After a period of challenging downwards price action, there are signs of life in Terra Luna Classic (LUNC). Our analysts have identified clues that a major breakout rally could be inbound.

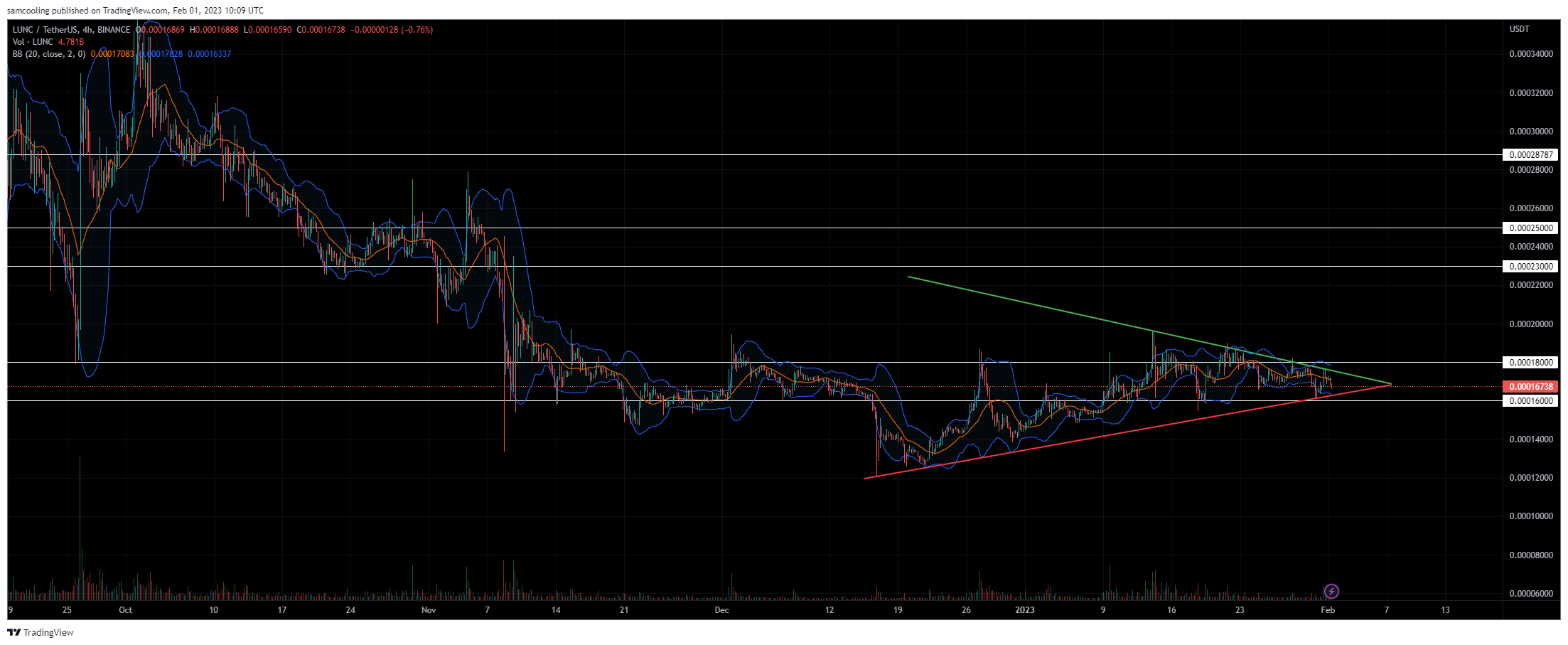

Currently trading at $0.00016 – LUNC has been on a continued uptrend from a local bottom of $0.00012.

LUNC bulls ignited the impressive, ongoing 42-day rally on December 21. So far, carrying LUNC up a whopping 40% over the past month – smashing back into the key price level between $0.00016 – $0.00018 multiple times.

Resistance at $0.00016 finally flipped to become an area of support on January 9.

It’s clear LUNC bulls became emboldened by market sentiment. This flip correlates to strong macro support from Bitcoin’s (BTC) major 25% rally from $16,850 to $21,350 the same week.

We have seen the vital support between $0.00016-$0.00018 before, in November, LUNC clung to this range for over a month.

Downwards price exploration bouncing hard off $0.00012 gives us two clues. One is an sign of LUNC’s lower support level in event of a breakdown of rally structure.

But there is also a confirmation that this rally is looking to test resistance at $0.00018, for a second time after December’s rejection.

Price action here is precarious. Terra Classic bulls have battled to crack the ceiling at this level for over 10 days.

This demonstrates the continued bull pressure in the rally, but could represent a slowing in rally momentum. After all, every rally has a finite amount of gunpowder supplying it.

A successful breakout of this price level would be big.

The next obvious area of resistance sits between $0.00023-$0.00025. That marks a potential gain of between 37% to 50% from current prices. Leaving LUNC in bullish territory not seen in 3 months.

But a breakdown from here would be very ugly for LUNC holders, downward risk implies a retrace of -40% back to $0.00012.

LUNC Open Interest Forecasts Big Move Soon?

Luna Classic’s RSI 14 illuminates cautious optimism for this potential breakout. Currently sat at 42.76 – a signal that LUNC might currently be oversold is bullish news.

Even more bullish looking at the RSI; we can see that it overheated on January 15 as price tested resistance at $0.00018. Since then the RSI has cooled off, and price has found solid support against our trend lines. Priming the rally for another hammering run against the ceiling at $0.00018.

The MACD continues to sit on the fence, with a miniscule bullish divergence at 0.00000004 – this could signal crunch time for this rally.

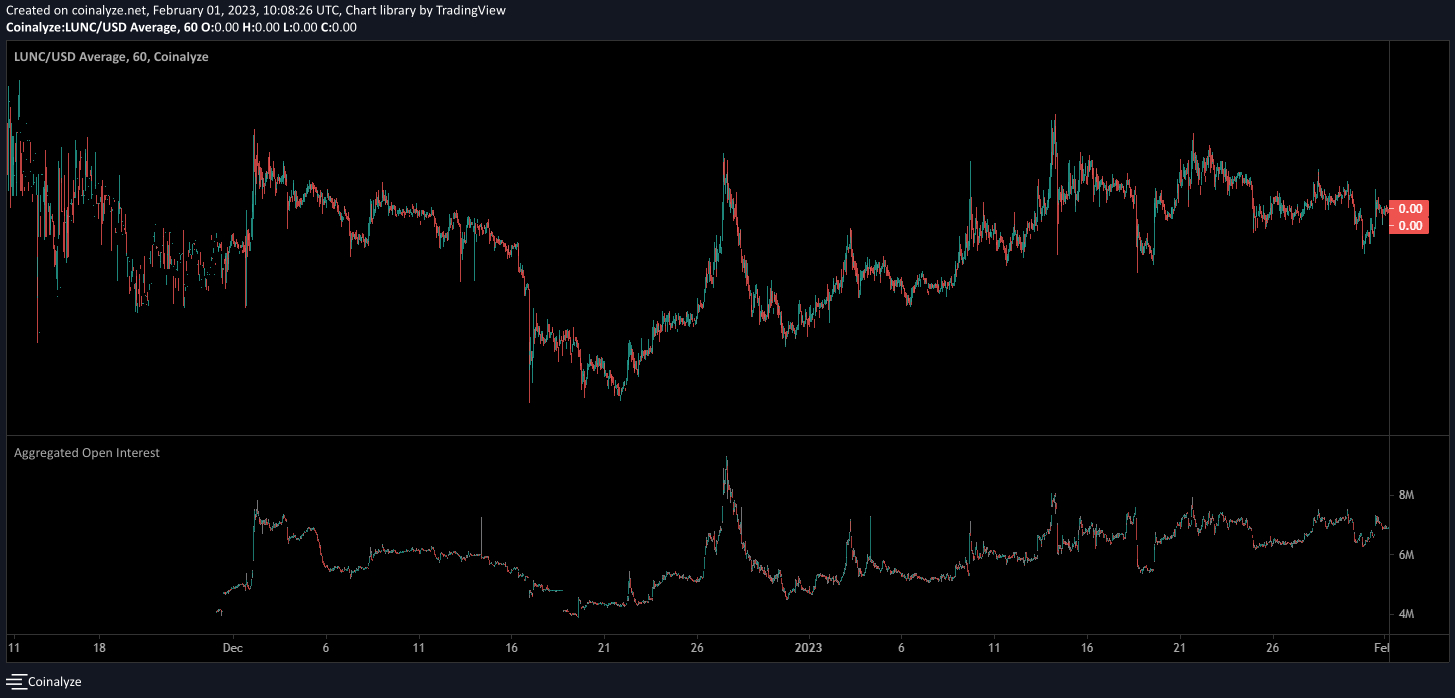

Finally, glancing open interest can inform the propensity for explosive price action.

There is currently $6.67m in open interest sat on the tables at the Huobi and OKX exchanges (a 24hr increase of +1.49%).

Speculators are cautious about the direction of price action. While there is plenty of money on the table, this is not indicative of a big move inbound.

The past three spikes upwards have all precipitated upon higher open interest above $7.9m. Suggesting there is more space on the table ahead of a decisive move.

An uptick of around $1m in open interest could catalyze the next big push.

Another major catalyst for LUNC price action in coming weeks is an ambitious community proposal that could potentially see an effort to repeg USTC in a major comeback for the project.

This is worth keeping an eye on, if it’s passed it could be the bullish news needed to breakout of the current structure to a higher price level.

For now $0.00018 is the critical test that will make or break this rally, watch this space closely.

LUNC Alternatives

If you’re looking for other high-potential crypto projects alongside LUNC, we’ve reviewed the top 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.