly $11k on November 7th, 2022.

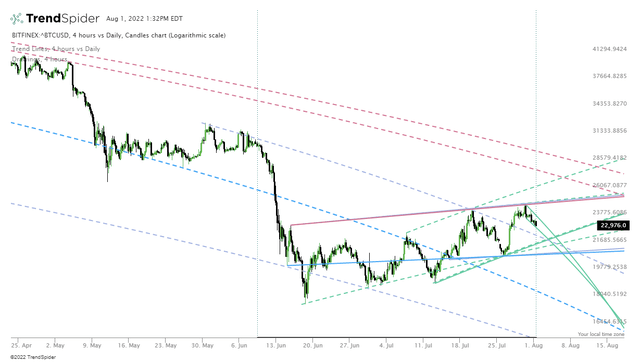

On a shorter time frame, TrendSpider shows that Bitcoin is trading in a range. In our view, altcoin season can continue for as long as Bitcoin stays rangebound between its $24k – $28k ceiling and $21k – $20k floor.

Bitcoin Trendlines: 4H (solid) vs 1D (dashed) (TrendSpider 8-1-2022)

Furthermore, Bitcoin’s daily trendlines (dashed) show significant bearish momentum, indicating that Bitcoin’s bear market is not finished. To confirm a new bull trend (and verify that $17k is the bottom), Bitcoin must confidently break above $28k.

Key Takeaways

- Investors have interpreted the Fed’s actions to signal that altcoin season is beginning.

- Consequently, we expect Bitcoin and many altcoins to trade bullish until the next FOMC meeting on September 20th, 2022.

- After September, Bitcoin may mirror previous cycles and crash lower to form a final bottom at approximately $11k in November.

- Altcoin season can continue for as long as Bitcoin stays rangebound between its $24k – $28k ceiling and $21k – $20k floor.

- Investors can profit from this altcoin season (if it happens) by cycling into cryptocurrencies positively affected by the Ethereum 2.0 merge, high-revenue DeFi protocols, and metaverse / NFT projects.