Every time the market experiences even a small surge, investors quickly begin speculating whether an altcoin season might be around the corner. This cycle has repeated itself through every major crypto bull run. Bitcoin usually leads the initial recovery, setting off optimism, after which capital begins rotating into smaller assets with higher risk and reward profiles.

Altcoins are the beneficiaries of this enthusiasm, often seeing rapid price movements once confidence returns. With indicators across the market showing renewed momentum and liquidity beginning to rise again, sentiment is turning increasingly bullish. This could set the stage for a powerful move in altcoins that have been consolidating and quietly building strong fundamentals.

Rate Cut Expectations, Stablecoin Expansion, and Altcoin Potential

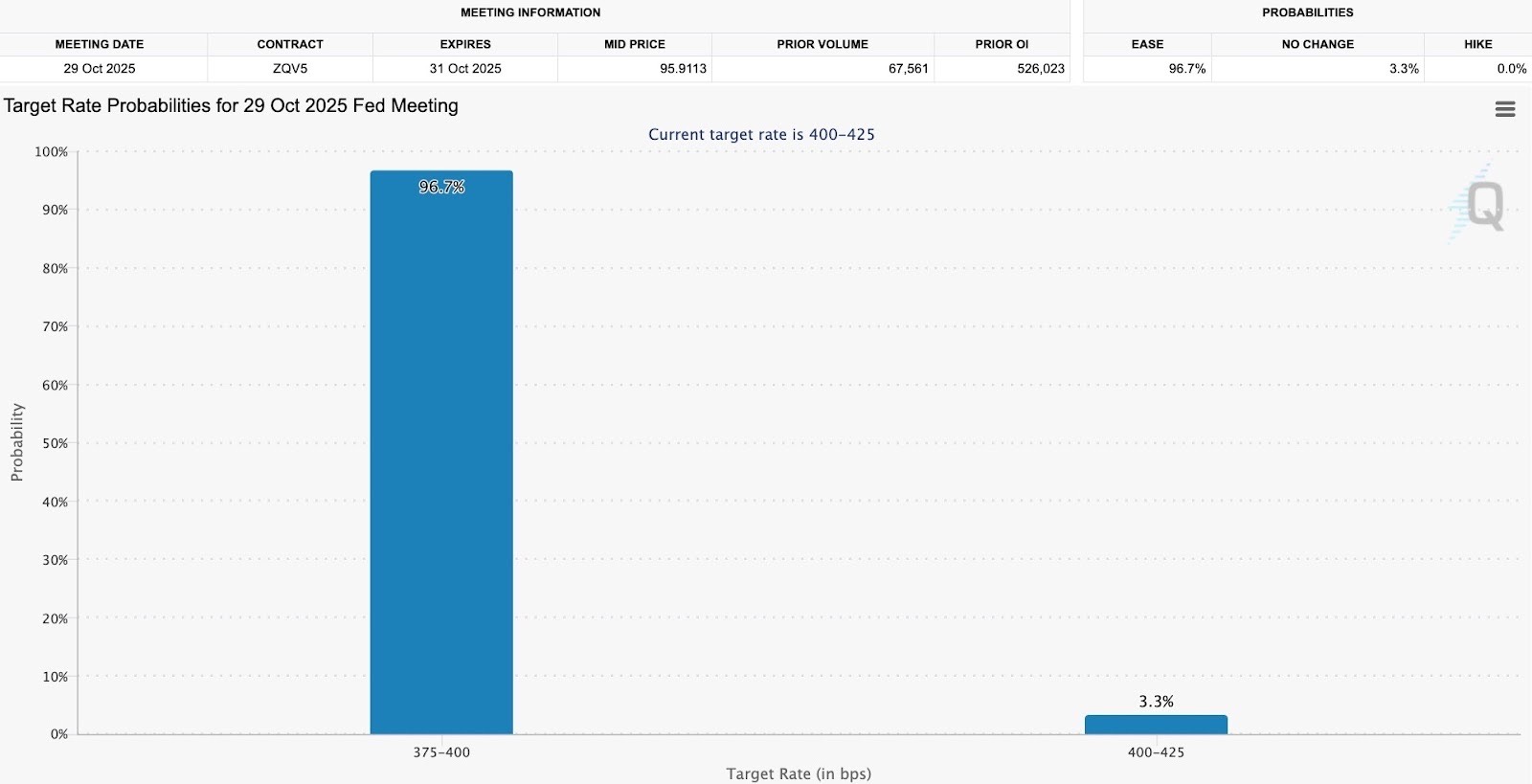

According to the latest CME data, traders are assigning a 97.8% probability of a 25 basis point rate cut in the upcoming Federal Reserve meeting on Wednesday. Such an overwhelming consensus itself acts as a catalyst, reflecting market-wide anticipation of easier monetary conditions.

The last time the Fed delivered positive news aligned with dovish policy expectations, the crypto market experienced a broad rally within days, led initially by Bitcoin before capital rotated into altcoins.

This time, the setup appears similar but potentially stronger. Liquidity conditions are improving, and macro sentiment is tilting toward risk assets. What is particularly noteworthy is the recent $8.5 billion increase in circulating stablecoins from issuers such as Tether and Circle following the market correction earlier this month.

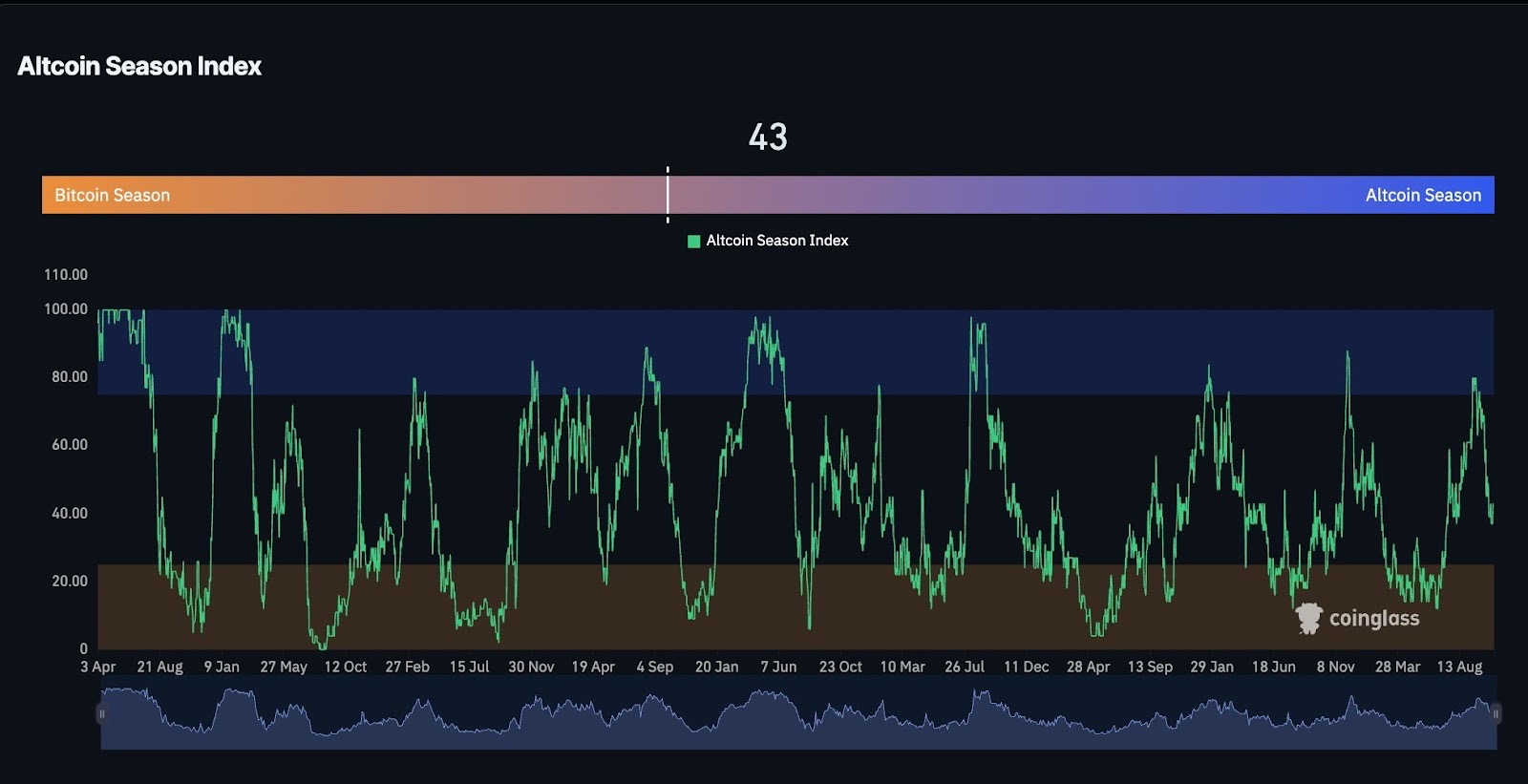

Historically, surges in stablecoin supply have preceded strong buying activity across exchanges, as new liquidity flows into digital assets seeking yield or speculative opportunity. Despite these bullish undercurrents, it is not yet officially altcoin season, according to the Altcoin Season Index, which currently stands at 43.

Altcoin season is typically declared when the index crosses above 75, a level that signals that the majority of top-performing assets have started outperforming Bitcoin. The current reading therefore suggests that the market is still in its accumulation phase, a stage that often precedes the most explosive upside moves once rotation begins.

The chart data reinforces this interpretation. The index shows prior surges into altcoin season territory followed by resets that allowed capital to consolidate before the next leg higher. With Bitcoin dominance still relatively strong and risk appetite gradually increasing, this positioning indicates that the next major move could favor altcoins as confidence builds.

Combining the macro tailwinds of a likely rate cut, the visible rise in stablecoin liquidity, and the early-stage metrics on the altcoin index, conditions are forming that could precede a significant rotation. Investors anticipating this shift may find that the present moment, before the official onset of altcoin season, offers some of the best asymmetric opportunities for identifying high potential tokens before the broader crowd takes notice.

Best Crypto to Buy Now – Undervalued Tokens to Buy

Best Wallet Token

Best Wallet Token has become one of the most promising assets in the growing intersection between self-custody, user experience, and AI-driven analytics. As Web3 matures, the need for accessible yet powerful wallet infrastructure has become one of the market’s defining challenges. Best Wallet has managed to turn that challenge into its strength.

The platform offers a unified gateway for DeFi, trading, and NFT management across multiple chains while introducing intelligent wallet features that simplify the complexities of Web3 for both new and experienced users.

At the core of this ecosystem lies the BEST token, which acts as the utility and governance backbone. It is used to unlock exclusive wallet features, earn tiered staking benefits, and participate in early-access token launches integrated within the Best Wallet ecosystem.

What sets it apart is how seamlessly it fuses user-centric design with on-chain intelligence. Its AI-powered assistant helps users discover new tokens, manage portfolios, and identify yield opportunities with real-time market analysis directly embedded in the wallet interface.

💥 $16M Raised & Counting! 💥

We’re building the wallet for the next era of crypto:

✅ Buy new tokens early, directly in-app

✅ Buy and swap across chains in one place

✅ Full portfolio control, no clutterDownload the app today! 📲 https://t.co/Ykt3PTsnvy pic.twitter.com/aKKy9x1LMu

— Best Wallet (@BestWalletHQ) September 22, 2025

The project’s success so far speaks volumes. Having raised over $16 million, it has already built a strong foundation of credibility in a crowded market. The rise in adoption mirrors broader investor appetite for self-custodial solutions, especially as centralized platforms continue to face scrutiny.

If the anticipated rate cuts and fresh liquidity inflows do trigger an altcoin rally, Best Wallet Token could easily become one of the standout performers of the cycle. It combines functionality, growth readiness, and strong token utility, three traits that often precede exponential returns during altcoin season.

Sei

Sei is currently one of the most technically advanced Layer 1 networks in the digital asset space, designed specifically for trading-focused applications.

Unlike general-purpose chains that often struggle with transaction congestion, Sei introduces a highly optimized parallel execution engine that enables sub-second finality and minimal transaction cost. This makes it particularly attractive for decentralized exchanges, prediction markets, and real-time on-chain trading tools that depend on speed and reliability.

Its architecture incorporates native order-matching logic and front-running prevention, creating a framework that feels tailor-made for the next generation of on-chain trading protocols.

The ecosystem has been expanding rapidly, with developers migrating to Sei to build products that benefit from its unmatched performance layer. As liquidity and user numbers continue to rise, Sei’s role in the broader DeFi ecosystem is beginning to mirror what Solana once represented in its early breakout phase.

Despite this accelerating growth, Sei’s market capitalization remains below $1.3 billion, a figure that appears significantly undervalued when compared to peers offering similar throughput. Even a modest revaluation to $3 billion would represent more than a twofold gain, which seems attainable given its pace of adoption and developer engagement.

This makes Sei an appealing option for investors looking to accumulate before the next liquidity wave hits altcoins. With the Fed poised for a rate cut and stablecoin inflows surging, conditions are aligning perfectly for infrastructure tokens like Sei to capture renewed momentum. In a market searching for speed, scalability, and dependability, Sei delivers all three with clear precision.

Bitcoin Hyper

Bitcoin Hyper has gained visibility across the crypto community as one of the most ambitious attempts to extend Bitcoin’s functionality beyond its traditional limitations. As a Bitcoin Layer 2, it enables faster, cheaper transactions and introduces programmable utility through EVM compatibility, allowing developers to build decentralized applications and financial tools that anchor themselves in Bitcoin’s unmatched security base.

What makes Bitcoin Hyper stand out is not just its technical proposition but its timing. The crypto market currently sits between cycles, with Bitcoin dominance elevated but altcoin valuations still compressed. Historically, this stage has been the incubation period for the next generation of high-growth assets.

Bitcoin Hyper’s ecosystem expansion, which includes liquidity bridges, DeFi integrations, and plans for interoperability with other major networks, positions it as a core contender for the upcoming wave of capital rotation. This approach has resonated with traders and analysts alike, including influencers such as Austin Hilton, who have highlighted its potential to bridge Bitcoin’s dominance with the innovation seen on newer smart contract platforms.

Moreover, Bitcoin Hyper benefits from the psychological advantage of association. Investors are naturally drawn to assets that connect directly to Bitcoin’s identity while offering the flexibility of a high-performance chain.

As confidence rebuilds across the market and liquidity flows increase, particularly following the $8.5 billion stablecoin injection and expectations of a dovish Fed, Bitcoin Hyper’s dual positioning as both a Layer 2 solution and a narrative-driven token could propel it into the spotlight.

If the market’s next phase indeed favors utility-backed altcoins, Bitcoin Hyper could emerge as one of its defining leaders.

Pepenode

Pepenode represents one of the most creative evolutions in the meme coin landscape, bringing genuine on-chain utility to a space that has long relied on hype alone. It blends the cultural power of memes with the technological backbone of decentralized mining, specifically a mine-to-earn model that allows users to generate tokens through participation rather than speculation.

This structure has given Pepenode an identity far beyond its playful mascot. It operates as a gamified mining network where holders can contribute computational resources or complete interactive tasks to earn rewards, creating a dynamic and participatory ecosystem that sustains user engagement.

The project has already gained significant traction, raising over $1 million in its early phase. That achievement reflects more than retail enthusiasm, it shows a growing appetite for meme-driven projects that combine creativity with economic substance. Pepenode’s mining mechanism not only introduces real engagement but also decentralizes token distribution, which strengthens its long-term sustainability.

Its tokenomics are designed to encourage community participation while maintaining scarcity, and the project’s expanding social presence across Telegram and X has helped it build one of the most vocal emerging communities in the meme sector.

Altcoin season has not yet begun, but speculative momentum is quietly returning, and tokens with active communities tend to outperform once rotation starts. The infusion of over $8.5 billion in new stablecoins suggests that liquidity is ready to re-enter risk assets, and meme coins with real functionality like Pepenode are likely to be among the earliest beneficiaries.

For investors looking for similar cryptos with potential, our regularly updated guide on the best crypto to buy now could be a good place to start their research.

Its combination of culture, innovation, and economic design places it in a position to perform strongly once the broader market turns. For investors seeking early exposure to creative projects with organic growth potential, Pepenode offers precisely the kind of asymmetric opportunity that defines pre-altcoin season accumulation phases.

Conclusion

As the market edges closer to a decisive phase, the current mix of liquidity growth, dovish monetary expectations, and steady investor optimism presents a rare opportunity. The broader sentiment remains cautiously positive, with Bitcoin’s strength setting the foundation for the next capital rotation.

Once confidence spreads and the altcoin index begins its climb, early-positioned assets with real use cases and engaged communities often lead the rally. The projects highlighted above align strongly with that pattern. Their growing ecosystems, functional depth, and early-stage valuations make them well placed to capture momentum once the next true altcoin season finally begins to unfold.