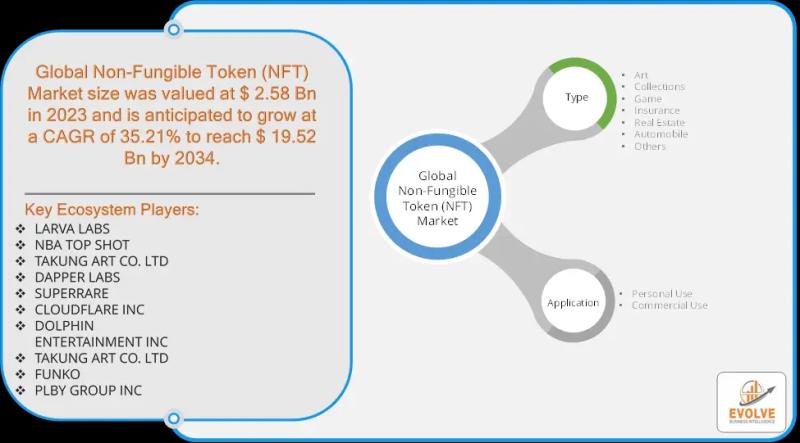

The Non-Fungible Token (NFT) market, once dismissed as a fleeting trend, is rapidly evolving into a significant arena for commercial innovation and investment. While the market has experienced its share of volatility, with one report indicating over 95% of NFT collections having zero monetary value by September 2023, the underlying technology and its versatile applications present substantial commercial opportunities for businesses willing to navigate its complexities. The global NFT market size was estimated at USD 6.00 billion in 2024 and is projected to reach USD 26.92 billion by 2030, exhibiting a robust Compound Annual Growth Rate (CAGR) of 28.39%. This growth underscores a shift from speculative investment to utility-driven adoption across various sectors.

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/global-non-fungible-token-nft-market-analysis/

Unlocking Commercial Potential

NFTs, as unique digital identifiers on a blockchain, verify authenticity and ownership of digital goods, offering lasting value to collectors and brands alike. Beyond their initial use as speculative investments, NFTs are now being strategically leveraged for:

• Marketing and Promotion: Brands like Balenciaga, Taco Bell, Coca-Cola, and BMW have successfully used unique NFT art drops and collectibles to build brand awareness, promote new products, and engage with audiences in novel ways. Free tokenized art (airdrops) can convert recipients into brand ambassadors.

• Direct Sales and Collectibles: Brands can directly sell NFTs as digital products and collectibles, similar to how luxury brands like Gucci have sold NFT wearables for avatars.

• Exclusive Access and Experiences: NFTs can unlock special access to virtual events, in-person tours, private communities, or exclusive content, fostering deeper connections with customers.

• Curated Marketplaces: Companies can operate their own NFT marketplaces, generating revenue through auctions, bids, and trading fees while providing a hub for their community.

• Gaming and Metaverse Integration: In gaming, augmented reality (AR), and virtual reality (VR) environments, branded NFT upgrades, virtual clothing, and digital accessories offer identity and self-expression, opening up significant revenue streams as the metaverse expands. Nike’s virtual sneakers, for instance, grant access to exclusive virtual spaces.

• Membership Programs and Loyalty: NFTs can serve as digital membership cards, offering discounts, rewards, and exclusive member-only opportunities that can also be easily traded.

• Attracting Investors: Businesses are using NFTs as an incentive for investors, offering ongoing rewards or even shares in the business in NFT form.

• Supply Chain and Real Estate: Beyond digital art, NFTs can represent real property titles or be used to streamline real estate transactions, cutting out intermediaries and saving on fees.

Problems Faced in the Commercial NFT Market

Despite the immense opportunities, the commercial NFT market is not without its significant challenges:

• Intellectual Property Rights and Fraud: The ease of creating and selling NFTs has led to rampant intellectual property theft and the proliferation of fake NFTs. It’s difficult to verify the true owner of an NFT or the copyright of the underlying asset, and seeking recourse for fraud can be challenging due to the decentralized nature of the blockchain.

• Security Risks: NFT marketplaces are susceptible to cyberattacks, hacking, and phishing, leading to compromised user funds and personal information.

• Regulatory Uncertainty: The lack of a clear and consistent regulatory framework across jurisdictions creates uncertainty for businesses and investors. NFTs can sometimes be considered securities, adding another layer of legal complexity.

• Scalability Challenges and High Fees: Many NFTs are built on blockchains like Ethereum, which can suffer from congestion, leading to slow transaction times and high “gas fees” (transaction costs), especially during peak demand.

• User Experience (UX): Many existing NFT marketplaces have poor user interfaces, limited payment methods, and confusing navigation, making it difficult for new users to engage.

• Valuation Challenges: Determining the fair market value of NFTs can be difficult due to their novelty, uniqueness, and the subjective nature of their appeal.

• Environmental Concerns: The energy consumption of certain blockchain consensus mechanisms (e.g., Proof-of-Work) used for NFTs raises environmental concerns, though more energy-efficient solutions are emerging.

• Lack of Liquidity: While some NFTs fetch high prices, many lack sufficient buyers and sellers, leading to liquidity issues.

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/global-non-fungible-token-nft-market-analysis/

Proposed Solutions for Implementation

To foster a more robust and sustainable commercial NFT market, several solutions can be implemented:

• Enhanced IP Protection and Verification: Implementing robust IP tracking and monitoring mechanisms, alongside clear verification processes for ownership records and seller identities, can combat fraud. Legal frameworks need to evolve to provide better recourse for intellectual property infringement.

• Improved Security Measures: Marketplaces must implement multi-factor authentication, advanced encryption, and distributed storage systems. Regular security audits and the use of secure smart contract templates are crucial to prevent hacks.

• Regulatory Clarity and Collaboration: Governments and regulatory bodies need to work towards clear, standardized regulations for NFTs, categorizing them appropriately and providing guidelines for businesses and investors.

• Scalability and Cost Reduction: Adoption of Layer-2 scaling solutions (e.g., Polygon, Arbitrum, Optimism) can significantly increase transaction throughput and reduce gas fees, making NFT transactions more accessible and cost-effective.

• User-Centric Design and Education: NFT marketplaces should prioritize intuitive UI/UX design, simplified onboarding processes, and offer comprehensive educational resources (FAQs, webinars) to bridge the knowledge gap for new users.

• Price Prediction Tools and Data: Marketplaces can offer tools that provide historical sales data, market trends, and expert analysis to help users make more informed pricing and purchasing decisions.

• Sustainability Initiatives: Promoting and adopting energy-efficient blockchain solutions (e.g., Proof-of-Stake) and encouraging NFT projects that incorporate environmental responsibility (e.g., donating proceeds to sustainability initiatives) can address ecological concerns.

• Diversification of Utility: Focusing on NFTs with real-world utility beyond just being collectibles-such as access, voting rights, or in-game benefits-will drive long-term value and engagement, moving beyond speculative hype.

• Community Building: Fostering vibrant communities around NFT projects, actively engaging with holders, and listening to feedback can build loyalty and increase long-term value.

US Tariff Implications on the Non-Fungible Token (NFT) Market

While specific direct “tariffs” on NFTs as goods are not explicitly defined in current US trade policy, the broader implications of US tariffs on digital assets and blockchain technologies could impact the NFT market.

• Increased Operational Costs: Tariffs on blockchain-related hardware, software, or services, particularly for dominant platforms like Ethereum-based ones, could increase the cost of developing and trading NFTs. This could translate to higher transaction fees for users, potentially raising costs by an estimated 10-15% for impacted sectors.

• Slower Adoption and Scalability Challenges: Higher costs could deter new entrants, especially smaller creators and businesses, and limit the scalability of NFT platforms, thus slowing the market’s rapid growth. This could particularly affect sectors like art and digital collectibles.

• Economic and Business Impact: Companies may face decreased margins or be forced to pass on increased costs to consumers, impacting profitability and hindering the overall expansion of the NFT industry within the US.

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/global-non-fungible-token-nft-market-analysis/

Despite these potential challenges, the long-term outlook for the NFT-as-a-Service (NFTaaS) market remains positive, with an expected growth from USD 1.5 billion in 2023 to USD 34.7 billion by 2033. North America currently dominates the market, holding over 40% of the share due to high demand and significant investments. The continued evolution of blockchain technology and the integration of NFTs into gaming, art, and virtual worlds are expected to drive further innovation and adoption.

To understand further and explore opportunities in the Non-Fungible Token (NFT) Market or any related industry, please share your queries/concern at info@evolvebi.com.

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Email: sales@evolvebi.com

Website: https://evolvebi.com/

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing

innovative solutions to challenging pain points of a business. Our market research reports include data

useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere

data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate

data through our in-house AI-modelled data analysis and forecast tool – EvolveBI. This tool tracks real-

time data including, quarter performance, annual performance, and recent developments from

fortune’s global 2000 companies.

This release was published on openPR.