- TON flipped ADA to become the ninth-largest asset by market cap.

- ADA plunged 15% in the last month, and barely recorded any noticeable increase since 2024 began.

Cardano [ADA] was at a serious risk of getting pushed out of the top 10 cryptos by market capitalization list.

Another coin surpassed Cardano

After an impressive 16% jump in the last 24 hours, Telegram-linked cryptocurrency Toncoin [TON] flipped Cardano to become the ninth-largest asset by market cap, data from CoinMarketCap showed. Not too long ago, the king of meme coins Dogecoin [DOGE] had overtaken Cardano in terms of market value.

These repeated slides in market rankings piqued the interest of observers, with many predicting that ADA would eventually be bettered by Avalanche [AVAX] as well.

Cardano sees FUD, supporters defend

Negative commentary around ADA has surged over the past month or so, helped by the coin’s under par performance on the price charts. ADA plunged by 15% in the last month, and barely recorded any noticeable increase since 2024 began.

The lackluster performance invited criticism, and at times, ridicule and jibes from influencers like Arthur Hayes, and even crypto exchanges like Gemini.

The Cardano community has energetically countered these arguments every time. Even the latest hot topic of TON surpassing Cardano was met with a strong rebuke from a passionate community member known as ADA whale on X.

ADA whale highlighted the stark difference in the decentralization levels of the two projects, with top 10 TON holders controlling 60% of the supply, compared to top 10 in Cardano controlling just 8.96%.

Source: X/ADA whale

Another proponent jumped in questioning the low value given to attributes like low fees and stability, something which Cardano delivers. They also drew an indirect comparison with Solana [SOL] which was struggling with transaction failures.

Read ADA’s Price Prediction 2024-25

What’s the ground reality?

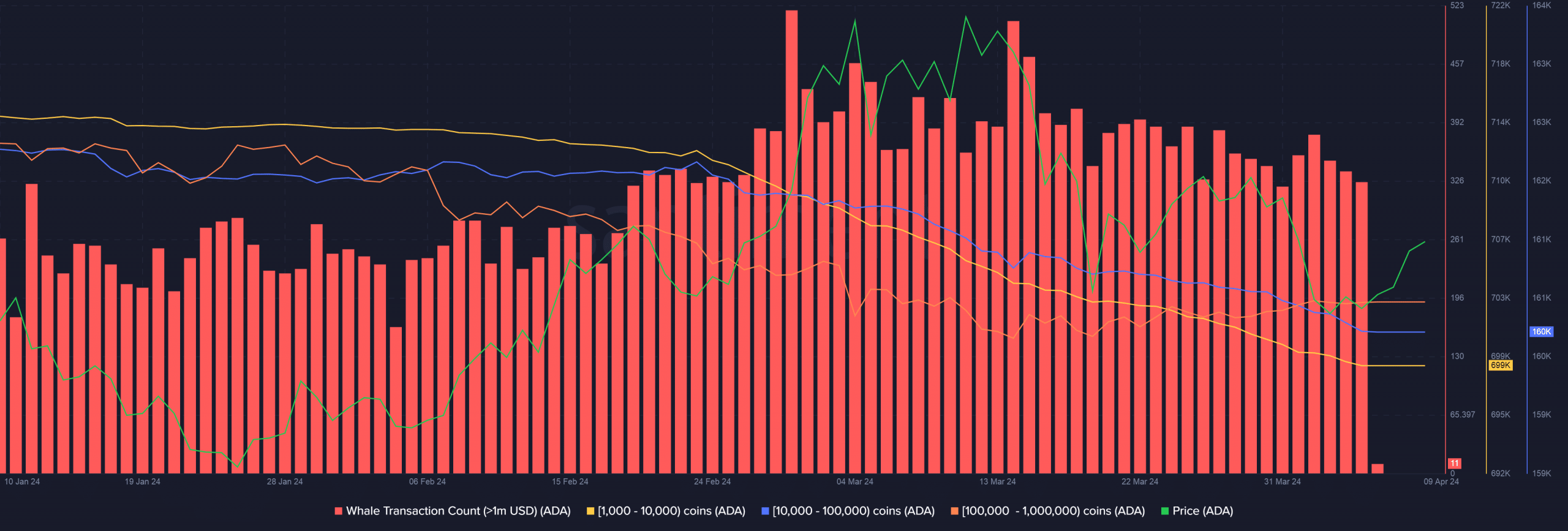

Their spirited defense notwithstanding, ADA has struggled to find favors with large investors of the coin. According to AMBCrypto’s analysis of Santiment’s data, transactions worth more than $1 million have significantly come down in recent weeks.

Moreover, holdings of key whale cohorts shrank in the same time, suggesting that whales were selling off ADA.

Source: Santiment