An Ethereum (ETH)-based decentralized finance (DeFi) protocol has exploded in price amid a recent spike in whale activity and new addresses, according to the crypto analytics firm Santiment.

YFI, the native asset of automated yield-farming protocol Yearn.Finance, is trading at $10,242 at time of writing.

Santiment notes that the number of YFI transactions valued at more than $100,000 recently surged to its highest level since July 2022. New address growth has also been “exponentially increasing,” according to the analytics firm.

Despite its recent gains, YFI remains nearly 89% down from its all-time high of $90,786, which it hit in May 2021.

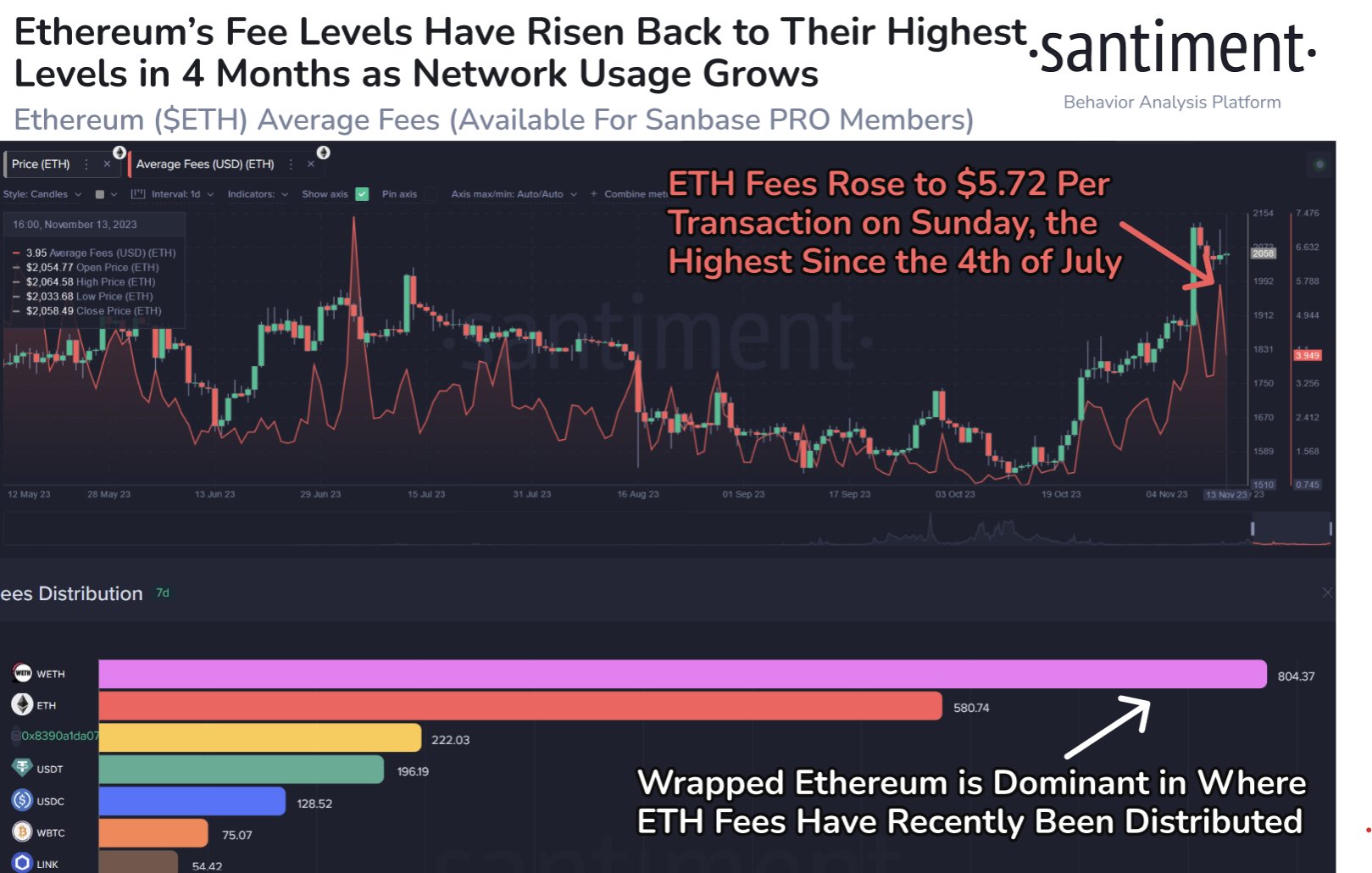

Santiment also notes that Ethereum fees have risen back to their highest levels in four months.

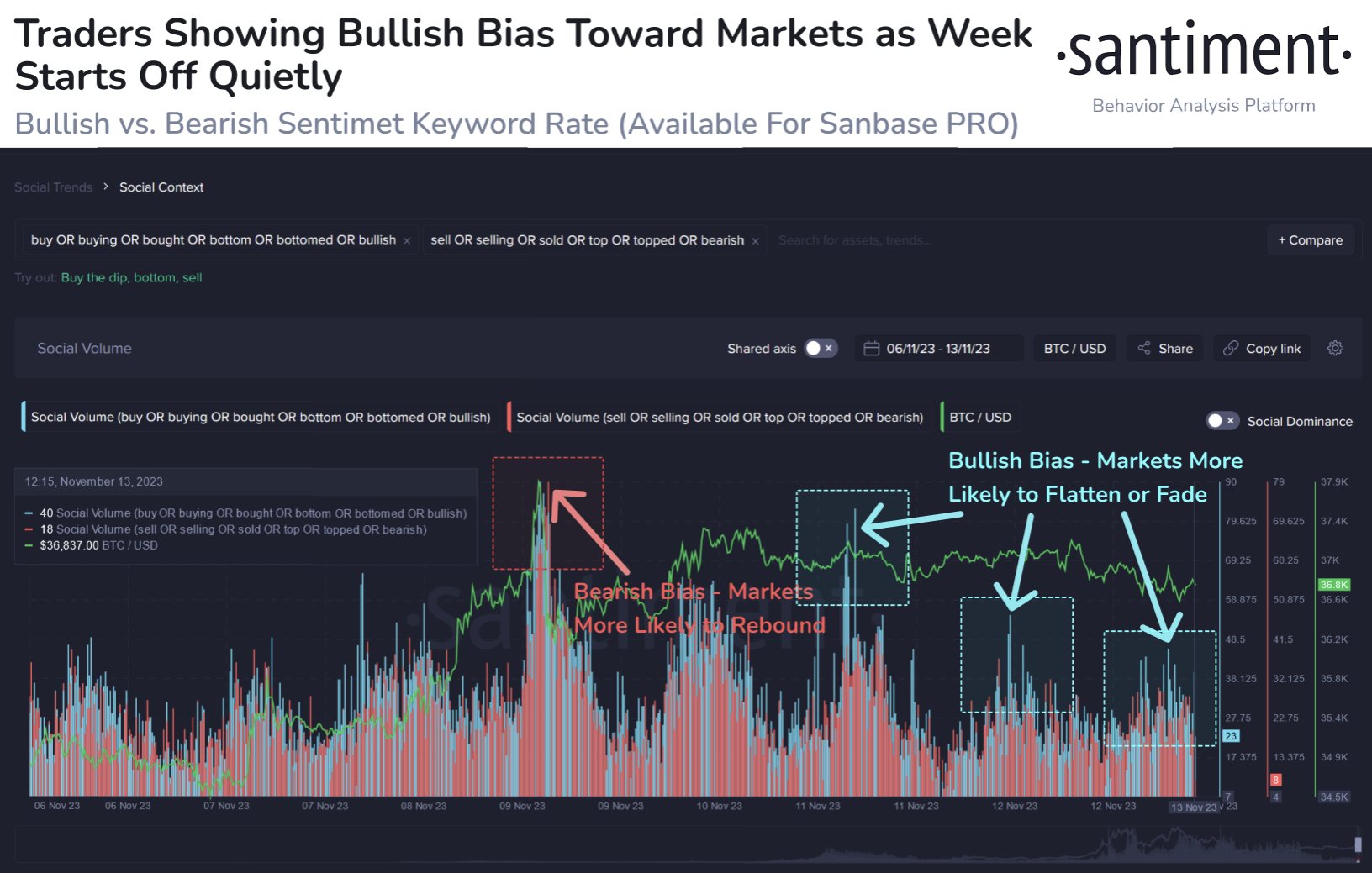

In terms of the overall crypto market, Santiment says digital asset traders still have a bullish bias, which has historically made markets more likely to flatten or fade.

“Crypto markets have flattened the past three days, but traders are still showing signs of optimism and FOMO. Historically, price rises are most likely to occur after the crowd becomes fearful and keywords like sell, top, or scam rise on social media.”

The 129th-ranked crypto asset by market cap is up more than 71% in the past seven days.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney