Vitalik Buterin is one of the biggest names in the crypto space, having co-founded the immensely popular Ethereum blockchain. Enthusiasts commonly look to Buterin for crypto perspectives, but a March 2023 dump of Ethereum-based altcoins by Buterin has caused quite a stir.

So, why did Vitalik Buterin sell such a significant holding of crypto, and did it affect the crypto market?

Who Is Vitalik Buterin?

Vitalik Buterin is a Russian-Montenegrin computer programmer who, along with Gavin Wood, Anthony Di Iorio, and other contributors, founded the Ethereum network in 2014.

Since 2014, Buterin has amassed a mammoth wealth and secured himself as one of the crypto industry’s most prominent figures. Wealthy Gorilla reported that Buterin’s net worth was around $400 million as of March 2023. Though this figure fluctuates frequently, there’s no denying that Buterin has achieved success.

As you may have guessed, most of Buterin’s holdings consist of Ether (ETH). While he remains loyal to this asset, in March 2023, Buterin dumped over $700k in Ethereum-based altcoins. So, why did this happen?

Why Did Vitalik Buterin Sell His Huge Altcoin Holdings?

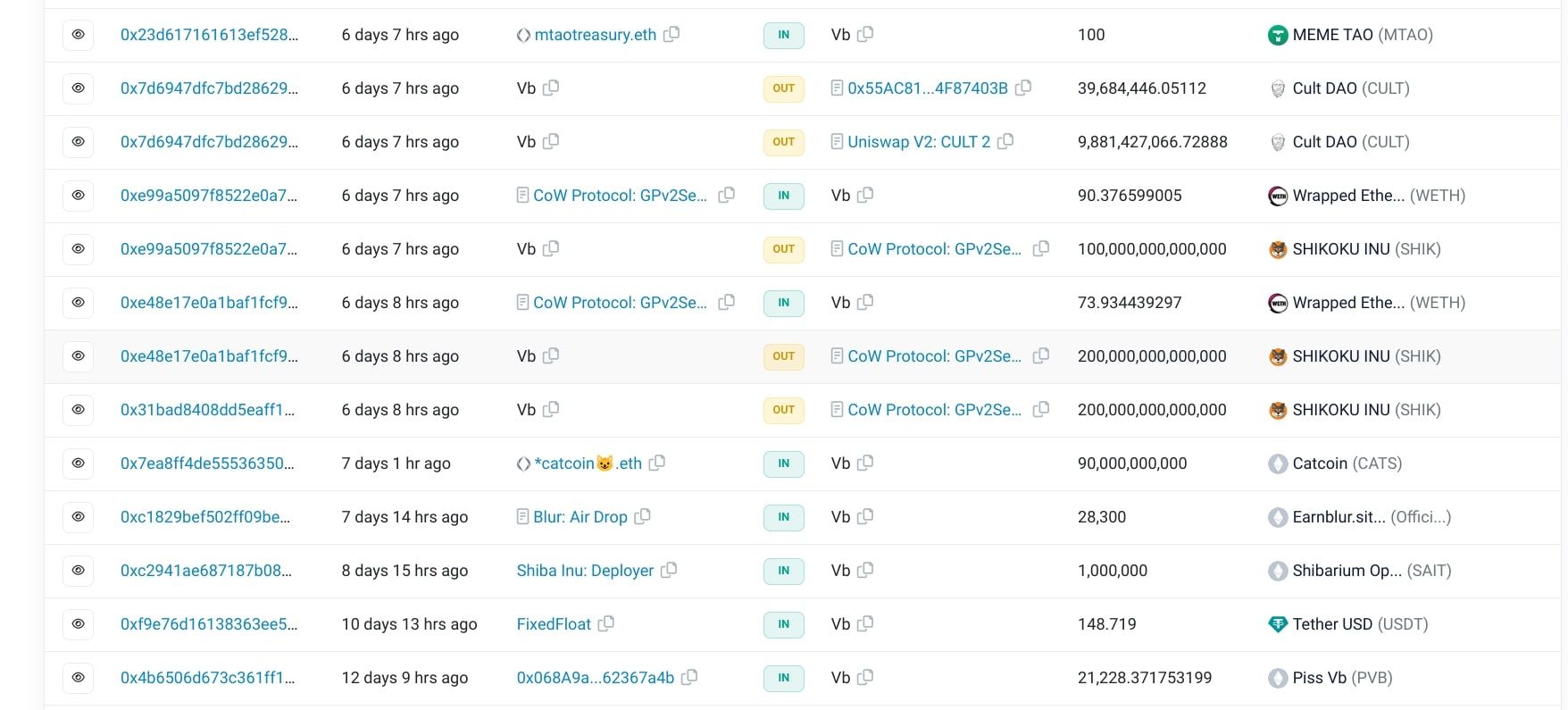

On March 7, 2023, Etherscan showed one of Buterin’s known Ethereum wallet addresses displaying some unusual figures. The transaction chart showed that two lots of 200 trillion SHIKOKU were sent from the wallet within a four-minute window. Then, just a few minutes later, another 100 trillion in SHIKOKU was withdrawn from the same wallet address.

This 500 trillion SHIKOKU makes up half of the token’s circulating supply.

Shikoku is an Ethereum-based meme coin project, within which SHIKOKU is the native asset. SHIKOKU is a meme coin (like Dogecoin and Shiba Inu) that holds a value of just $0.000000005812 at the time of writing. The token experienced a severe price drop on March 7 after the huge sell-off from the Buterin ETH wallet.

But things didn’t stop there. On the same day, more large transactions were seen on Etherscan alongside the SHIKOKU dump, including an outgoing amount of 9.9 billion CULT tokens from the Cult DAO project. This is another decentralized Ethereum-based platform, with its native token, CULT, suffering a price drop on March 9 (though the price is recovering at the time of writing).

Lastly, the Etherscan transaction chart showed a dump of 50 billion MOPS, the native token of the Ethereum-based project Mops. All of these tokens were sold in exchange for Ether, which amounts to almost $700,000.

Buterin confirmed that the wallet in question was his in a tweet in 2018.

So, why did this happen?

Buterin is yet to make any official statement on the ERC-20 token dumps, leaving them open to speculation.

One Twitter user commented on the sell-off, suggesting that Buterin’s accountant “warned him these tokens would count as income on his tax sheet.”

Another Twitter account tweeted about the dumps, stating that Buterin was “selling his free sh**coins.”

At the moment, the true reason for Buterin’s multiple ERC-20 token sell-offs is unknown. However, another development suggests a possible motive.

Buterin’s RAI to USDC Conversion

A few days after the series of token dumps, Etherscan showed that another Buterin-owned wallet had deposited 500 ETH in the Reflexer decentralized platform, where he used it to mint RAI, an Ethereum-based algorithmic stablecoin.

Buterin then swapped this RAI for USD Coin, the second most popular stablecoin also based on the Ethereum blockchain. A portion of the RAI was also converted to DAI, another popular stablecoin.

This suggests that Buterin is looking to secure some of his wealth using stablecoins, which are designed to be far less exposed to market volatility than other cryptocurrencies, including Ethereum. Buterin’s purchase of USD Coin coincided with the stablecoin’s de-peg on March 11, 2023. At the time of writing, USDC has returned to its 1:1 peg.

Buterin may have shredded the Ethereum-based meme coins to gather funds to convert to USDC and DAI via Reflexer, though this has not been confirmed. Given Buterin’s alleged wealth, it seems somewhat unlikely. Could Buterin have been attempting to inspire confidence in the market? Or was it just a prime opportunity to make some extra cash? We’ll likely never know.

Buterin’s Move Is Good for Some and Bad for Others

While Buterin’s ERC-20 token dump caused some nasty price drops (for some fairly unheard of meme coins), it may be good news for USD Coin, as well as DAI. Some believe that stablecoins are the future of crypto, and Buterin’s decision to convert some ETH into stablecoin holdings could push other investors to follow suit.