By Amy Castor and David Gerard

- We write for money! Here’s Amy’s Patreon and here’s David’s. For casual tips, here’s Amy’s Ko-Fi and here’s David’s.

- If you liked this post, tell just one other person. Send them a link! This really helps.

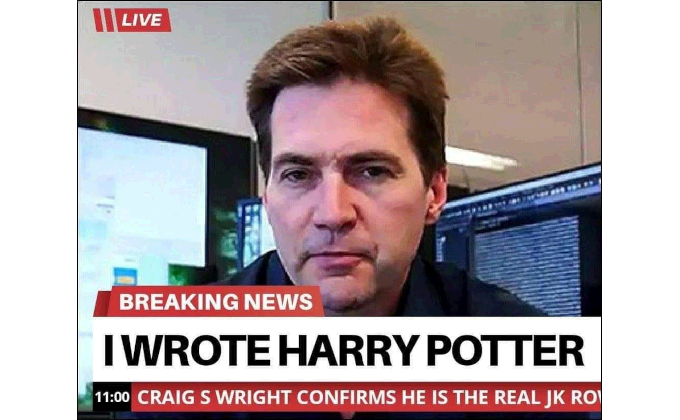

“he actually is satoshi and has access to the satoshi bitcoin horde, but wants nobody to know this. so he’s convincing everyone he absolutely isn’t satoshi by claiming he is satoshi in the least believable way imaginable”

— SubG

KuCoin busted

The KuCoin crypto exchange has been charged by the Justice Department with deliberate and knowing violation of the Bank Secrecy Act, as have its founders, Chun Gan and Ke Tang. [press release; indictment, PDF]

The prosecution is for large-scale money laundering — “proceeds from darknet markets and malware, ransomware, and fraud schemes.”

The price of bitcoin is set in these unregulated offshore floating casinos — and we expect them to keep getting busted, because they’re all laundromats for money.

KuCoin didn’t even require customers to provide identification until July 2023, when it got wind of a US investigation.

KuCoin was previously charged by New York in March 2023 for dealing unregistered securities to New York users. They settled in December 2023.

The CFTC has also charged KuCoin for offering commodity derivatives to US customers without registering and for failing to identify its customers. [Press release; complaint, PDF]

Users have been leaving KuCoin as fast as possible. The exchange announced a $10 million airdrop of its own KCS token and some bitcoin just after the charges were announced. [KuCoin, archive]

Blockchain case study: Kickstarter

Kickstarter is a crowdfunding platform. You put up a planned creative work, get pledges, and Kickstarter takes a percentage. This is pretty simple. There are very few ways to mess it up.

One way you can mess it up is to go into growth-at-any-cost mode and do stupid things for the sake of funding.

In December 2021, Kickstarter announced that it was pivoting to blockchain! Nobody had any idea what this meant — including Kickstarter, who couldn’t advance a single coherent reason, let alone a plan. [Kickstarter, 2021; Bloomberg, 2021]

Users revolted. They were disgusted at the idea of the platform that many of them relied on getting into bed with scammy nonsense — “pretty much all we have seen in that time from the crypto space is rampant fraud, theft, and financial ruin,” said Isaac Childres of Cephalofair Games.

Before the blockchain announcement, board games and tabletop gaming had long-established relationships with Kickstarter. In fact, Kickstarter had a near-monopoly in the sector. After the announcement, the game creators largely moved to BackerKit and Gamefound.

Fantasy author Brandon Sanderson used to pre-market his books at Kickstarter. His last Kickstarter campaign made $41 million — the largest project in Kickstarter’s history. $2 million went to Kickstarter for just running the platform. Sanderson moved to BackerKit after Kickstarter’s blockchain announcement; his present project is at $23.7 million as we write this. [CNBC; Backerkit]

Why did Kickstarter do something so stupid? It turns out that Andreessen Horowitz, through their a16z Crypto unit, promised to buy $100 million of early Kickstarter investors’ shares in return for 25% of the company — if Kickstarter would just say they were adopting “blockchain.” [Fortune, archive]

The particular blockchain was Celo — a basket-based stablecoin intended to copy Facebook’s ill-fated Libra, with Libra’s original creator Morgan Beller on board as an advisor. Celo happens to be another a16z portfolio company.

Kickstarter was profitable before this. But they didn’t have a path to cancer-like growth at all costs. So they went along with a16z’s blockchain promotion.

Kickstarter had refused to recognize a union at the company in 2019 and illegally fired two of the union organizers. Kickstarter finally did recognize the union, but also had massive layoffs because so many creators had left the platform due to Kickstarter’s efforts not to recognize the union. They preferred to destroy their profitable company rather than allow a union to gain the slightest toehold.

Everette Taylor, Kickstarter’s fifth CEO in a decade, told TechCrunch a week after he started in September 2022 that “we’re not committed to moving Kickstarter to the blockchain or doing anything specific there.” [TechCrunch]

Taylor is still casting about for new revenue opportunities for Kickstarter — but not on the blockchain.

Tethers, right, but on the AI

Tether has announced a pivot to AI. This is definitely the most bizarre Tether news we’ve heard in a while. But apparently Tether invested in Northern Data Group in September 2023. [Tether, 2023, archive]

Northern Data is a bitcoin miner based in Germany that’s attempting its own pivot to AI. They have three lines of business: Taiga (NVidia cards in the cloud), Ardent (data center space), and bitcoin mining as Peak Mining.

Northern Data as a whole seems to be losing money fast. Their 2022 financials are only just out and show considerable losses. [Northern Data, PDF]

Peak Mining seems to be doing okay? Mining cost them 13,011 EUR per BTC in 2023 and they sold most of the fresh coins at a considerable profit. It was Northern Data who bought the Whinstone facility in Texas in 2020 and sold it to Riot in 2021. [press release, archive]

Anyway, Tether is setting up its own new AI labs in London and Turkey. [Tether, archive; Tether, archive; Tether, archive]

In more normal Tether news, USDT appears to be the favored method to evade international sanctions on Russia, to the tune of $20 billion sent through the Garantex crypto exchange — after Garantex was sanctioned in April 2022 for cashing out ransomware payouts. “The trick is Tether.” The US and UK are investigating. [Bloomberg, archive; WSJ, archive]

The US has busted a tech support scam that took payment in tethers and has seized 14 million USDT. Tether has been keen to promote how helpful it was to the US government, if only because they didn’t want to go to jail themselves. [Justice Department; Tether]

We are all Satoshi. Not you, Craig

In the most stunningly obvious legal finding in history, a UK court has ruled that Craig Wright is not Satoshi Nakamoto:

First, that Dr Wright is not the author of the bitcoin white paper. Second, Dr Wright is not the person who adopted or operated under the pseudonym Satoshi Nakamoto in the period 2008 to 2011. Third, Dr Wright is not the person who created the bitcoin system. And, fourth, he is not the author of the initial versions of the bitcoin software.

This will tremendously help anyone that Wright has sued and made legal threats against for saying that he is not Satoshi.

Wright was sued in 2021 by a conglomerate of crypto companies called the Crypto Open Patent Alliance — who wanted to stop what they saw as Wright’s abuse of the English legal system to silence critics.

COPA’s lawyer, Jonathan Hough KC, told the high court that Wright’s claim to be Satoshi was a “brazen lie and elaborate false narrative supported by forgery on an industrial scale.” [Guardian]

COPA will be suggesting perjury action against Wright over all the ineptly forged documents he submitted for the case.

The judge has ordered that £6 million of Wright’s assets be frozen to cover court costs. [CoinDesk; Bitcoin Defense, PDF]

Rory Cellan-Jones, the former BBC technology reporter who was one of the three journalists to publicize Wright’s initial claims, wrote up the ruling. [Substack]

Calvin Ayre, Wright’s billionaire backer, didn’t quite do a victory lap. Ayre will be disappearing from Twitter for a while. [Twitter, archive]

The Kleiman v. Wright case from 2018, which Wright lost in 2021, is still ongoing. Wright was found in civil contempt for messing around in discovery and must pay Kleiman’s attorney fees. [Case docket]

ETFs will surely save bitcoin

The UK has been more cautious than the US when it comes to bitcoin-based securities. The FCA allows ETNs (exchange-traded notes, a bit like ETFs) based on crypto in the UK — but only for professional and institutional traders, not for retail mums and dads. The London Stock Exchange will start listing bitcoin ETNs on May 28. [FCA; CoinDesk]

All US bitcoin ETFs are cash-create only, but Bloomberg Intelligence thinks that Hong Kong is likely to approve bitcoin ETFs and that they’ll allow in-kind creation — deposit your bitcoins directly for shares. This will be an extremely handy money laundromat. [CoinDesk]

US bitcoin ETFs have shown a consistent net inflow of funds since they were created in January. In late March, this started reversing on many days — it seems that total demand may substantially have been filled, for all the furious marketing. Grayscale’s GBTC continues being drained. [The Block; CoinDesk; CoinTelegraph]

Grayscale wants a new mini-ETF for bitcoins, to be spun off from GBTC. The new fund will offer lower fees — though Grayscale hasn’t said how low. Maybe they hope this will stem the bleeding. Or they think they can get the “BTC” stock market ticker. Grayscale holders will get some percentage of the new trust. [CoinDesk; S-1]

BlackRock attempts to temper market expectations: yeah, bitcoin is gonna suck for future returns, but that’s good news for bitcoin. [CNBC]

The SEC is looking to classify ether (ETH) as a security, in an ongoing investigation that began after Ethereum shifted to proof of stake. This may delay an ETH spot ETF. [CoinDesk; Fortune, archive]

It came from Chapter 11

Genesis has sold its GBTC! … and bought 32,000 bitcoins with the proceeds. This is not usual — but the largest creditors are crypto firms and they seem to have agreed to take bitcoins rather than dollars. This includes the Gemini Earn customers.

This is a gamble that the price of bitcoin will still go up — at a market peak. It could be one of the stupidest things we’ve heard this week. [Doc 1546, PDF; CoinDesk]

Gemini will be returning up to $1.1 billion to Earn customers — whatever they don’t get back from Genesis — and will pay a $37 million fine to New York. [DFS]

Genesis has settled the SEC’s case against them over Gemini Earn — a $21 million fine payable at the end of the bankruptcy. [SEC]

BlockFi has settled with FTX and Alameda and will receive $874.5 million once FTX’s bankruptcy plan is approved. $250 million of this will be treated as a secured claim. The court still needs to approve this. [CoinDesk; Doc 2172, PDF]

BlockFi was dead after Three Arrows Capital blew up. FTX kept BlockFi’s head above water with a $400 million line of credit — but then FTX imploded in turn. FTX filed for bankruptcy, and BlockFi followed. The companies sued each other over pre-bankruptcy loans in 2023.

The searing light of regulatory clarity

FTX founder Sam Bankman-Fried has been sentenced. We are delighted not to have to think about him again for at least 12 years, if not the full 25. Sam got up to speak for himself during the sentencing hearing and, of course, tried yet again to throw Caroline Ellison under the bus. Molly White’s post goes into depth. [Citation Needed]

The SEC is still going in hard against crypto exchanges for dealing in unregistered securities. It just settled with Erik Voorhees’ ShapeShift crypto exchange for a $275,000 fine and a bar from dealing in unregistered securities — even though ShapeShift left the US in 2021. [CoinDesk; Order, PDF]

Do Kwon, perpetrator of the Terra-Luna crash of May 2022, is still in Montenegro. The legal wrangling continues over whether he gets extradited to the US or to South Korea. In the meantime, Kwon and Terraform Labs were found guilty of civil fraud in the SEC’s case against them over Terra-Luna. [CoinDesk]

Roman Sterlingov, the founder of old-school crypto mixing service Bitcoin Fog, has been convicted of money laundering. Sterlingov was initially busted by the IRS and the FBI in 2021. Ilya Lichtenstein, a witness in the case, said he used the mixer to launder some of the massive pile of bitcoins that he and his wife Heather “Razzlekhan” Morgan stole from Bitfinex in 2016. [Bloomberg, archive]

More good news for bitcoin

We detailed in April last year how the Federal Reserve told Custodia Bank of Wyoming to just go away — they definitely weren’t going to be allowed to start a money-laundromat stablecoin backed by Fed dollars. As well as being dangerously incompetent.

Custodia sued, but their case was thrown out in summary judgment. Judge Scott Skavdahl thinks the letter and intent of the law is extremely clear here. [Order, PDF]

Dan Davies, author of Lying for Money, has a new book out: The Unaccountability Machine: Why Big Systems Make Terrible Decisions — and How The World Lost its Mind. You should also read his newsletter, it’s great. [Amazon UK; Amazon US; Substack]

Amy got a bizarre email from Matthew Ledvina, a US tax advisor based in Switzerland, asking her to remove his name from a post she wrote in 2020. Ledvina pleaded guilty to a pump-and-dump in 2019 and was sentenced to 30 months probation and ordered to pay a fine — but in his email, he said he was “exonerated.” Unfortunately, it turns out he was not exonerated — he pleaded guilty and was duly sentenced. Ledvina sent similar requests to Offshore Alert, who also noticed that his claims didn’t check out — and they made his request public. [Amy Castor; Offshore Alerts; Offshore Alerts; DOJ, PDF]

Media stardom

David spoke to an Al Jazeera podcast about Worldcoin and its hunger for eyeballs. He comes on around 8:30 for literally two sentences. But he did supply a pile of the background and gets a credit, so that’s fine! [Al Jazeera]

Amy and David both went on the BBC to talk about Sam Bankman-Fried’s sentencing, but BBC News doesn’t put clips up. David’s clip on CGTN, six minutes after the sentence dropped, is available. You can tell they had to throw away the question list at the last second. [YouTube]