- Circle rolls out new Euro-based stablecoin as an ERC20 token on Ethereum.

- Ethereum’s on-chain metrics rose as a result of the announcement.

The Ethereum [ETH] network just added support for another stablecoin. The network has so far supported multiple stablecoins, but most are pegged on the U.S. dollar. This time the latest addition is Euro Coin [EUROC], which will be pegged on the Euro.

Read about Ethereum’s [ETH] Price Prediction 2023-24

The new Euro-backed stablecoin issued by Circle might be the first major attempt at properly tapping into the European market. The Coinbase exchange is already making efforts to make EUROC available. It noted recently that the new stablecoin is an ERC20 token and that it will be available in regions where Coinbase is supported.

Coinbase will add support for Euro Coin (EUROC) on the Ethereum network (ERC-20 token). Do not send this asset over other networks or your funds may be lost. Inbound transfers for this asset are available on @Coinbase & @CoinbaseExch in the regions where trading is supported.

— Coinbase Assets (@CoinbaseAssets) February 21, 2023

Coinbase also noted that the support may be restricted. In addition, the exchange noted that it will initially be available as EUROC-EUR and EUROC-USD pairs. While this new stablecoin might be a game changer for European crypto traders, Ethereum will be one of the biggest beneficiaries.

Assessing the on-chain impact

Europe is one of the biggest economic regions in the world. As such, it can control a substantial amount of trading volumes in the crypto market. A direct link to the market through a Euro-backed stablecoin may thus prove quite useful. Ethereum is banking on this development to tap into more trading volume and network growth.

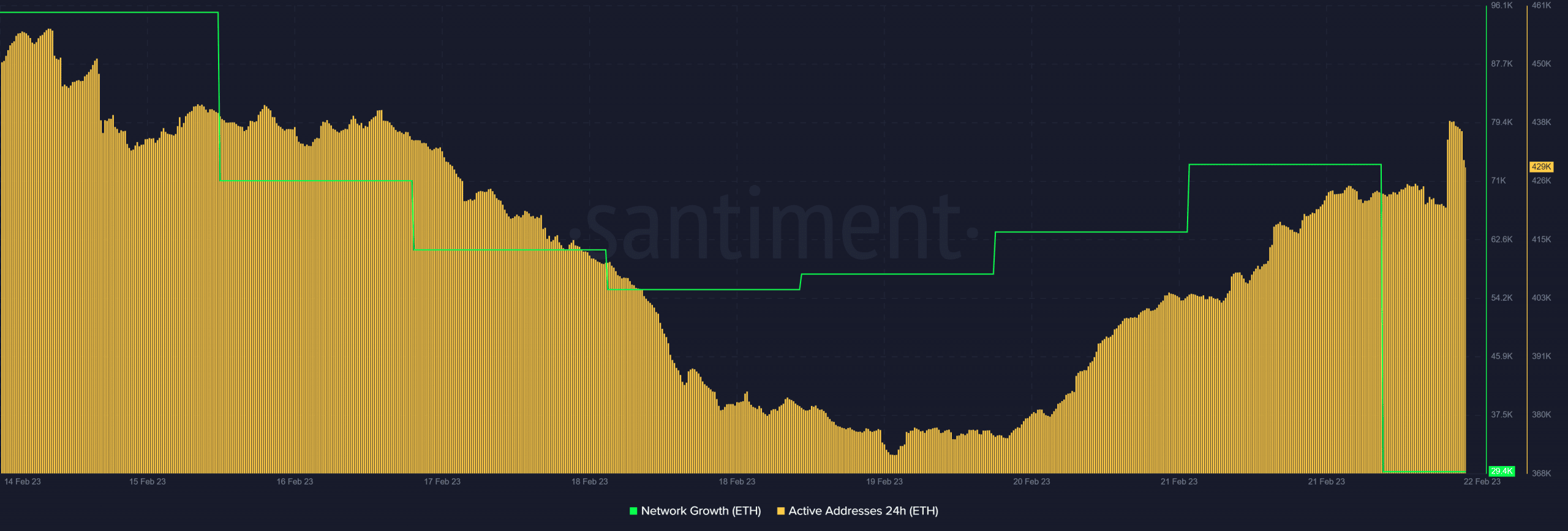

Source: Santiment

Such a major development is bound to have an impact in both the short and long term. Ethereum’s development activity metric registered a sharp rally in the last 24 hours ahead of the EUROC launch. In addition, its on-chain volume grew by over $2 billion within the same 24-hour period.

Source: Santiment

On the network activity side of things, there was a noteworthy surge in 24-hour active addresses in the last 24 hours. Ethereum’s network growth tanked to a new weekly low. This is contrary to expectations that a major stablecoin launch would likely trigger renewed interest.

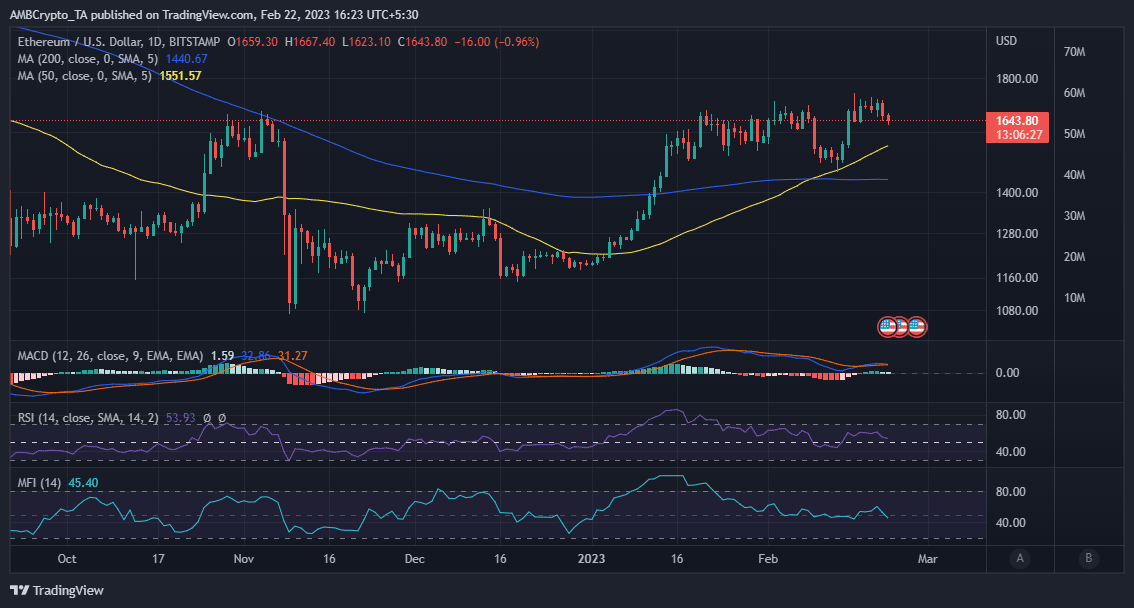

A potential reason for the relatively low change in activity is that ETH is currently slowing down after facing resistance above $1,700. It experienced a return of sell pressure so far this week, but it remains to be seen whether the new development will breathe life to the bulls.

Is your portfolio green? Check out the Ethereum Profit Calculator

ETH traded at $1,623 at press time.

Source: TradingView

As far as metrics are concerned, there is room for more downside before it interacts with the 50% RSI level. There is a sizable probability that demand may resume at the RSI midpoint, especially since the current bearish momentum is not so strong.