- GMX’s total value locked increased by 35% since the FTX debacle.

- The protocol’s native token registered a jump in price and trading volume in recent days.

According to a tweet by an on-chain analyst, one of the largest decentralized derivative exchanges GMX, hit a fresh all-time high (ATH) in its total value locked (TVL), underlining its continued dominance in the DeFi landscape.

GMX TVL hitting a new all-time high almost daily. pic.twitter.com/eHlBRlB7an

— Patrick | Dynamo DeFi (@Dynamo_Patrick) February 18, 2023

At the time of writing, the TVL of the Arbitrum-based protocol reached $624 million, gaining 20% over the last week and 35% since the FTX contagion hit the cryptocurrency market.

Is your portfolio green? Check the GMX Profit Calculator

The age of decentralized staking

The growing interest in GMX could be linked to U.S. regulators’ strengthening chokehold on centralized staking offerings. Consider this- GMX recorded an ATH in its trading fees and revenue on 10 February, the day when Kraken stopped all the staking activity on its exchange after being reprimanded by U.S. Securities and Exchange Commission (SEC).

GMX’s staking solution guarantees a 30% share of the generated trading fees to users who lock their GMX tokens.

Liquidity providers (LPs), on the other hand, take a 70% cut of trading fees. The lucrativeness of this staking policy was evidenced by the growing number of daily active users and the protocol’s trading volume, fetched from Token Terminal.

Source: Token Terminal

Native token absorbs the gains

The sustained growth in key metrics resulted in greater action on the token front as well. At the time of writing, GMX logged gains of more than 25% over the last week while its trading volume more than doubled in the same time, per data from Token Terminal.

At press time, however, the token fell by 1.63% in the 24-hour period, per CoinMarketCap.

Source: Token Terminal

How much are 1,10,100 GMXs worth today?

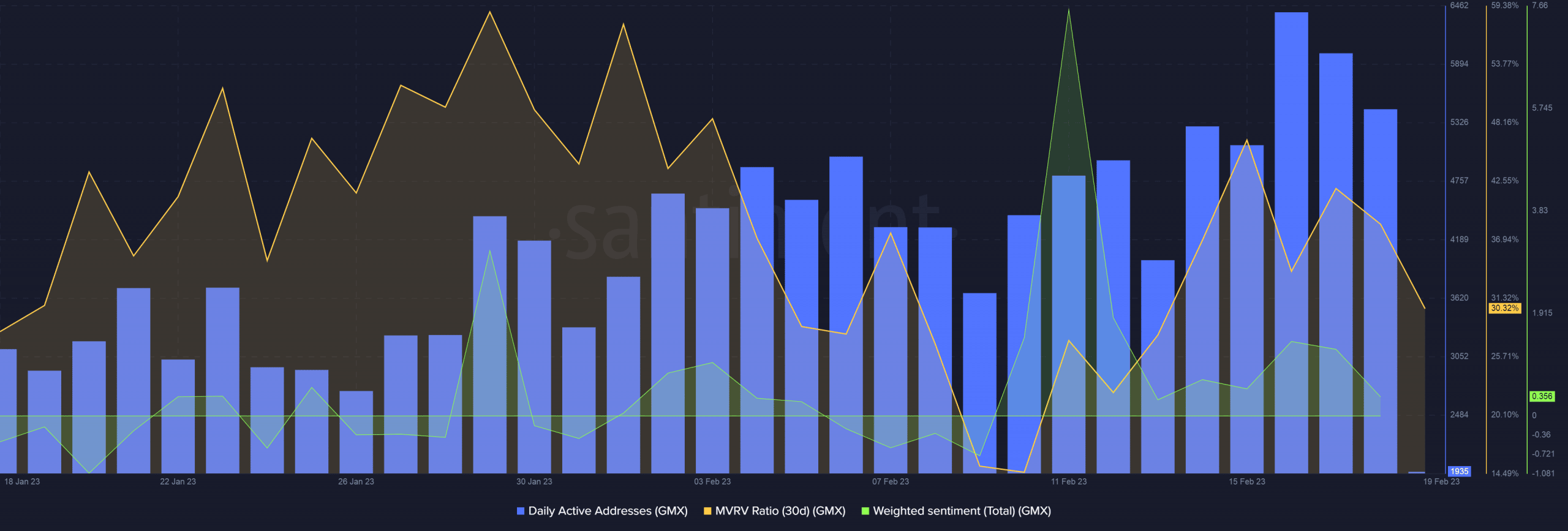

According to Santiment, the daily active addresses jumped 36% over the last week, adding to the bullish narrative of the token. The 30-day MVRV ratio was on the higher side, indicating that most holders will realize profits if they were to sell their GMX tokens.

Investors should take this reading with a pinch of salt as it had the potential of exerting considerable selling pressure in the days to come.

The weighted sentiment was positive which meant that investors pinned their hopes on the viability of GMX.

Source: Santiment