Evan van Ness, a seasoned ConsenSys veteran and the author of the popular “Week in Ethereum” newsletter, has raised the alarm over the recent performance of Solana (SOL). According to van Ness, the current bullish rally in the cryptocurrency market might have been the last one for Solana.

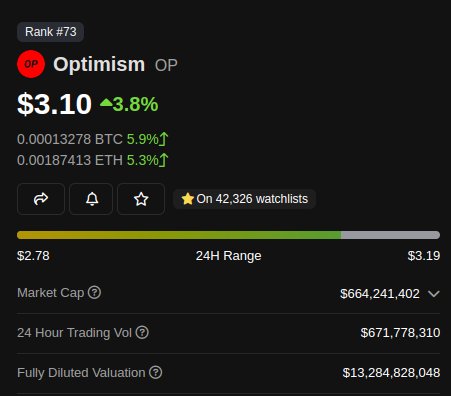

In a recent tweet, van Ness highlighted an interesting “flippening” between Solana and Optimism (OP), which he called a leading execution environment for the world’s settlement layer.

He further stated that Solana is an ill-performing web2 database and is now lagging behind AVAX, which is a geth fork that tries to hide its scalability problems with big blocks and sidechains.

Flippening Between Solana & Optimism

As explained by van Ness, the flippening between Solana and Optimism refers to the recent shift in the market performance of both cryptocurrencies. He noted that Optimism has now taken the lead over Solana, which is a worrying sign for those invested in the latter.

Van Ness also mentioned that the circulating supply of Optimism is only 5% of its total supply, which was news to him when he initially tweeted about the flippening. He clarified that he has no investment opinion on either of the cryptocurrencies and that this is not financial advice.

However, he did express that he believes Optimism will likely be around for the long term and could potentially be a profitable business with its optirolls. On the other hand, he doubted that SOL would last more than a cycle.

A community member commented on van Ness’s tweet, stating that Optimism is even worse than Solana right now and that he should know better than to promote a low circulating supply of trash.

Van Ness responded by arguing that he was not shilling either of the cryptocurrencies and that he just found the flippening interesting and thought to tweet about it.

Another individual commented on van Ness’s tweet, accused him of promoting a liquidity pump, and criticized his use of “X has surpassed Y due to fundamentals.” The commenter went on to question the validity of van Ness’s analysis, suggesting that if Luna Classic was up, it must also be due to fundamentals.

In response to the individual’s comment, van Ness stated that they were projecting and that he did not have any significant holdings in either Optimism (OP) or Solana.

He further stated that his only real position was that Solana would be and was worth much less than Optimism in the long term because rollups have good business models.

Related Reading | Here’s how Ripple CTO Congratulated Elon Musk Over His Victory