Dogecoin and Ethereum were the only major cryptocurrencies trading higher, while the broader market declined.

- Bitcoin slipped 1.4% to around $67,500, and retail sentiment shifted to ‘bearish’ on Stocktwits.

- Roughly $195 million in crypto positions were liquidated over 24 hours, with long positions accounting for most of the losses.

- The pullback in Bitcoin coincided with weakness in software stocks.

- Markets was also tempered ahead of the Fed’s latest meeting minutes scheduled to go public on Wednesday afternoon.

Dogecoin (DOGE) and Ethereum (ETH) led gains among crypto majors on Tuesday night, while Bitcoin (BTC) climbed back around $67,000 after a brief dip below the mark.

The broader cryptocurrency market fell 1.6% in the last 24 hours to under $2.4 trillion, while Bitcoin’s price slid 1.4% to around $67.500. On Stocktwits, retail sentiment around the apex cryptocurrency dipped to ‘bearish’ from ‘neutral’ territory over the past day, while chatter stayed at ‘low’ levels.

Why Is Crypto Falling?

The drop in Bitcoin’s price came as software stocks continued to plunge on Tuesday, with the iShares Expanded Tech-Software Sector ETF (IGV) falling 2.19%. Retail sentiment on Stocktwits around the fund slipped to ‘bullish’ from ‘extremely bullish’ over the past day. Software stocks have been pressured of late with AI seen as a threat to their business models.

Markets was also tempered ahead of the Federal Open Market Committee (FOMC) latest meeting minutes scheduled to go public on Wednesday afternoon. Market watchers are hoping that commentary from Fed Chair Jerome Powell and other policymakers will provide clues on when the next interest rate cut is slated to take place.

Dogecoin, Ethereum Outperform Amid Crypto Weakness

Dogecoin’s price moved 0.7% higher to $0.1012 in the last 24 hours, while Ethereum’s price edged 0.4% higher, still below $2,000 at around $1,994. They were the only two cryptocurrencies trending in the green on Tuesday night.

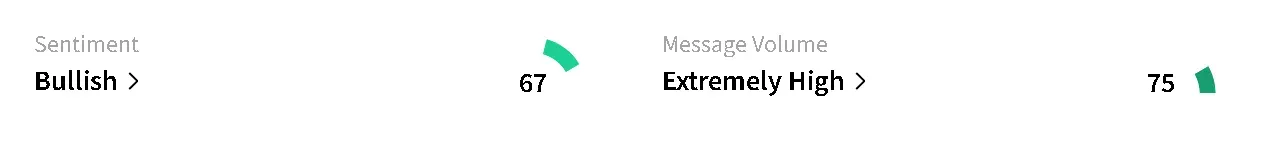

Retail sentiment around Ethereum on Stocktwits remained in ‘bearish’ territory alongside ‘low’ levels of chatter over the past day. However, retail sentiment around Dogecoin remained in the ‘bullish’ zone, accompanied by ‘extremely high’ levels of chatter.

Some users speculated that the cryptocurrency market is being manipulated, citing the CLARITY Act stalemate as a potential cause.

Another said that Bitcoin’s price is overdue to take another run at the $100,000 level.

Other crypto majors also outperformed Bitcoin, but were in the red. Ripple’s XRP (XRP) dipped 0.3% while Solana (SOL), Binance Coin (BNB), and Cardano (ADA) fell more than 1% each in the last 24 hours.

CoinGlass data showed liquidations at around $195 million, with more long bets getting wiped out that short bets, indicating a higher ratio of traders expected a recovery in the cryptocurrency market.

Read also: GNS Stock Soars Overnight After Over 16 Million ‘Lost’ Shares Enter Bitcoin Loyalty Lockup

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read about our editorial guidelines and ethics policy