- Most ETH traders have taken to distributing their holdings.

- The positive conviction still lingers as many anticipate the Shanghai Upgrade.

On-chain assessment of the Net Taker Volume metric has revealed that following the recent rally in the price of Ethereum [ETH], traders have been exiting the market in large numbers, with the highest volume of exits seen since the collapse of Terra-Luna.

Read Price Prediction for Ethereum [ETH] 2023-24

According to CryptoQuant analyst Maartunn, the Net Taker Volume metric tracks the aggressiveness of market sellers and buyers for a specified crypto asset.

The metric calculates the difference between the ‘Taker Buy Volume’ and ‘Taker Sell Volume’ and provides insights into the behavior of market participants who use market orders.

Market participants who use market orders are willing to buy or sell at any price, regardless of the cost or fees involved. However, their main priority is to exit their position, according to Maartunn.

With ETH’s Net Taker Volume at its deepest negative value since May 2022, “traders on Ethereum are escaping the market through market orders, which is pushing the price down,” Maartuun noted.

Source: CryptoQuant

On ways to hedge against the impending price drawdown, Martuun advised:

“The strongest signal of the indicator is when prices are still relatively high, but Net Taker Volume is deeply red. And that is where Ethereum is currently. This doesn’t mean that Ethereum can’t bounce in the short term, but as long as Net Taker Volume shows negative values, it’s better to sell the dip other than buy the dip.”

Buying has weakened, but Shanghai Upgrade might work wonders

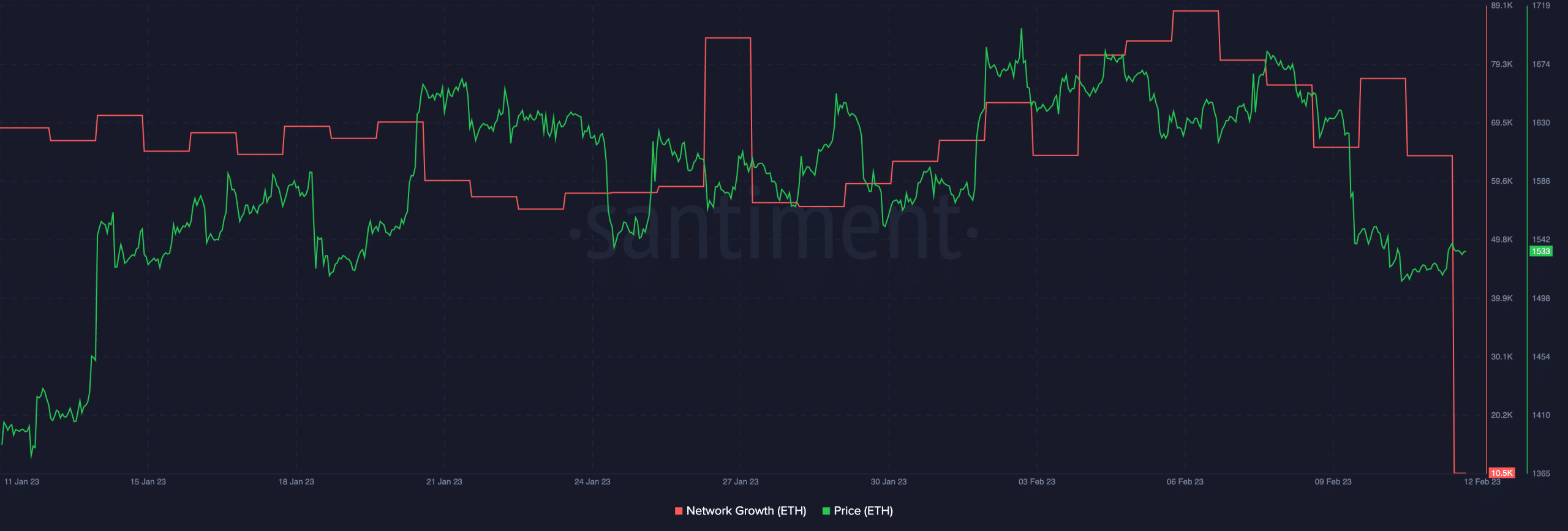

According to data from Santiment, after ETH crossed the $1600 price mark, new demand for the alt weakened. The count of new addresses created on the network daily since has since fallen by a whopping 88%.

Source: Santiment

With the buyers in the market exhausted and unable to initiate any further price rallies, the market has also been without the necessary infusion of new liquidity. Hence, a 6% decline in price in the last week.

Is your portfolio green? Check the Ethereum Profit Calculator

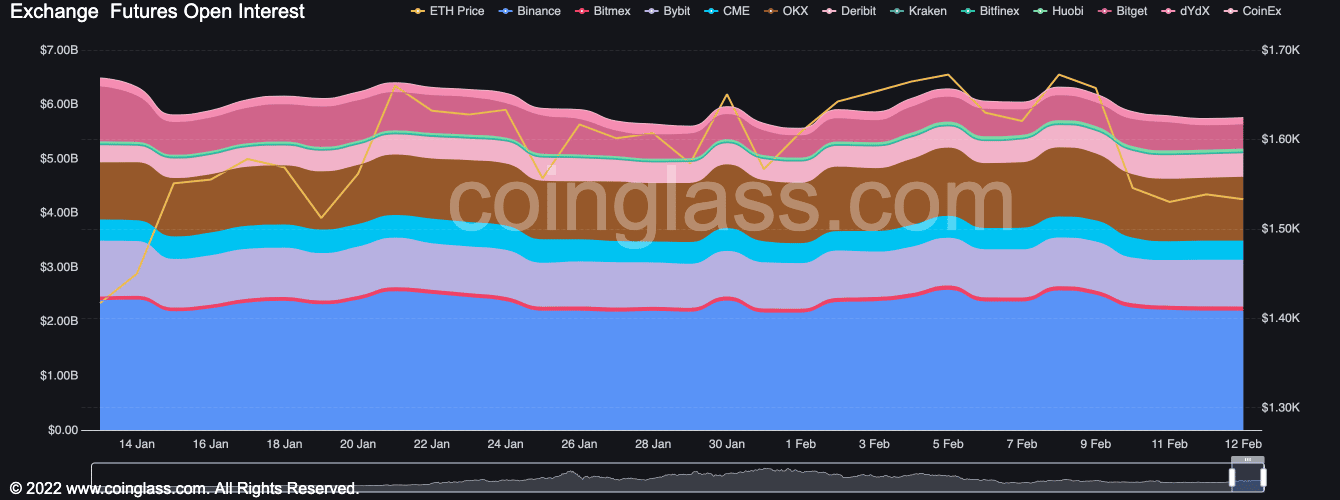

Further, per data from Coinglass, during that period, ETH’s Open Interest fell by 5%. It is trite that a decrease in an asset’s Open Interest often suggests a shortage of market demand or investor attraction to the asset, potentially resulting in a drop in price.

Source: Coinglass

Despite this, many investors maintain a positive outlook due to the possibility of unlocking long-staked ETH coins with the upcoming Shanghai Upgrade in March.

According to CryptoQuant, ETH’s funding rates remained positive and have so been in the last month, suggesting that investors continue to place bets in favor of the altcoin.

Source: CryptoQuant