The company first announced that users could borrow against their Bitcoin holdings in 2025, and expanded to Ethereum in November last year.

- Data showed Coinbase’s lending product has already seen more than $1.9 billion in loan originations to date.

- The exchange reported last week that it held $17.23 billion in XRP on its platform, as per regulatory filings.

- Coinbase also reported $27.28 billion of “other crypto assets” at the end of the fourth quarter, besides Bitcoin, Ethereum, Solana, and USDC.

Coinbase (COIN) is expanding its crypto lending business, adding support for Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Litecoin (LTC) beyond its existing offerings for Bitcoin (BTC) and Ethereum (ETH).

The move allows users to borrow up to $100,000 in USDC (USDC) against their tokens, without having to sell their holdings. The company first announced that users could borrow against their Bitcoin holdings in early-2025, and expanded to Ethereum in November.

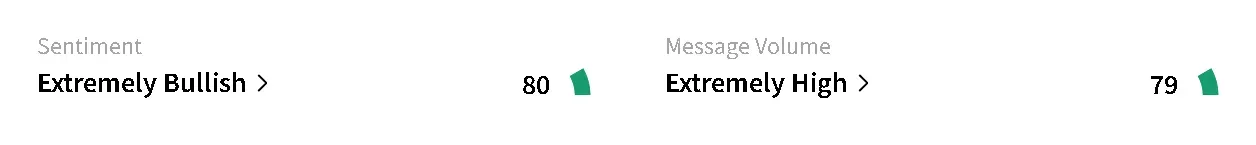

COIN’s stock edged 0.1% lower in pre-market trade on Thursday, with retail sentiment around the company trending in ‘extremely bullish’ territory over the past day and chatter at ‘extremely high’ levels, according to Stocktwits data.

Coinbase Builds Toward Super App Vision

The move could be a big unlock for Coinbase. The exchange reported last week that it held $17.23 billion in XRP on its platform, according to its regulatory filings with the Securities and Exchange Commission (SEC). Coinbase also reported $27.28 billion of “other crypto assets” at the end of the fourth quarter (Q4), besides Bitcoin, Ethereum, Solana (SOL), and USDC.

Users can currently borrow up to $5 million in USDC against Bitcoin and up to $1 million in USDC against Ethereum. Data showed the product has already seen more than $1.9 billion in loan originations to date.

The move comes after CEO Brian Armstrong reiterated on the company’s recent earnings call that Coinbase is looking to become an “everything app” for its users, a pivot that kicked off at the company’s keynote event in December last year.

Crypto Market Stays In The Red

The overall cryptocurrency market fell 1.6% in the last 24 hours, to around $2.37 trillion. Bitcoin’s price dropped 2% to under $67,000. Meanwhile, Ethereum’s price slid 2.7%, dipping further below the $2,000 mark to $1,960. Retail sentiment around both crypto majors continued to trend in ‘bearish’ territory over the past day on Stocktwits.

Meanwhile, XRP, DOGE, ADA, and LTC were also trading in the red on the day. While retail sentiment around XRP remained in the ‘bearish’ zone, sentiment around Litecoin was in ‘neutral’ territory, and sentiment around Cardano and Dogecoin was in the ‘bullish’ zone.

Read also: Coinbase CEO Predicts ‘Win-Win-Win’ Result – CLARITY Act Approval Odds Climb to 90% On Prediction Markets

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read about our editorial guidelines and ethics policy