Dogecoin may need to double up on its ecosystem expansion to drive its core metrics upward

The broader digital currency ecosystem appears to be on track to end the first quarter of this year on a positive note with the combined market cap hovering above the $1 trillion benchmark. Riding on the strength of this growth, many cryptocurrencies are ending the quarter with impressive growth, but that of Dogecoin (DOGE) can be judged as mild.

Per its outlook for the first quarter, Dogecoin’s price has risen by just 8.02% in the year-to-date period, a growth trend that is antagonistic to the massive positive volatility that Dogecoin is known to possess.

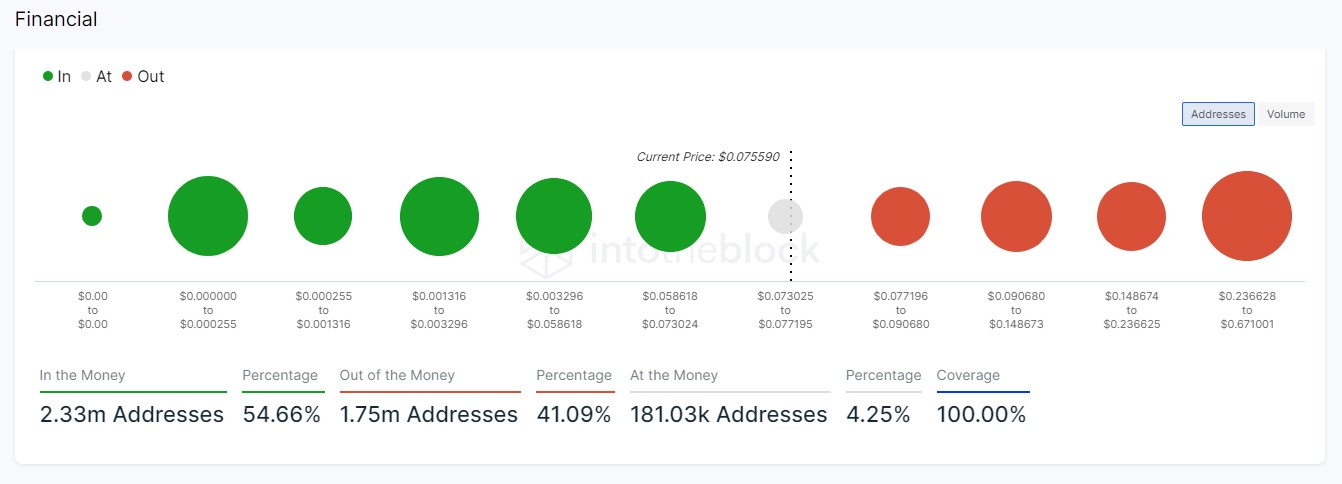

Despite this relatively poor performance, after a deeper look at the Dogecoin on-chain metrics, it will be discovered that more than 54% of addresses holding the meme coin are in profit at the moment. This figure corresponds to a total of 2.33 million addresses, leaving just about 41% in loss.

This metric makes it evident that despite the gloom covering the industry in the past three months, the addresses that held onto their DOGE are largely being rewarded. Depending on the yardstick used to measure performance, Dogecoin will not fare badly.

Getting DOGE groove back

Though investors were very skeptical about meme coins in this first quarter as positive sentiment in the industry was deployed toward Bitcoin (BTC) and most Layer 2 solutions, Shiba Inu (SHIB) still fared better than the premier meme coin.

This lends credence to the fact that core Dogecoin developers must do all they can to be more innovative and introduce new utilities that can drive intense adoption of the highly speculative asset.

Shiba Inu and Shibarium are advancing the reach of their ecosystem through targeted partnerships with high-growth brands around the world. With more potential proactive moves, Dogecoin can record a better Q2 than most altcoins in the top 20 rankings.