David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Crypto, shares the fund’s regular take on what’s happening in the fast-changing and volatile cryptocurrency space.

AI-based tokens might be stealing the crypto limelight just lately, but there’s plenty of exciting building taking place in the realms of decentralised finance, aka DeFi, which is where we’re happy to land again in this installment of Apollo’s Alpha.

Analyst David Angliss talks us through one of Apollo Crypto’s favourite DeFi protocols right now – Lyra Finance, and he notes at least a couple of strong, crypto-narrative-related reasons to keep an eye on it as the market continues its good run of form this year.

Lyra leveraging leading layer 2s

That tongue twister aside, what is Lyra Finance (LYRA)?

“It’s co-founded by Australians, and we think it’s the most complete decentralised crypto options trading protocol built on Ethereum,” explains Angliss.

“It combines the best of traditional options market making (tried and tested pricing and risk management) with crypto’s two biggest strengths – scalability and composability.”

And as for that “narrative” aspect? In addition to already launching on Optimism, Lyra recently expanded to another much-hyped Layer 2 scaling blockchain layer for Ethereum – Arbitrum, which, notes Angliss has “captivated the market recently”.

There are, of course, reasons Arbitrum is capturing so much attention, apart from the fact it may be airdropping its token to the market soon.

It can be put down partly to the fact it’s said to be particularly user-friendly for developers, but, more significantly, it’s largely due to the success of DeFi protocol GMX, believes Angliss.

“GMX, a perpetual contract trading platform, has become the killer app for layer 2s,” notes the Apollo analyst. “And Arbitrum is the leading layer 2 in the space right now, even without a token.”

And the best part about that is, Lyra Finance announced about a week ago that it’s now integrated with GMX (one of 2022’s best crypto performers in a pretty horrendous market) as well as going live on the Arbitrum chain with a new upgrade called Newport.

2/ With the deployment of Lyra Newport, our community has unlocked a number of technical features and usability benefits including 👇

💸 Cash Collateral: Reduced cost for the AMM

📊 Tighter Spreads: Lower fees for traders

💱 Modular Design: Flexible deployment capability— Lyra (@lyrafinance) February 1, 2023

“It’s definitely a smart move by Lyra to leverage the Arbitrum ecosystem and technology, as well as Optimism’s. This will enable it to expand its market share and potentially become the number one decentralised trading options protocol built on L2s.

“We hold some LYRA tokens, so we’re invested in it,” adds Angliss, “so yes, we’re definitely bullish on Lyra Finance. Even though it’s done very well from its local low, a couple of months ago, we believe it’s still got a lot of growth potential.”

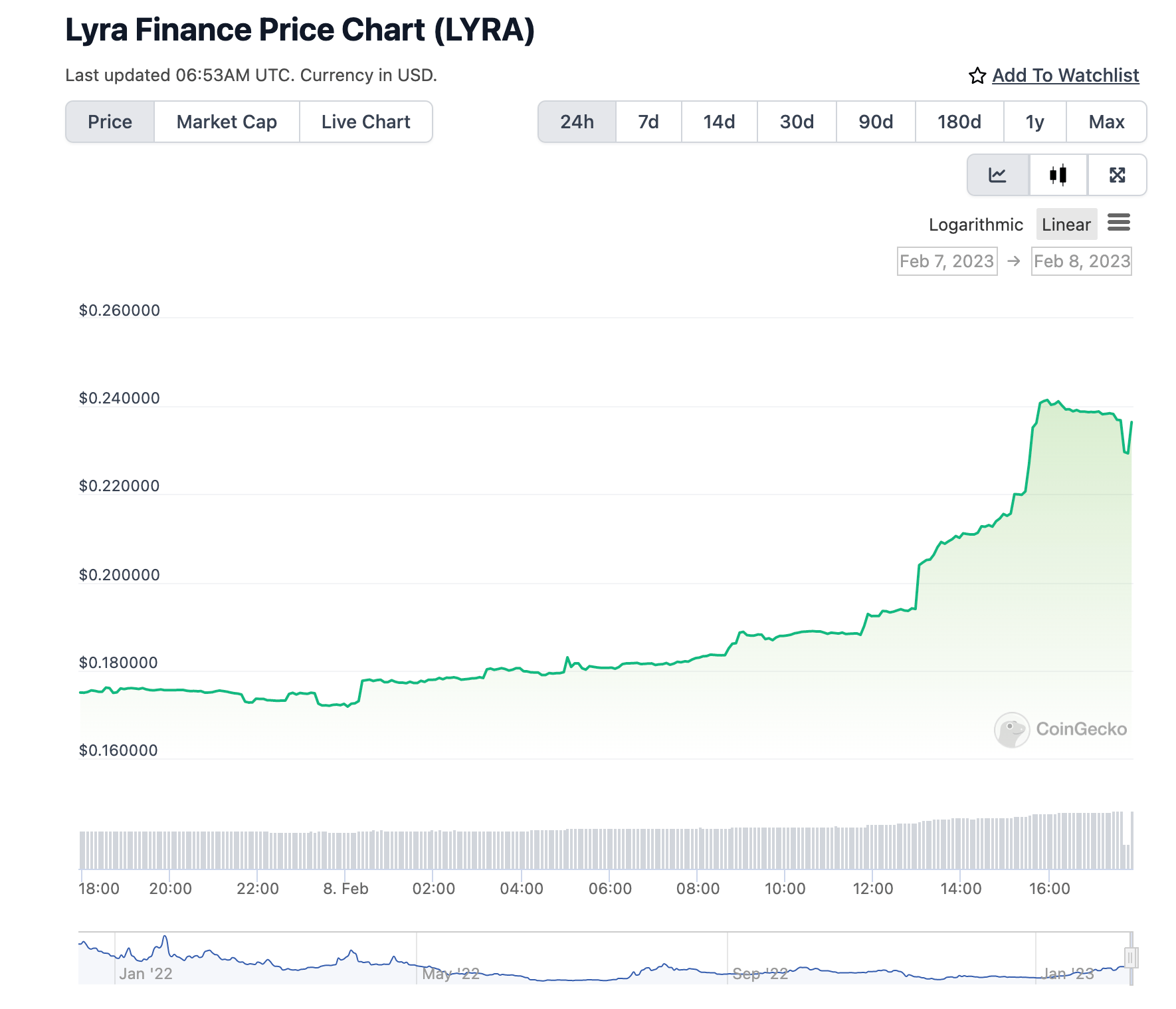

Note: ranked #443 on CoinGecko, with a US$54.4m market cap, the LYRA token is up 35.1% over the past 24 hours, and roughly 176.2% over the past 30 days.

So what does Lyra do?

Lyra is an option-automated market maker (AMM) that allows traders to buy and sell options on cryptocurrencies against a pool of liquidity. The Lyra protocol has two key user groups, liquidity providers and options traders.

Options traders will use the protocol to:

- Hedge their risk

- Lock in a payoff

- Generate extra income on their assets

- Speculate on future price movements with precision

- Get leverage

And the liquidity providers will utilise the protocol to earn yield by depositing stablecoin assets into one of the asset-specific Lyra Market Maker Vaults (MMVs). This liquidity is used to make two-sided (buy and sell) option markets for the asset that the vault specifies (e.g. ETH Market Maker Vault LPs quote options on ETH).

Lyra’s ‘first mover’ opportunity on Layer 2s

“GMX is really good at doing what it does,” says Angliss, “but there are other sectors of DeFi up for ‘first-mover’ grabs. Lyra is going for the options-trading sub-sector, so hopefully they can become as big a name as GMX in that regard.”

And the Apollo analyst points out that Lyra does have a good chance of catching up to its two main competitors in Dopex and Opyn in terms of volume and TVL, especially seeing as it’s the first protocol to integrate on the two largest layer 2s and is the only protocol out of the three utilising an option automated market maker (AMM).

Lyra also has strong protocols demand, evident by it powering some reputable DeFi names such as polynomial.fi, brahma.fi, and dHEDGE – a decentrlaised asset management platform founded by Apollo Crypto’s Chief Investment Officer Henrik Andersson.

Bonus alpha – Apollo’s Crypto Quarterly highlights

Just as an aside from Lyra’s bullish thesis, and to serve as some additional info regarding Apollo Crypto’s current stance on the market, the leading Aussie crypto fundies shared the following key points with us, which they delivered in detail at their recent Crypto Quarterly Webinar.

In brief, then:

• The BTC four-year cycle theory hasn’t been broken yet. (Note: this is a reference to the four-year Bitcoin halvings, which cuts in half the supply of new bitcoins, and the reward for mining them. It’s bullish because it reduces the rate of Bitcoin inflation and has always resulted in pushing the price of BTC higher.)

• The fund predicts strong performance for the “on-chain derivatives” it holds, which includes GMX, Perpetual Protocol, dYdX – and Lyra Finance.

• Apollo will be continuing on its ~1 primary investment per month cadence.

• The cash/market neutral position in Apollo’s flagship fund, ACF, is now below 25%, as Apollo continues to deploy capital.

Note: none of the information presented in this article should be construed as financial advice.